Key Takeaways

- Expansion into advanced silicone and biotech solutions enables faster margin and revenue growth, with premium pricing and strong execution accelerating segment performance.

- Leadership in eco-friendly materials, supply chain adaptability, and efficiency initiatives drive market share gains and sustained net margin expansion despite industry headwinds.

- Margin and revenue pressures stem from global overcapacity, regulatory costs, cyclical end-markets, trade disruptions, and intense competition from lower-cost and greener alternatives.

Catalysts

About Wacker Chemie- Provides chemical products worldwide.

- Analysts broadly agree that specialty silicones' contribution to sales and margin improvement is material, but the ongoing shift toward an even higher mix of advanced, differentiated silicone solutions-including new products for sustainability, e-mobility, and health care-positions Wacker to not only exceed margin targets but also to command premium pricing and potentially achieve structurally higher EBITDA than currently expected.

- Analyst consensus recognizes new biotech facility ramp-ups as a growth lever for Biosolutions, but the recent surge in demand for biopharma capacity and Wacker's proven execution suggest an acceleration of contract wins and capacity fill-allowing this segment to become a much larger, high-growth revenue and margin driver sooner than the market anticipates.

- The rapid adjustment of global solar supply chains in response to new tariffs creates an emerging window for Wacker to sharply boost U.S. and European polysilicon sales; the company's unparalleled compliance and contracts position it to take disproportionate share as premium-pricing, locally-sourced solar and semiconductor materials become the default-supporting an outsized top-line and earnings rebound.

- Wacker's relentless implementation of nearly 1,000 annual efficiency and digitalization projects has a compounding effect, driving ongoing reductions in operating and energy costs that materially expand net margins over the next several years, even in the face of industry cyclical headwinds.

- With aggressive global policy moves toward renewable infrastructure, electrification, and tighter environmental regulation, Wacker's leadership in next-generation, eco-built chemicals and its deep Asia-Pacific and North American presence set up a multi-year runway for accelerated market share gains and revenue growth, capitalizing on secular demand for green, specialty materials across diversified end-markets.

