Key Takeaways

- Brand repositioning, celebrity partnerships, and digital innovation are driving stronger-than-expected revenue growth and premiumization across expanded global markets.

- Leaner supply chains, cost efficiencies, and geographic diversification position Hugo Boss for improved profitability and stability despite macroeconomic uncertainties.

- Weakening demand, margin pressure, legacy retail challenges, and shifting consumer trends threaten Hugo Boss's revenue growth, profitability, and ability to adapt to evolving market dynamics.

Catalysts

About Hugo Boss- Provides apparels, shoes, and accessories for men and women worldwide.

- Analysts broadly agree that David Beckham's partnership will boost brand awareness and sales, yet initial figures indicate an even greater upside, with the campaign's underwear line alone already achieving over 20% sales growth and delivering a powerful halo effect lifting other categories and average ticket sizes; this momentum could drive sustained above-expectation revenue growth.

- The analyst consensus sees ongoing cost efficiencies and sourcing improvements modestly boosting net margins, but Hugo Boss's structurally leaner supply chain-with further reductions in air freight, enhanced in-house sourcing capabilities, and lower China exposure-positions the company to surpass consensus margin expectations as macro headwinds abate, leading to a material uplift in profitability.

- Hugo Boss's brand repositioning toward a younger, more casual demographic, and the global expansion of wholesale and franchise networks, vastly broadens the addressable market and opens new growth runways, suggesting long-term revenue growth will significantly exceed current expectations as the global middle class accelerates premium brand demand.

- Rapid gains in omnichannel retail, digital partnerships, and efficient adoption of new technology (e.g., tailored online experiences, data-driven insights, and reduced delivery lead times) position Hugo Boss to capitalize on the global shift to digital commerce, amplifying both top-line growth and gross margin improvement as scale advantages deepen.

- The company's disciplined expansion in Asia and the Americas-along with market share gains in U.S. department stores and success in tourist-driven destinations-leverage rising global travel and wealth growth in emerging markets, meaning that diversified geographic revenue streams and reduced regional dependence will drive both revenue stability and sustained earnings outperformance.

