Key Takeaways

- Accelerated digital adoption and personalized app-based engagement could enable Redcare Pharmacy to outperform revenue and margin expectations, driving structural cost efficiencies and higher profitability.

- Expanding its marketplace and digital health services positions Redcare to dominate the European health platform space, benefiting from persistent demand and untapped high-margin opportunities.

- Rising competition, regulatory hurdles, and slow healthcare digitalization are straining margins and limiting Redcare Pharmacy's growth prospects despite expanding health demand.

Catalysts

About Redcare Pharmacy- Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

- Analyst consensus sees rapid revenue growth from e-Rx adoption and strong customer retention, but widespread app-based eRx uptake could accelerate adoption even further, positioning Redcare Pharmacy to capture a disproportionately large share of the prescription drug market much faster than expected and driving both top-line revenue and structural cost efficiencies that unlock higher EBITDA margins.

- While analysts broadly expect marketing and digital engagement initiatives to lift customer acquisition and retention, these estimates may understate the compounding effect of app-based journeys, CardLink, and personalized communications, which are showing signs of driving both average order value and repeat order rates significantly beyond modeled assumptions, supporting sustained high revenue growth and rapid margin expansion.

- The ongoing shift in consumer healthcare towards digital channels and e-commerce has reached a tipping point, and Redcare's established digital infrastructure, multi-country logistics, and marketplace expansion place it at the epicenter of this migration, creating the potential for Redcare to become the dominant one-stop health platform in Europe and structurally outgrow the broader sector.

- With an aging population and rising chronic disease burden across Europe, Redcare is uniquely positioned to benefit from persistent demand for prescription medicines and health solutions, not just through sales volume but also by layering on data-driven personalized services and digital health offerings-which could open lucrative, high-margin revenue streams and raise net margins over time.

- The rapid scaling of its proprietary marketplace, substantially expanding available SKUs and fostering cross-selling between Rx and non-Rx baskets, has the potential to materially increase average basket size, drive significant GMV growth, enable higher-margin private label penetration, and further leverage fixed logistics costs, accelerating growth in revenue, gross profit, and overall earnings beyond current market expectations.