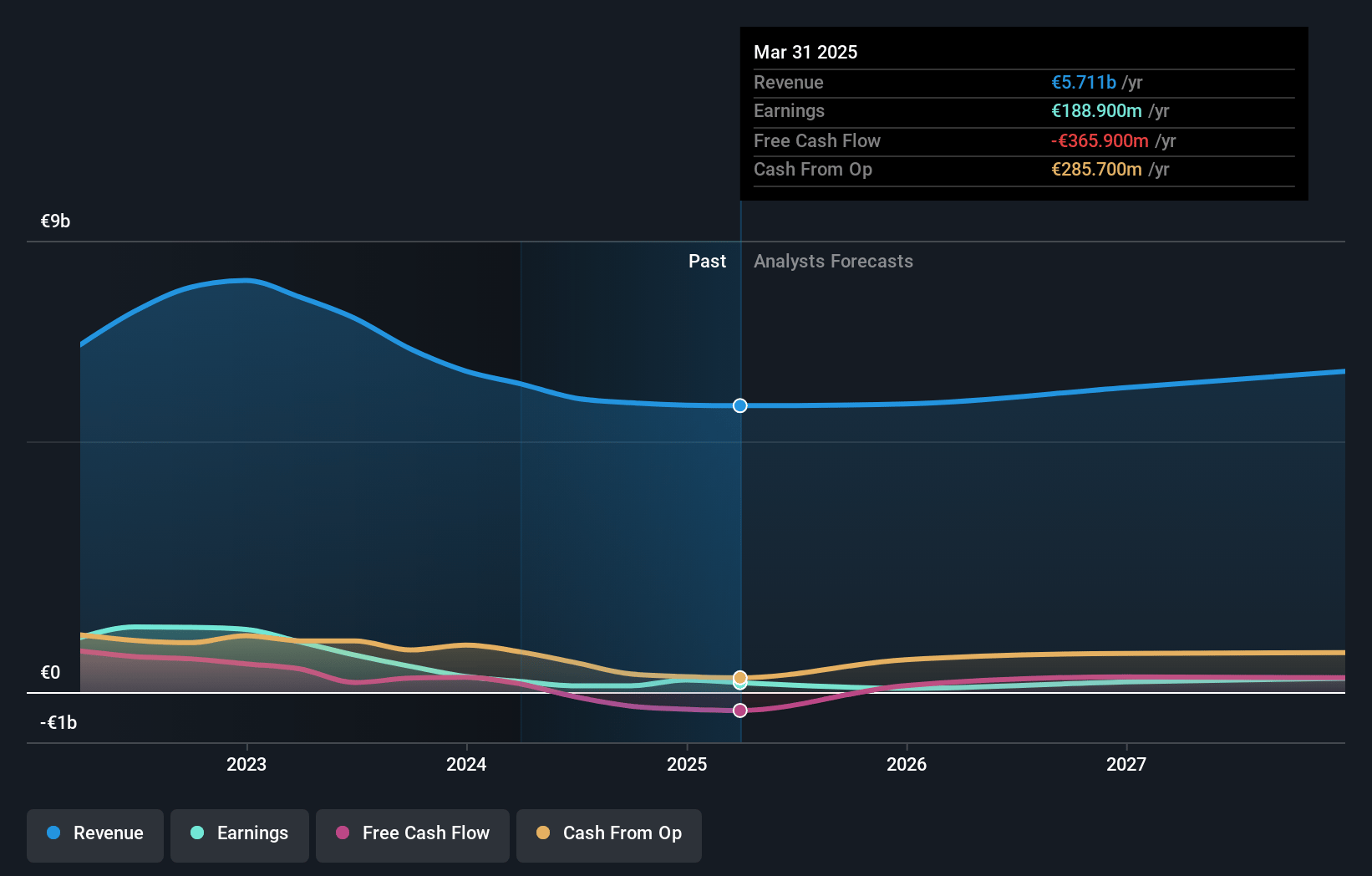

Wacker Chemie Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wacker Chemie compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wacker Chemie's revenue will grow by 7.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.3% today to 7.4% in 3 years time.

