Key Takeaways

- Climate regulations and the shift toward greener transport threaten MTU's market size and erode demand for core engine products.

- Geopolitical fragmentation and slow adaptation to next-generation engines risk international contracts, sustained margin pressure, and increased financial vulnerability.

- Strong growth in commercial and military engine programs, aftermarket expansion, and strategic partnerships underpin MTU Aero Engines' long-term revenue and margin enhancement.

Catalysts

About MTU Aero Engines- Engages in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines, and aero-derivative industrial gas turbines in Germany, other European countries, North America, Asia, and internationally.

- Escalating climate policy and emissions regulation globally threaten to suppress long-term air travel growth and impose stricter standards on aviation, directly reducing the overall addressable market for MTU's engines and constraining future revenue expansion over the coming decade.

- Rapid adoption of sustainable transport alternatives such as high-speed rail and emerging electric vehicle technologies may accelerate displacement of regional and short-haul flights, undermining demand for MTU's core engine offerings and eroding long-term revenue streams.

- Intensifying geopolitical fragmentation and protectionist policies could force more aviation supply chains and aircraft procurement to be localized within major markets, jeopardizing MTU's ability to win and maintain lucrative international OEM and joint venture contracts, which would negatively affect both top-line growth and margins.

- Continued heavy dependence on legacy engine platforms coupled with slow adaptation to next-generation engine technologies, as highlighted by ongoing GTF-related reliability and compensation costs, threatens future product competitiveness and risks declining margins and sustained elevated warranty expenses into 2026 and beyond.

- Relentlessly rising R&D requirements and capital expenditures to pursue emerging propulsion technologies combined with uncertain customer adoption means potential for chronic margin pressure, weaker free cash flow generation, and increased financial risk if next-generation programs fail to scale or deliver expected returns.

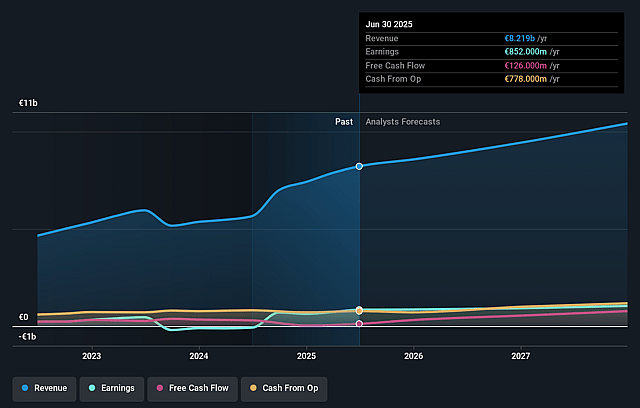

MTU Aero Engines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on MTU Aero Engines compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming MTU Aero Engines's revenue will grow by 7.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 10.4% today to 9.4% in 3 years time.

- The bearish analysts expect earnings to reach €969.3 million (and earnings per share of €17.57) by about September 2028, up from €852.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, down from 22.8x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 106.4x.

- Analysts expect the number of shares outstanding to decline by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.73%, as per the Simply Wall St company report.

MTU Aero Engines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained global air passenger and cargo traffic growth, with passenger traffic up 6% and cargo up 3% in the first five months, as well as record-breaking order intakes for narrow

- and wide-body engines, supports strong backlog and long-term revenue growth for MTU Aero Engines.

- Expansion of MTU's commercial aftermarket and MRO capacity-including investments in new facilities such as Fort Worth and EME Aero's additional test cell-as well as strong GTF MRO demand and joint ventures, will increase high-margin, recurring revenue streams and earnings stability over the coming years.

- Ongoing partnership expansion and deepening with industry leaders (Airbus for hydrogen propulsion technology and Avio Aero/Safran for next-gen helicopter engines) positions MTU to capture opportunities in emerging propulsion systems, potentially enhancing both revenue growth and margins in the long term.

- Increased production rates and deliveries for major engine programs-such as the PW1100 powering the A320neo family, GEnx on the Boeing 787, and anticipated growth in T408 and EJ200 military engine programs-are set to drive strong top-line growth and support overall earnings expansion.

- Long-term guidance and targets (revenues of €13 billion to €14 billion and EBIT margin of 14.5% to 15.5% by 2030, with high double-digit cash conversion) indicate management's confidence in sustained profitable growth, driven by execution on operational improvements and secular industry tailwinds favorably impacting both revenue and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for MTU Aero Engines is €296.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of MTU Aero Engines's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €470.0, and the most bearish reporting a price target of just €296.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €10.3 billion, earnings will come to €969.3 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 5.7%.

- Given the current share price of €361.5, the bearish analyst price target of €296.0 is 22.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MTU Aero Engines?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.