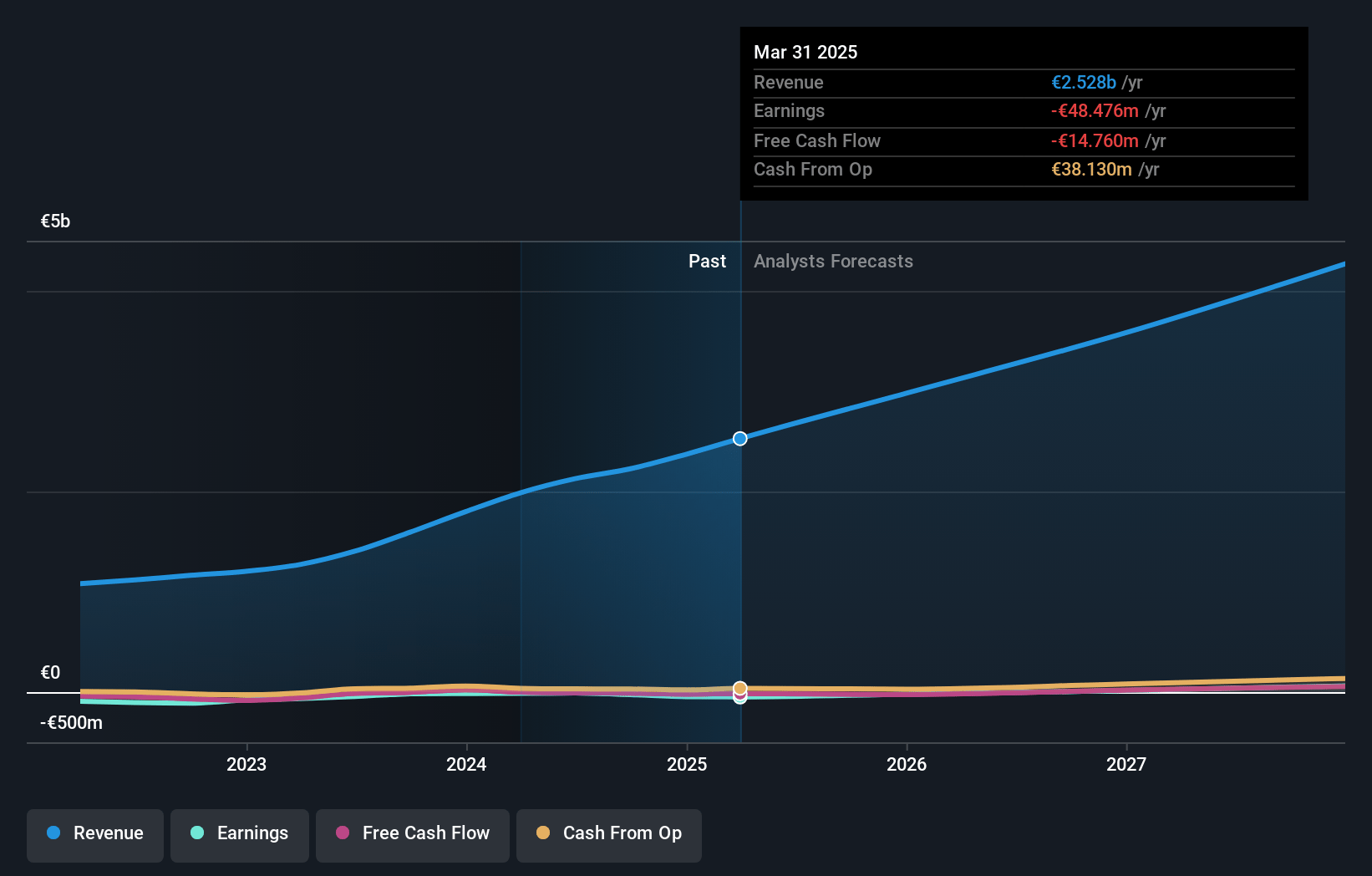

Redcare Pharmacy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Redcare Pharmacy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Redcare Pharmacy's revenue will grow by 27.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -1.9% today to 2.1% in 3 years time.