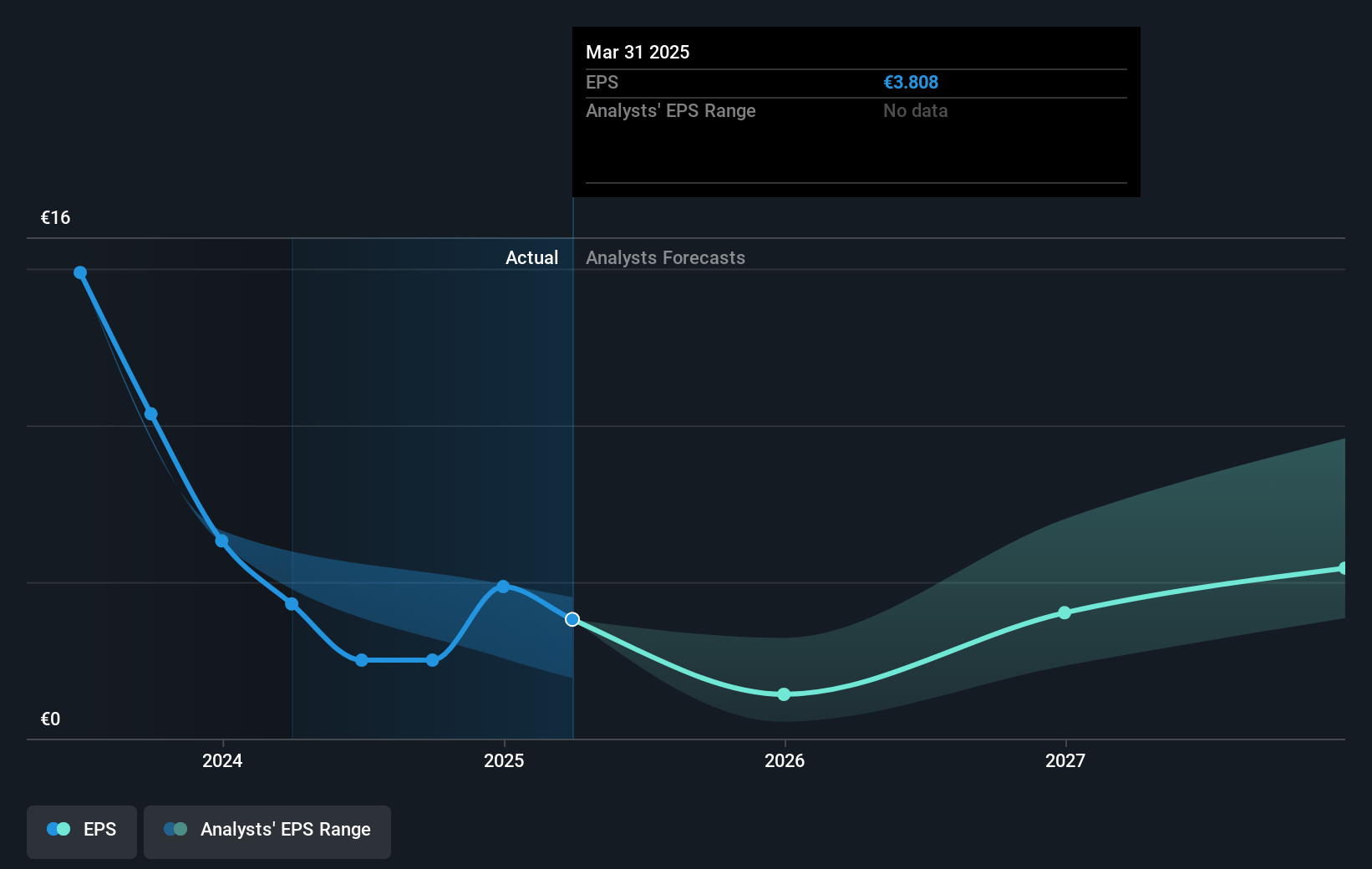

- The bullish analysts expect earnings to reach €527.7 million (and earnings per share of €10.6) by about July 2028, up from €188.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, down from 18.5x today. This future PE is lower than the current PE for the GB Chemicals industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.1%, as per the Simply Wall St company report.

Wacker Chemie Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wacker Chemie faces long-term pressure on margins and revenue due to persistent global overcapacity in basic chemicals and polysilicon, which has already resulted in weak demand, lower utilization rates, and an 18% year-over-year decline in Polysilicon sales.

- Growing regulatory scrutiny and environmental standards worldwide could require costly compliance and capital expenditures, potentially eroding net margins as the company seeks to modernize aging production facilities, especially in energy-intensive segments.

- The company's increasing reliance on cyclical end-markets like electronics and construction exposes its earnings to significant downturns; recent weakness in construction-related polymers and ongoing macroeconomic uncertainty have already led to volatility in order intake and negative net income for the quarter.

- Regionalization of supply chains and frequent, unpredictable changes to global trade tariffs risk disrupting Wacker's export markets, while the commentary highlights rising trade tensions, higher tariffs, and volatility in order entry, particularly in the U.S. and China-all of which could pressure future revenue and profitability.

- Intensified competition, especially from state-backed Asian firms with cost advantages and the increasing adoption of greener alternatives in chemicals, threatens demand for Wacker's traditional product lines and specialty silicones, potentially leading to long-term stagnation or decline in revenue and a need to sacrifice margins to retain market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wacker Chemie is €110.48, which represents two standard deviations above the consensus price target of €78.93. This valuation is based on what can be assumed as the expectations of Wacker Chemie's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €113.0, and the most bearish reporting a price target of just €52.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €7.1 billion, earnings will come to €527.7 million, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of €70.35, the bullish analyst price target of €110.48 is 36.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.