Last Update 27 Nov 25

Fair value Increased 0.25%TIMA: Raised Earnings Guidance And Lower Discount Rate Will Drive Future Upside

Analysts have marginally raised their price target for ZEAL Network from €66.17 to €66.33. They cite a slightly improved revenue growth outlook and a modest reduction in the discount rate. Analysts also acknowledge higher projected earnings multiples for the company.

What's in the News

- ZEAL Network SE raised its earnings guidance for the financial year 2025, now expecting revenues between €205 million and €215 million. This is up from the previously announced range of €195 million to €205 million (Key Developments).

- The company has updated its forecast, reflecting increased confidence in near-term revenue growth (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has increased slightly from €66.17 to €66.33.

- Discount Rate has decreased moderately from 6.27% to 6.25%.

- Revenue Growth assumption has gone up from 6.50% to 6.80%.

- Net Profit Margin is nearly unchanged, moving from 18.44% to 18.42%.

- Future P/E multiple has increased notably from 24.4x to 32.0x.

Key Takeaways

- Expansion of proprietary products and successful online migration are driving user growth, product differentiation, and increased market share.

- Investments in technology and targeted marketing enhance operational efficiency and margins, while strategic focus and new initiatives support sustainable long-term profitability.

- Reliance on jackpot-driven growth, high marketing costs, regulatory risks, and limited cross-selling restrict revenue stability, margin expansion, and diversification potential for ZEAL Network.

Catalysts

About ZEAL Network- Engages in the online lottery brokerage business in Germany.

- The continued expansion and success of ZEAL's proprietary product verticals, such as Traumhausverlosung and the rapidly growing Games segment (up 49% YoY), demonstrate strong product differentiation and new user acquisition potential, driving revenue growth and higher customer lifetime value.

- Sustained migration of lottery and gaming activity from offline to online channels, as evidenced by a record 1.5 million active monthly users and resilience even in a weak jackpot environment, positions ZEAL to further expand its addressable market, supporting long-term revenue and market share gains.

- Investment in technology, automation, and targeted marketing initiatives (including performance and brand marketing for Traumhausverlosung) is enabling operational efficiencies and more effective customer segmentation, with early signs of improving margin (lottery gross margin above 17% and steady CPLs), thus supporting future net margin and EBITDA expansion.

- ZEAL's ability to retain and grow its user base even during periods with fewer high-value jackpots, combined with ongoing improvements in product-market mix and pricing, suggests that the business is becoming structurally less dependent on jackpot volatility, de-risking earnings and supporting long-term profitability.

- Management's reaffirmation of full-year guidance, ongoing exploration of further investment opportunities, and strategic focus on scaling new business areas indicate clear visibility into future growth initiatives likely to have a positive impact on revenue and earnings trajectory.

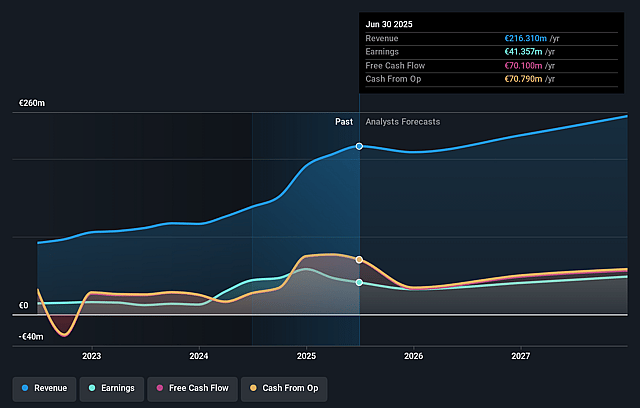

ZEAL Network Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ZEAL Network's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 19.3% today to 17.9% in 3 years time.

- Analysts expect earnings to reach €48.9 million (and earnings per share of €2.22) by about September 2028, up from €41.6 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as €56.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.2x on those 2028 earnings, up from 22.4x today. This future PE is greater than the current PE for the GB Hospitality industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

ZEAL Network Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ZEAL Network's continued dependence on jackpot-driven customer acquisition creates revenue cyclicality and volatility, meaning periods with fewer or smaller jackpots could depress new customer growth and transactional activity, leading to unpredictable or declining revenues and EBITDA in the long run.

- Heavy marketing investment and rising customer acquisition costs-particularly highlighted by the higher cost per lead (CPL) for Traumhausverlosung versus the core lottery business-may suppress net margins, especially if efficiency gains from scaling new products or improving marketing effectiveness do not materialize.

- Concentration risk in the core German lottery brokerage business exposes ZEAL to adverse regulatory, tax, or competitive changes in its primary market; any unfavorable developments could have an outsized negative impact on revenue and earnings.

- Regulatory and licensing constraints in cross-selling and gaming remain a structural challenge: current restrictions prevent ZEAL from marketing Games to its established lottery customer base, limiting upselling potential, slowing growth of new verticals, and potentially capping revenue diversification and scalability.

- As ZEAL scales new offerings like Traumhausverlosung and Games, there is ongoing risk that sustained higher acquisition costs, slower-than-expected margin improvement, or inability to increase average revenue per user in these new segments will erode overall profitability and impact long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €63.75 for ZEAL Network based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €73.0, and the most bearish reporting a price target of just €60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €273.5 million, earnings will come to €48.9 million, and it would be trading on a PE ratio of 25.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of €44.1, the analyst price target of €63.75 is 30.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.