Key Takeaways

- Heavy reliance on electronic prescription adoption and regulatory trends poses significant risks to growth and revenue predictability.

- Intensifying competition, persistent offline loyalty, and regulatory scrutiny threaten market share, margin expansion, and sustainable digital penetration.

- Heavy dependence on eRx rollout, rising costs, customer retention issues, slow own-brand growth, and intensified competition pose significant risks to future profitability and margin expansion.

Catalysts

About Redcare Pharmacy- Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

- Although Redcare Pharmacy continues to deliver robust organic sales growth, with group sales up 28% year over year and a substantial expansion in the Rx segment (191% growth in Germany), the business remains heavily reliant on the widespread adoption and regulatory momentum of electronic prescriptions. Any policy delays, incomplete regional rollouts, or unfavorable regulatory shifts could significantly disrupt the expected revenue growth trajectory.

- While the aging population and the increasing prevalence of chronic diseases in Europe are expected to expand the addressable market for digital pharmacy services, there remains a persistent risk that a significant portion of prescriptions will continue to be filled offline as patients, particularly older cohorts, maintain loyalty to traditional brick-and-mortar pharmacies. This could cap digital penetration rates and limit Redcare's long-term revenue ceiling.

- Even as Redcare Pharmacy invests in further technological and logistical optimization, including automation and AI, the landscape is rapidly evolving with large incumbent healthcare and retail players accelerating vertical integration and embracing omnichannel strategies. This intensifying competition could erode Redcare's market share over time and impose sustained pressure on net margins despite operational improvements.

- Despite a positive long-term trend toward direct-to-home pharmacy delivery and growing platform sales, rising regulatory scrutiny-including tighter price controls and evolving data privacy rules-has the potential to significantly increase compliance expenses and legal risks. This would weigh on operational efficiency and could hamper future EBIT expansion.

- Although the company's own-brand and private label products are delivering higher growth rates, Redcare's margin profile is still dominated by established A and B brands and a low share of own-label sales. Limited product differentiation in the online pharmacy sector, combined with persistent price-based competition and rising customer acquisition costs, poses ongoing risks to sustaining high customer retention and recurring revenue, which may ultimately limit improvements in gross and net margins.

