Key Takeaways

- Accelerating decarbonization and reliance on German infrastructure projects expose the company to shrinking fossil fuel demand and significant earnings volatility.

- Limited international diversification and slow scaling in new energy markets heighten the risk of stagnation and persistent margin pressure.

- Leading position in hydrogen and next-gen infrastructure markets, supported by policy tailwinds and a strong project pipeline, underpins long-term revenue growth and profitability resilience.

Catalysts

About Friedrich Vorwerk Group- Provides various solutions for transformation and transportation of energy in Germany and Europe.

- Systematically declining future demand for natural gas infrastructure, which remains a core part of Friedrich Vorwerk's business, is likely as European decarbonization policies accelerate and fuel switching to renewables intensifies. This will lead to shrinking revenue opportunities and overcapacity in the coming decade.

- Increasing regulatory and societal pressure for rapid decarbonization, as well as strong public opposition to new pipelines, will result in fewer fossil fuel-related projects and the cancellation or delay of many pipeline awards, limiting new project inflows and impacting long-term revenue growth.

- The company's heavy reliance on large, Germany-based infrastructure projects and transmission upgrades leaves revenue and earnings highly vulnerable to shifting political priorities, delayed customer decisions, and single-country risk, which could create ongoing earnings volatility and cap long-term margin expansion.

- Limited international diversification and slow progress in scaling up hydrogen and CO2 pipeline segments expose the company to the risk of stagnation if these nascent markets fail to reach scale or are deprioritized due to high upfront capital spending and uncertain project economics, weighing on net margin and return on invested capital.

- Greater competition from alternative energy and infrastructure engineering firms, coupled with the ongoing trend toward commoditization in core markets, will put sustained pressure on profit margins, while tightening environmental and safety regulations drive up operating and compliance costs, negatively impacting overall profitability.

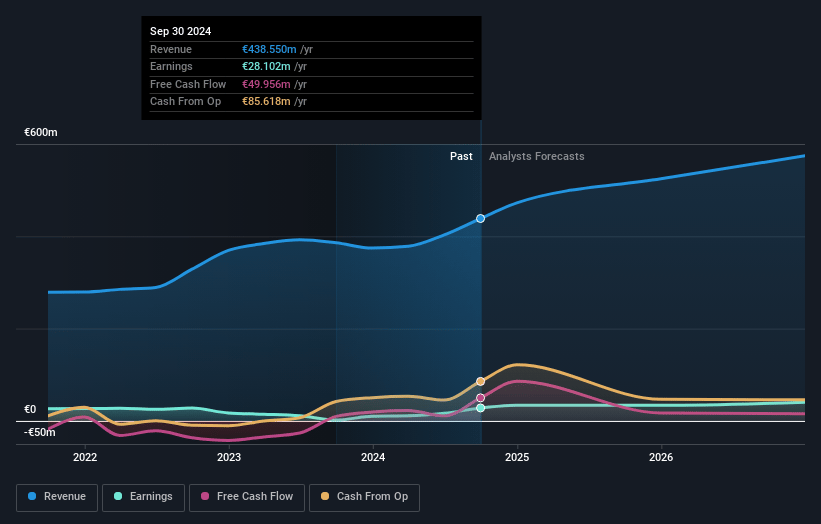

Friedrich Vorwerk Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Friedrich Vorwerk Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Friedrich Vorwerk Group's revenue will grow by 6.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.7% today to 8.3% in 3 years time.

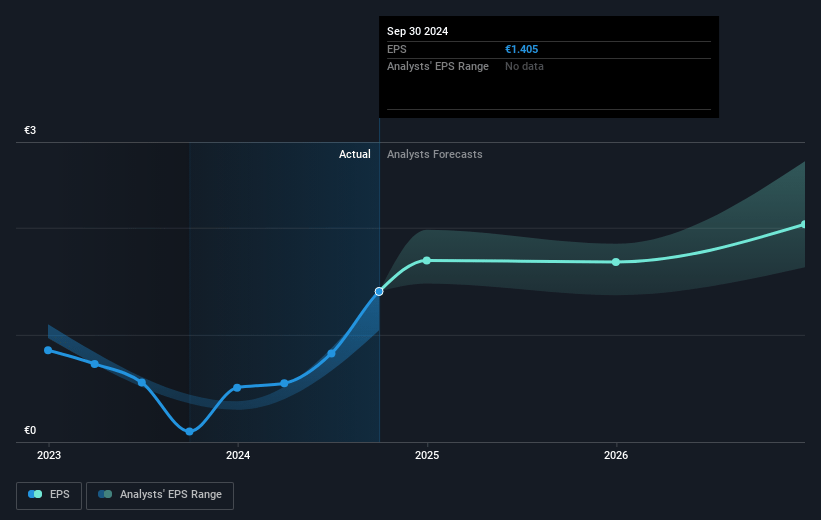

- The bearish analysts expect earnings to reach €56.0 million (and earnings per share of €2.79) by about July 2028, up from €42.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, down from 39.1x today. This future PE is greater than the current PE for the DE Oil and Gas industry at 9.8x.

- Analysts expect the number of shares outstanding to grow by 0.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.73%, as per the Simply Wall St company report.

Friedrich Vorwerk Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing acceleration of Europe's energy transition, including robust investments in clean hydrogen and renewable gas infrastructure, is likely to increase order inflow and sustain revenue growth for Friedrich Vorwerk due to strong policy support and large-scale projects in the coming decade.

- The company's leading role in early-stage hydrogen infrastructure-including electrolyzer systems and hydrogen pipeline conversion-positions it to capture high-margin, multi-year projects, which can drive long-term earnings growth and enhanced profitability.

- Structural upgrades and modernization of Germany's and Europe's energy systems, such as the development of the hydrogen core grid and massive water/wastewater investment programs, expand Friedrich Vorwerk's addressable market and provide resilience for future revenue streams well into the 2030s.

- The company's expertise and project pipeline in electricity underground cabling, as well as increasing activity in CO2 transportation networks, enable a shift towards next-generation infrastructure services, which supports margin expansion and recurring after-market services revenues.

- A well-diversified and sizable order backlog above 1 billion euros, strong Q1 financial performance with 73% revenue growth, and maintained high profitability levels create a foundation for continued earnings momentum and potential upward revisions of financial guidance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Friedrich Vorwerk Group is €52.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Friedrich Vorwerk Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €70.0, and the most bearish reporting a price target of just €52.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €672.8 million, earnings will come to €56.0 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 4.7%.

- Given the current share price of €83.6, the bearish analyst price target of €52.0 is 60.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.