Key Takeaways

- Partnerships in hydrogen propulsion and expanded digital MRO capabilities position MTU for long-term growth and leadership in emerging aerospace technologies.

- Operational upgrades and strong aftermarket demand drive revenue growth and margin outperformance amid industry consolidation and increased spare engine sales.

- MTU faces structural demand challenges, sector concentration risk, aftermarket margin pressures, geopolitical uncertainties, and must invest heavily to adapt to decarbonization and emerging technologies.

Catalysts

About MTU Aero Engines- Engages in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines, and aero-derivative industrial gas turbines in Germany, other European countries, North America, Asia, and internationally.

- While analyst consensus points to strong growth from air traffic and increased MRO demand, they may be underestimating the earnings leverage from record-breaking order wins and management's ambitious 2030 targets, which call for nearly tripling revenues and achieving mid-teens EBIT margins; sustained high levels of spare and lease engine sales, above historical norms, could significantly boost near-term and structural profitability.

- Analyst consensus forecasts margin improvement from higher spare and MRO pricing, but recent operational upgrades-including capacity expansions in high-growth regions like North America and Poland-could allow MTU to capture share ahead of expectations, driving a step change in both revenue scale and cost efficiency that supports margin outperformance beyond current forecasts.

- The company's deepening partnership with Airbus on hydrogen propulsion and fuel cell technologies positions MTU as a probable first mover in the transition to zero-emission flight, opening up a rapidly-expanding, high-margin market as airlines and regulators accelerate decarbonization by the late 2020s, supporting multi-decade, above-market revenue and earnings growth.

- MTU's increased investment in data-driven MRO services and predictive maintenance, alongside the ramp-up of new digital-enabled test facilities, will enhance operational efficiency and customer retention, supporting recurring, high-margin aftermarket revenue far above traditional shop-visit-based models.

- The maturation of MTU's risk-and-revenue-sharing positions on next-generation engine programs-across both commercial and defense-ensures a growing annuity stream of earnings insulated from cyclical downturns, while industry consolidation and proprietary technologies create long-term pricing power and defendable premium margins.

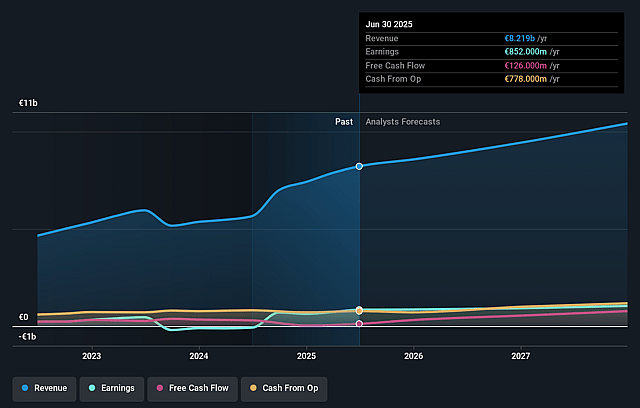

MTU Aero Engines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on MTU Aero Engines compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming MTU Aero Engines's revenue will grow by 11.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 10.4% today to 10.2% in 3 years time.

- The bullish analysts expect earnings to reach €1.2 billion (and earnings per share of €21.34) by about September 2028, up from €852.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.0x on those 2028 earnings, up from 22.8x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 106.4x.

- Analysts expect the number of shares outstanding to decline by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.73%, as per the Simply Wall St company report.

MTU Aero Engines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Long-term regulatory and societal pressure to decarbonize aviation, as well as advances in competing technologies like telepresence and high-speed trains, could structurally reduce demand for air travel over time, directly constraining MTU Aero Engines' core revenue growth from both OEM engine sales and aftermarket service.

- MTU's heavy concentration in the commercial aircraft engine sector-especially as a key supplier to programs like Pratt & Whitney's GTF-exposes the company to risks from technological disruption, cyclical downturns in passenger aviation, or program-specific issues, threatening earnings stability and long-term revenue diversification.

- The anticipated normalization of spare and lease engine sales after an exceptionally strong first half, combined with a high reliance on aftermarket revenues and service contracts, increases the risk of margin compression if airlines seek cost reductions or if engine reliability lengthens overhaul intervals, putting sustained pressure on net margins.

- Heightened geopolitical tensions and ongoing threats of new or higher tariffs-especially between the US and EU-cause significant uncertainty for globally integrated supply chains, which may result in increased costs, operational disruptions, and unpredictable impacts on both revenue and profitability for MTU.

- The aerospace sector's accelerating shift toward electric and hybrid-electric propulsion for regional and short-haul aviation, combined with necessary heavy investments in digitalization and cybersecurity, threaten to erode the future addressable market for traditional gas turbines, requiring MTU to make large, potentially margin-dilutive capital expenditures to remain competitive and affecting long-term returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for MTU Aero Engines is €470.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MTU Aero Engines's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €470.0, and the most bearish reporting a price target of just €296.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €11.4 billion, earnings will come to €1.2 billion, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 5.7%.

- Given the current share price of €361.5, the bullish analyst price target of €470.0 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MTU Aero Engines?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.