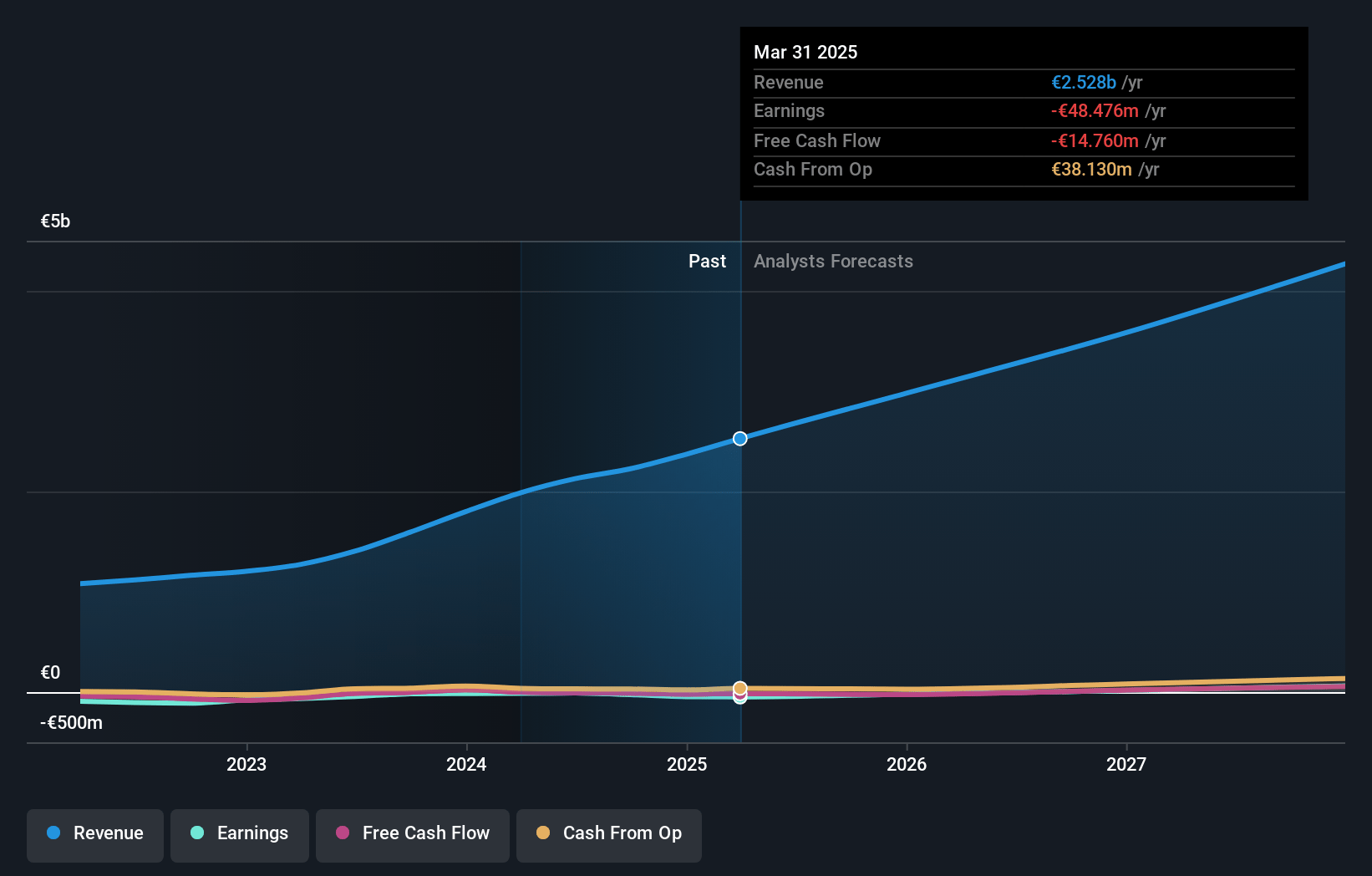

Redcare Pharmacy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Redcare Pharmacy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Redcare Pharmacy's revenue will grow by 18.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -1.9% today to 0.7% in 3 years time.

