Key Takeaways

- TUI leverages digitalization, dynamic packaging, and integrated travel experiences to drive higher margins, increase direct customer engagement, and strengthen recurring revenue.

- Strategic expansion in Asia and the Caribbean, plus European market consolidation, positions TUI for sustained industry outperformance and enhanced profitability.

- Exposure to regulatory, demographic, technological, financial, and industry shifts threatens TUI's growth, profitability, and market position amid intensifying competition and evolving consumer behaviors.

Catalysts

About TUI- Provides tourism services worldwide.

- Analyst consensus sees dynamic packaging as a lever for revenue and margin growth, yet the scale of TUI's rollout-leveraging technology partnerships and direct connects with airlines and hoteliers across multiple markets-suggests this business line could achieve high double-digit annual growth, with materially higher group net margins as it surpasses traditional wholesale in share.

- While analysts broadly expect expansion into new regions and higher hotel rates to lift revenues, the accelerating global pipeline-especially the pace of openings in Asia and the Caribbean-combined with rising middle-class wealth in these regions, positions TUI for outsized occupancy and rate growth that could sustain well above-industry revenue expansion for years.

- TUI's rapid digitalization and monthly release cadence for its app and web platforms unlocks structurally lower distribution costs and high-margin ancillary sales, supporting significant long-term improvement in gross margin and higher direct-to-consumer conversion.

- The company's advancing integration of travel experiences-via its Musement platform and curated ecosystem-harnesses a shift among younger travelers away from transactional travel and toward multi-product, high-attachment experiences, which should drive greater customer lifetime value and recurring revenue uplift.

- Recent structural changes in the European market, such as the collapse of FTI and TUI's focus on margin over market share in risk capacity, present an opportunity for TUI to consolidate share at stronger price points, likely improving both top-line revenue and sustainable net profit as competitors exit value-destroying segments.

