Catalysts

About MLP

MLP is a diversified financial services group that provides wealth management, insurance, banking and consulting solutions to private, corporate and institutional clients in Germany.

What are the underlying business or industry changes driving this perspective?

- The structurally rising need for independent wealth management and retirement planning in Germany, combined with MLP’s position as one of the largest bank independent asset managers, supports sustained growth in assets under management and therefore fee based revenue and earnings.

- Ongoing demographic shifts, increasing complexity of health care and pension systems and higher client demand for comprehensive advice should drive continued expansion in Property and Casualty as well as Life and Health consulting, lifting recurring revenue and stabilising net margins.

- The rapid adoption of artificial intelligence and digital tools in financial services is expected to materially increase MLP’s consulting efficiency and 24/7 client service capacity, which should support higher advisor productivity, operating leverage and EBIT growth.

- Strong growth in private banking inflows with attractive margins, together with disciplined risk management and very high liquidity and capital ratios, positions MLP to monetise client cash and investment flows more effectively, supporting net interest and fee income and underpinning earnings resilience.

- The scaling of FERI’s alternative and multi asset investment capabilities for institutional and high net worth clients, supported by professional research and a broad product platform, should benefit from increasing allocations to diversified and alternative strategies, driving management fees, performance related income and overall group profitability.

Assumptions

This narrative explores a more optimistic perspective on MLP compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

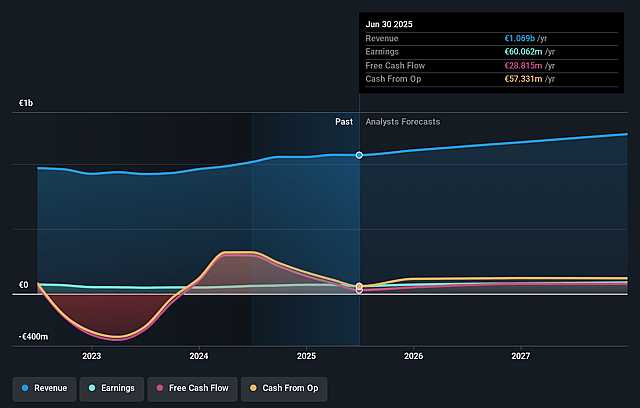

- The bullish analysts are assuming MLP's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.2% today to 8.3% in 3 years time.

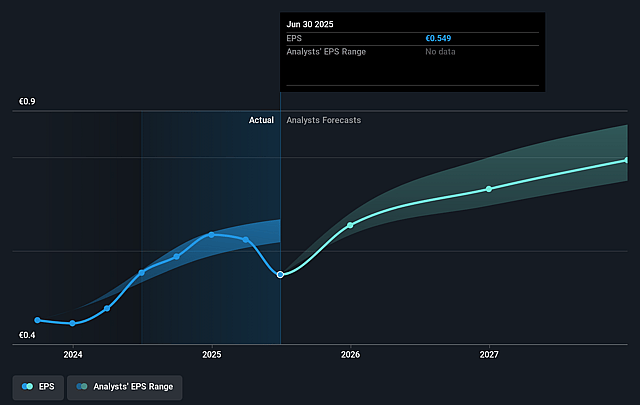

- The bullish analysts expect earnings to reach €105.6 million (and earnings per share of €0.97) by about December 2028, up from €65.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €82.6 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, up from 11.2x today. This future PE is greater than the current PE for the GB Capital Markets industry at 14.7x.

- The bullish analysts expect the number of shares outstanding to decline by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Performance based compensation in the Wealth competence field is structurally volatile and currently far below prior year levels, and if capital markets remain unsettled or regulation and client risk appetite continue to constrain performance fee generation, group revenue and EBIT could fall short of ambitious 2028 targets and weigh on earnings growth.

- The strategic withdrawal from higher risk real estate project development and the expectation of a negative contribution from this area in the near term highlight ongoing headwinds in real estate markets, and if transaction volumes and prices stay depressed for longer, this could cap revenue diversification benefits and suppress net margins.

- Weaker than expected old age provision business, partly because consultants are prioritising wealth management mandates, suggests that structural client caution and limited disposable income in a soft economy could persist, restraining growth in long duration retirement products and dampening recurring revenue and long term earnings.

- The macroeconomic backdrop of ongoing economic downturn, rising unemployment and political uncertainty, including tariff shocks and lack of supportive policy decisions, may continue to unsettle corporate and private clients, limiting net inflows, dampening demand for financial products and putting pressure on revenue and EBIT resilience.

- The group’s digitalisation and AI strategy requires sustained heavy IT investment, and if efficiency gains and 24/7 AI enabled client service fail to scale as planned or competitors deploy superior solutions, cost growth could outpace productivity improvements and compress operating leverage, reducing net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for MLP is €12.5, which represents up to two standard deviations above the consensus price target of €10.5. This valuation is based on what can be assumed as the expectations of MLP's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €12.5, and the most bearish reporting a price target of just €9.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €1.3 billion, earnings will come to €105.6 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of €6.74, the analyst price target of €12.5 is 46.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MLP?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.