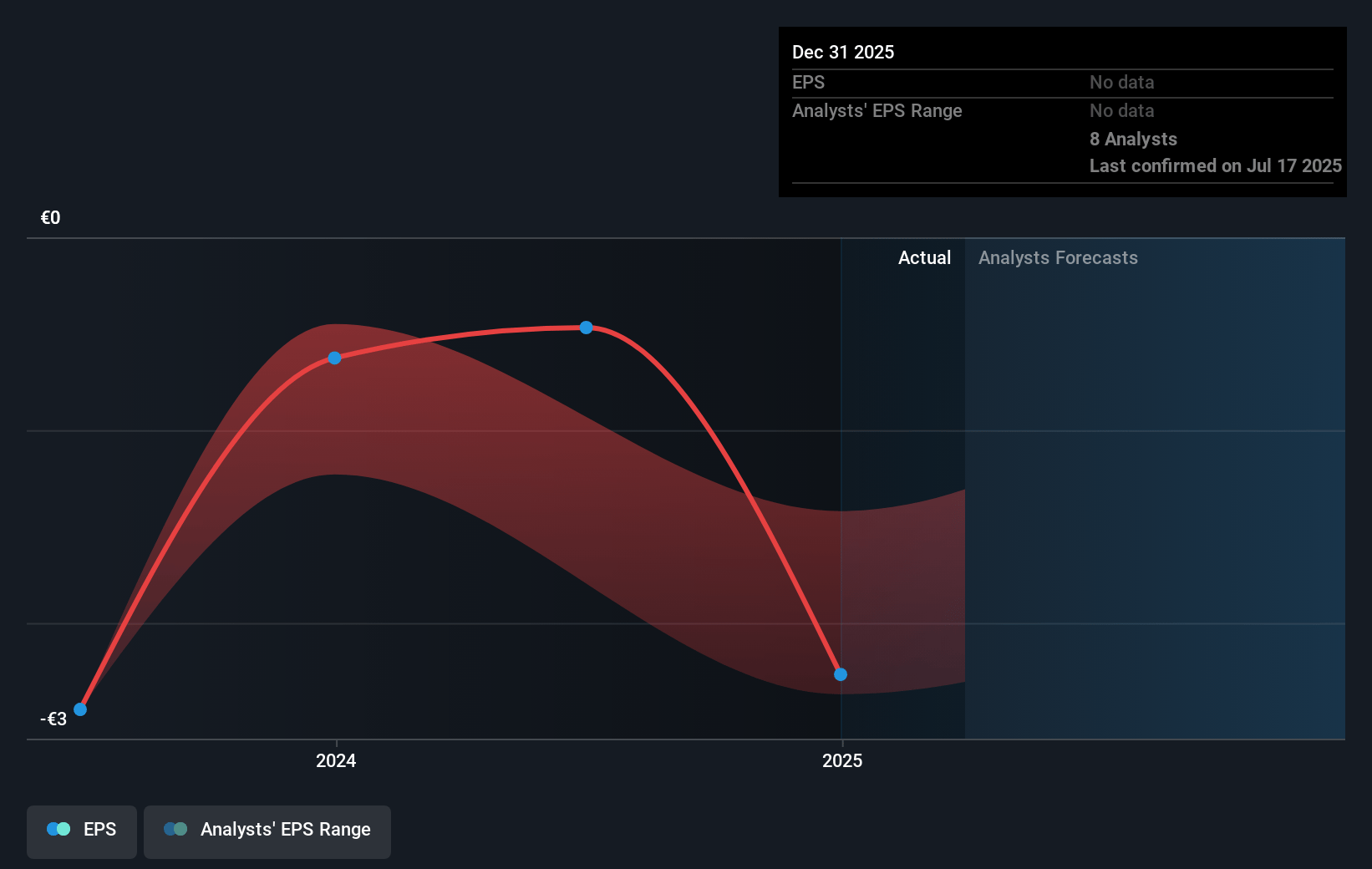

- The bearish analysts expect earnings to reach €29.2 million (and earnings per share of €nan) by about July 2028, up from €-48.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 78.5x on those 2028 earnings, up from -41.0x today. This future PE is greater than the current PE for the GB Consumer Retailing industry at 16.4x.

- Analysts expect the number of shares outstanding to grow by 1.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.9%, as per the Simply Wall St company report.

Redcare Pharmacy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's robust revenue growth is highly dependent on the ongoing rollout and mass adoption of electronic prescriptions (eRx) in Germany; any regulatory delays, policy changes, or lower-than-expected uptake could significantly stall revenue growth and impact the ability to scale profitability.

- Net Promoter Score (NPS) has declined due to challenges onboarding new customers and weaker satisfaction in newer business areas like Rx and the marketplace, suggesting customer retention and long-term loyalty could suffer, resulting in higher churn and potentially reduced recurring revenue.

- The business is exposed to increasing marketing and fulfillment costs, especially as incremental marketing spend per Rx revenue appears to be rising, which, if persistent, could compress net margins and impede the company's ability to hit its long-term EBITDA targets.

- The platform relies heavily on rapid international expansion and growing share of private-label and own-brand products for future margin gains, yet management admits that own brands still represent a small part of sales and that cross-selling rates lag behind brick-and-mortar levels, both of which could limit gross margin expansion and overall earnings growth if progress stalls.

- Market share gains and profitability are threatened by competition from both traditional pharmacies adopting omnichannel strategies and other digital players, as well as possible regulatory or reimbursement headwinds (such as price controls, new data privacy laws, or changes in pharmacy remuneration), each posing risks to topline growth and industry pricing power, potentially weighing on long-term revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Redcare Pharmacy is €94.39, which represents two standard deviations below the consensus price target of €165.0. This valuation is based on what can be assumed as the expectations of Redcare Pharmacy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €214.0, and the most bearish reporting a price target of just €94.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €4.2 billion, earnings will come to €29.2 million, and it would be trading on a PE ratio of 78.5x, assuming you use a discount rate of 4.9%.

- Given the current share price of €96.6, the bearish analyst price target of €94.39 is 2.3% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.