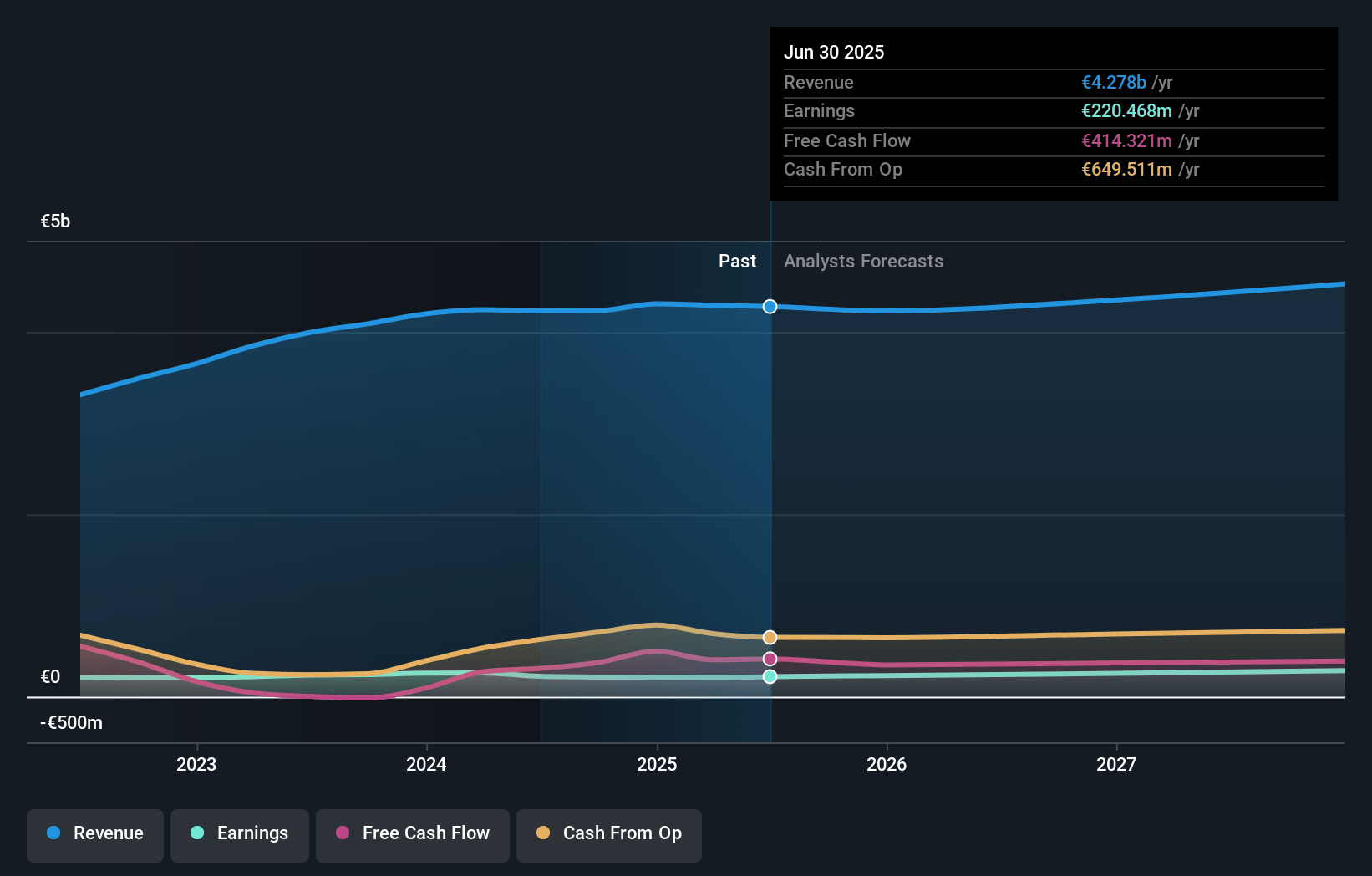

Hugo Boss Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hugo Boss compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hugo Boss's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.9% today to 7.5% in 3 years time.