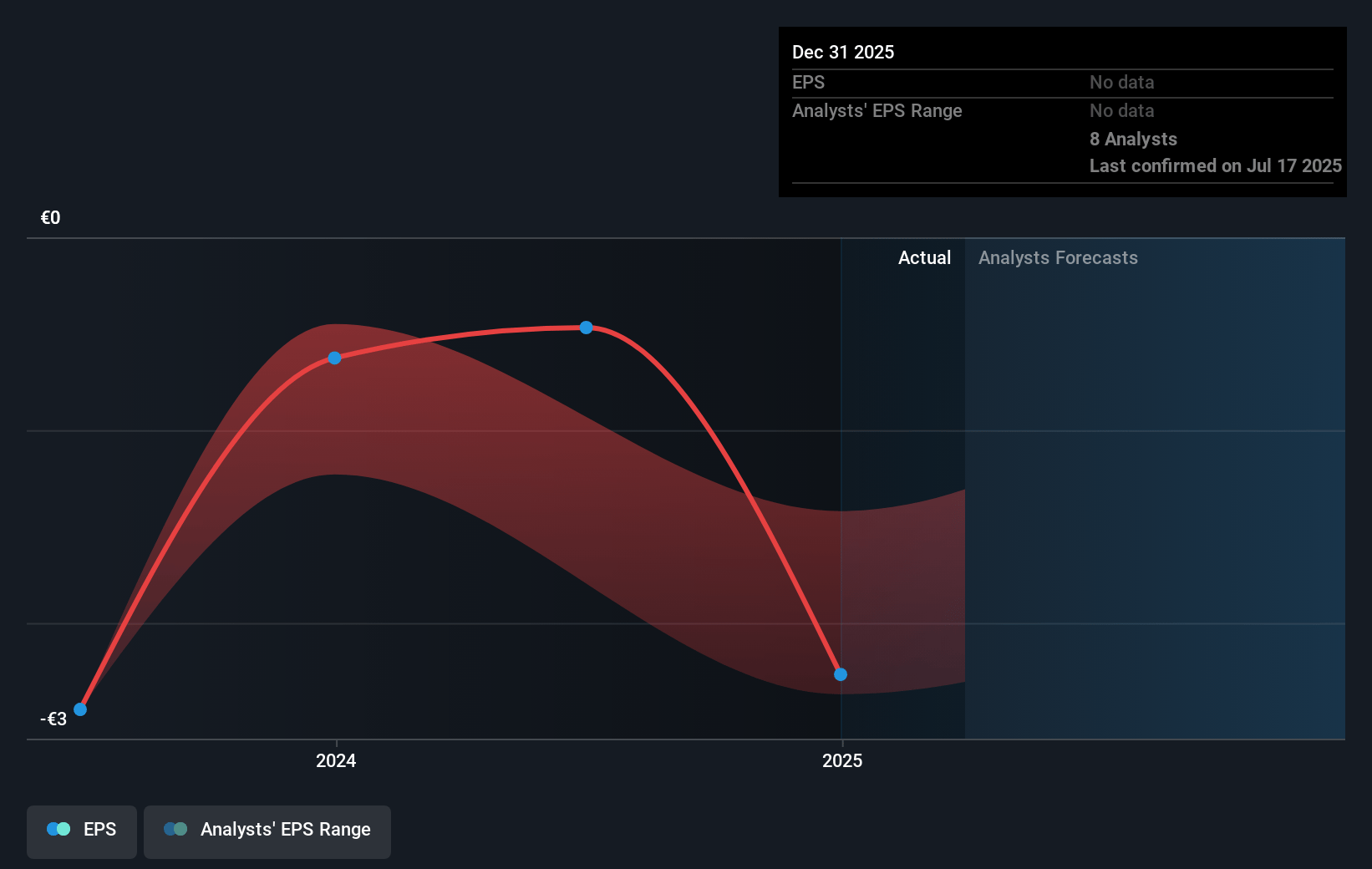

- The bullish analysts expect earnings to reach €111.9 million (and earnings per share of €nan) by about July 2028, up from €-48.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 46.4x on those 2028 earnings, up from -38.2x today. This future PE is greater than the current PE for the GB Consumer Retailing industry at 16.4x.

- Analysts expect the number of shares outstanding to grow by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.91%, as per the Simply Wall St company report.

Redcare Pharmacy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both legacy pharmacy chains ramping up online efforts and large e-commerce players, as well as specialized digital health startups, is driving up customer acquisition costs for Redcare Pharmacy and pressuring net margins, as evidenced by internal discussion on rising marketing expenditures and emphasis on the need for improved marketing efficiency.

- The online pharmacy sector is facing escalating regulatory scrutiny on pharmaceuticals and health data privacy, illustrated by the ongoing restrictions on OTC product sales through third-party platforms like Amazon and the significant focus in management commentary on data protection; this could increase compliance costs and limit digital marketing channels, negatively impacting long-term earnings and revenue growth.

- Redcare Pharmacy remains heavily reliant on low-margin prescription drug (Rx) sales while its private label and wellness offerings, though growing, are acknowledged as still limited and not yet a major differentiator, which could result in persistently capped profitability and limited contributions to future earnings growth.

- Ongoing challenges and slow progress in regulatory rollout and reimbursement for e-prescriptions and telehealth services across core European markets, as explicitly referenced in the cautious management commentary on German market share and reform, create risks of delayed revenue realization and suboptimal utilization of new investments, dampening top line growth.

- Demographic shifts such as an ageing population, while expanding healthcare demand overall, may not translate fully into online pharmacy revenue, since a substantial customer segment continues to prefer in-person consultations and physical pharmacies, thereby limiting digital penetration and capping long-term revenue opportunities for Redcare Pharmacy.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Redcare Pharmacy is €214.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Redcare Pharmacy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €214.0, and the most bearish reporting a price target of just €94.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €5.2 billion, earnings will come to €111.9 million, and it would be trading on a PE ratio of 46.4x, assuming you use a discount rate of 4.9%.

- Given the current share price of €90.0, the bullish analyst price target of €214.0 is 57.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.