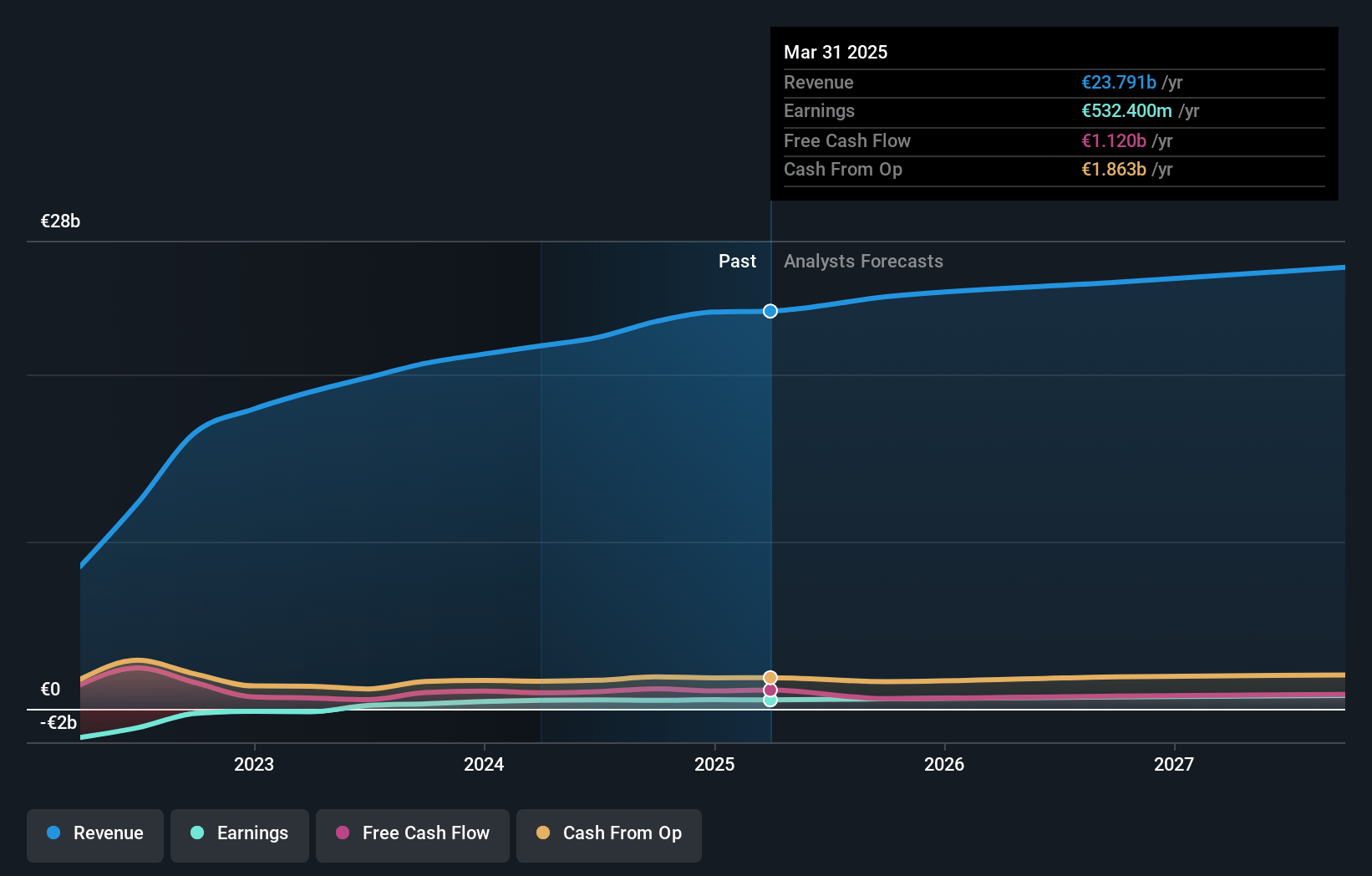

TUI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TUI compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TUI's revenue will grow by 6.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.2% today to 3.7% in 3 years time.

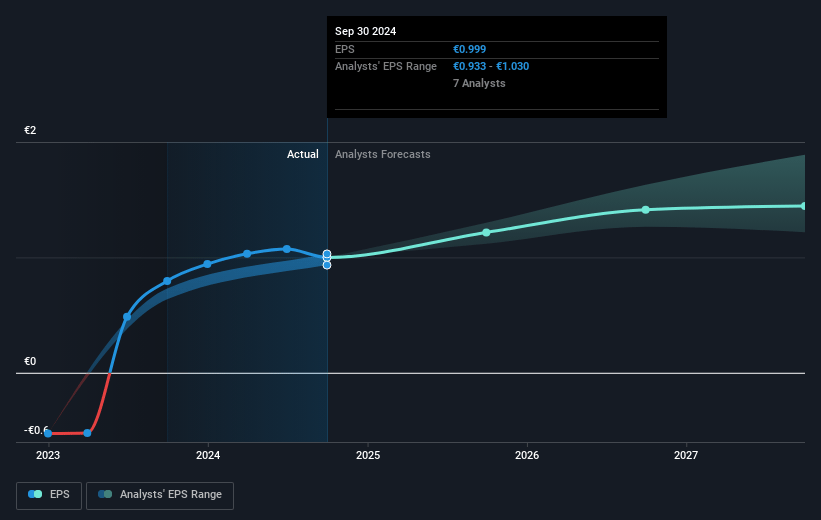

- The bullish analysts expect earnings to reach €1.1 billion (and earnings per share of €2.1) by about July 2028, up from €532.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.6x on those 2028 earnings, up from 7.7x today. This future PE is lower than the current PE for the GB Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to grow by 0.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.08%, as per the Simply Wall St company report.

TUI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The travel sector's increased vulnerability to stricter environmental regulations and rising climate concerns could reduce demand for TUI's long-haul and cruise products, ultimately constraining long-term revenue growth and pressuring gross margins.

- Demographic changes such as an ageing population in core European markets and a declining interest in traditional package holidays among younger consumers threaten TUI's ability to maintain or expand its customer base, putting long-term revenues and earnings at risk.

- Despite progress in digitalization, TUI's slower digital transformation and dependence on retail channels may leave it exposed to more agile, tech-driven competitors, which could erode market share and negatively impact revenue and net margin.

- Persistently high levels of debt, even after some deleveraging, leave TUI exposed to higher interest expenses and increased financial risk, which could depress net earnings and restrict investment in growth opportunities during periods of weak demand.

- The shift toward dynamic and independent travel models, rising industry costs, and competition from disruptive players like Airbnb and direct-to-consumer airlines create sustained margin compression, making it harder for TUI to achieve its targeted EBIT growth and maintain profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TUI is €15.27, which represents two standard deviations above the consensus price target of €10.52. This valuation is based on what can be assumed as the expectations of TUI's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €16.0, and the most bearish reporting a price target of just €7.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €28.8 billion, earnings will come to €1.1 billion, and it would be trading on a PE ratio of 9.6x, assuming you use a discount rate of 9.1%.

- Given the current share price of €8.03, the bullish analyst price target of €15.27 is 47.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.