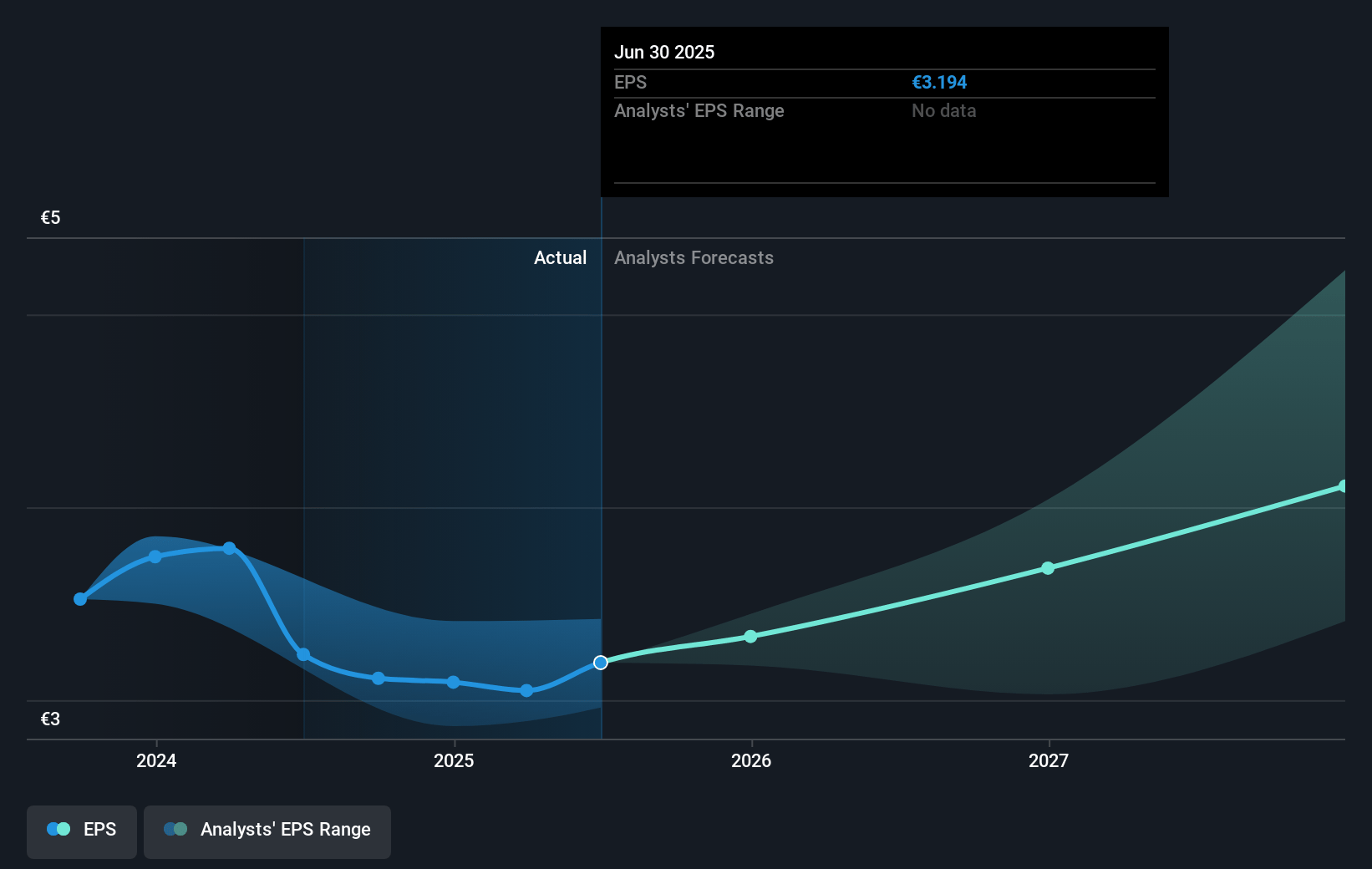

- The bullish analysts expect earnings to reach €384.9 million (and earnings per share of €5.59) by about July 2028, up from €210.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from 14.0x today. This future PE is lower than the current PE for the GB Luxury industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 2.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.21%, as per the Simply Wall St company report.

Hugo Boss Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hugo Boss faces secular headwinds from declining middle-class purchasing power and weak consumer sentiment in developed markets, as highlighted by subdued demand in China and the US and foot traffic falling as much as 20 to 30 percent in US malls and outlets, which could persistently reduce discretionary spending and limit top-line revenue growth.

- Intensified promotional activity and market saturation, particularly in multi-brand environments in Europe and the Americas, suggest sustained margin pressure and commoditization risks for accessible luxury, likely leading to persistent gross margin compression and lower operating profitability.

- The company remains heavily exposed to legacy brick-and-mortar retail and wholesale channels, both of which reported declines in the quarter, and may struggle to keep pace with digital-native competitors if its digital transformation continues to lag, ultimately capping growth potential and impacting future earnings.

- Despite cost-cutting efforts, EBIT declined 12 percent and free cash flow was negative 66 million euros in the quarter, with rising inventories and working capital requirements reflecting challenging supply chain dynamics and regional macroeconomic volatility, which may continue to weigh on net margins and cash conversion.

- Shifting consumer preferences away from traditional suiting and toward casual and athleisure wear threaten Hugo Boss's core brand positioning, and while efforts like the Beckham campaign aim to refresh brand relevance, failure to successfully reposition could result in long-term structural revenue declines if brand appeal does not keep pace with broader fashion trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hugo Boss is €60.18, which represents two standard deviations above the consensus price target of €43.2. This valuation is based on what can be assumed as the expectations of Hugo Boss's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €69.0, and the most bearish reporting a price target of just €32.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €5.1 billion, earnings will come to €384.9 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of €42.56, the bullish analyst price target of €60.18 is 29.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.