Key Takeaways

- Expanding project execution in Green hydrogen ventures and favorable EU regulations support robust revenue growth and improved margins.

- R&D and cost management strategies aim to boost technological leadership and maintain profitability despite potential sales slowdowns.

- Leadership changes and regulatory uncertainties could destabilize strategic execution and impact margins, revenue stability, and project profitability in key sectors.

Catalysts

About thyssenkrupp nucera KGaA- Engages in the development, engineering, procurement, commissioning, and licensing of high-performance electrolysis technologies in Germany, Italy, the Middle East, Africa, South America, Asia, and internationally.

- The successful handing over of electrolyzer modules for the NEOM project and ongoing progress in large-scale projects, like Shell's in Rotterdam, indicate a growing capability in executing significant Green hydrogen ventures. This is expected to drive revenue as these projects move to completion and potential new orders arise.

- The clear regulatory support in Europe, such as Red III quotas and EU hydrogen bank auctions, highlights a strong, favorable environment. This should not only increase demand for Green hydrogen but also secure profitable margins through localized production advantages due to new sourcing rules, thus improving revenue and net margins.

- Guidance on a strong sales pipeline in Europe, North America, and other regions, coupled with active negotiations for new projects like the one in Spain, shows potential for robust revenue growth in the Green hydrogen segment as more FIDs are expected by summer 2025.

- Cost containment strategies, along with increased service demand in the Chlor-alkali business, should support stable or improved margins despite expected sales deceleration. This maintains profitability by leveraging higher-margin service revenues.

- Growing R&D investment, focusing on advanced technologies like SOEC, suggests potential efficiency improvements and technological leadership, which could enhance future net margins and competitive positioning in the evolving hydrogen economy.

thyssenkrupp nucera KGaA Future Earnings and Revenue Growth

Assumptions

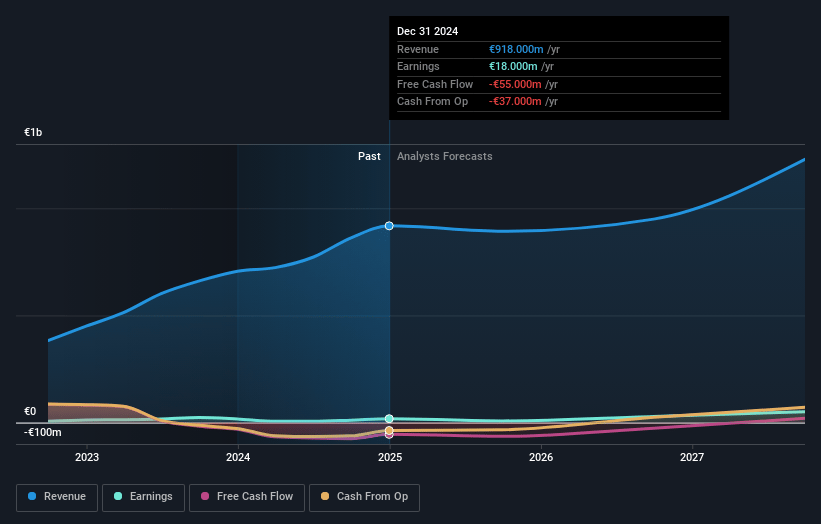

How have these above catalysts been quantified?- Analysts are assuming thyssenkrupp nucera KGaA's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.0% today to 4.7% in 3 years time.

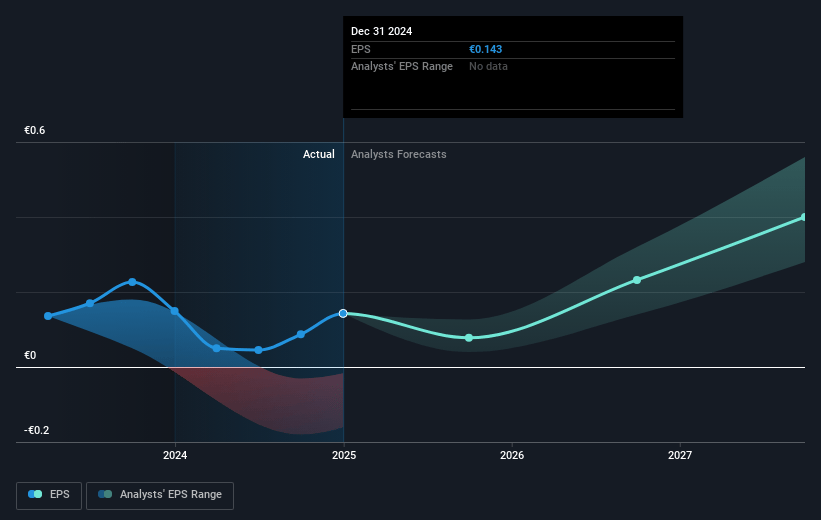

- Analysts expect earnings to reach €54.7 million (and earnings per share of €0.44) by about May 2028, up from €18.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €70 million in earnings, and the most bearish expecting €32 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, down from 64.2x today. This future PE is greater than the current PE for the DE Construction industry at 30.9x.

- Analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.49%, as per the Simply Wall St company report.

thyssenkrupp nucera KGaA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The departure of key management leaders, such as the CFO and CTO, raises concerns about leadership continuity and the impact on strategic execution, which could potentially affect net margins and earnings.

- The volatility and postponement of projects, particularly in the Green hydrogen segment, could result in fluctuating order intakes and affect future revenue stability.

- Regulatory uncertainty in markets, such as the dependency on U.S. administration actions regarding the IRA and 45V, poses a risk to the timely advancement of Green hydrogen projects and could impact future growth projections and revenue.

- The impact of European regulations like RED III on project profitability due to additionality and temporal correlation requirements could increase operational costs and potentially reduce net margins.

- Potential risks related to U.S. regulations on Chlor-alkali projects, such as conversions required due to bans on asbestos, could increase costs and impact profitability in the sector.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.442 for thyssenkrupp nucera KGaA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €20.0, and the most bearish reporting a price target of just €8.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.2 billion, earnings will come to €54.7 million, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 5.5%.

- Given the current share price of €9.14, the analyst price target of €13.44 is 32.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.