Last Update 11 Dec 25

Fair value Increased 0.18%MTX: Aftermarket Cash Flows Will Drive Future Upside Despite Visibility Concerns

The analyst-derived fair value estimate for MTU Aero Engines has edged up by about EUR 1 to roughly EUR 411, as analysts factor in a series of recent price target increases and ongoing confidence in the durability of cash flow and aftermarket-driven earnings, despite some lingering caution around visibility versus peers.

Analyst Commentary

Analysts remain divided on the risk reward profile for MTU Aero Engines, with a clear tilt toward higher valuation targets but ongoing debate around the durability and visibility of cash flow improvement.

Bullish Takeaways

- Bullish analysts have lifted price targets as high as EUR 500, arguing that recent performance and aftermarket trends justify a premium multiple to reflect sustained spare parts driven earnings growth.

- Strong Q3 execution is viewed by bulls as evidence that higher margin spare parts and aftermarket activity can continue to support robust cash generation, underpinning both higher valuation and confidence in medium term guidance.

- The decision by some firms to reinstate MTU as a top pick signals conviction that the company can outgrow the broader civil aerospace market through mix improvement and disciplined execution.

- Upward revisions to targets from major houses such as JPMorgan reinforce the view that earnings momentum and cash flow upgrades are not yet fully priced into the shares.

Bearish Takeaways

- Bearish analysts highlight that MTU’s cash flow trajectory lacks the clarity seen at certain peers, which tempers enthusiasm for multiple expansion despite near term upgrades.

- The weak share reaction following a strong Q3 is seen as evidence of investor skepticism about the sustainability of current performance, particularly around spare parts demand and aftermarket margins.

- Some coverage initiations at more neutral ratings suggest that, while upside exists, the valuation already embeds ambitious assumptions on execution, leaving limited room for disappointment.

- Concerns around visibility into long term cash conversion and cycle risk in civil aerospace keep a cohort of analysts cautious, capping how far consensus is willing to push fair value estimates in the near term.

What's in the News

- Jefferies raised its price target on MTU Aero Engines to EUR 500 from EUR 470, reiterated a Buy rating, and reinstated the stock as its Civil Top Pick, citing strong spare-parts-driven earnings following a stellar Q3, despite recent share price skepticism (Jefferies periodical).

- MTU Aero Engines reaffirmed its 2025 guidance, expecting group sales between EUR 8.6 billion and EUR 8.8 billion, based on an assumed USD 1.13 per EUR 1 exchange rate (Corporate guidance).

- MTU Maintenance and Teledyne Controls announced a partnership to provide enhanced engine health monitoring and predictive maintenance, with Viva Aerobus as launch customer leveraging the solution for its A320 V2500 fleet (Client announcement).

- MTU Aero Engines scheduled an Analyst and Investor Day, signaling continued engagement with the market on strategy, cash flow, and long term earnings visibility (Analyst/Investor Day).

Valuation Changes

- The fair value estimate has risen slightly from about €410.56 to approximately €411.28, reflecting modest upward adjustments in analyst expectations.

- The discount rate has increased marginally from around 5.62 percent to about 5.64 percent, implying a slightly higher required return in the valuation model.

- The revenue growth assumption is effectively unchanged, holding steady at roughly 10.15 percent, signaling continued confidence in the existing top line trajectory.

- The net profit margin forecast remains stable at about 10.59 percent, indicating no material change in medium term profitability expectations.

- The future P/E multiple has edged up slightly from roughly 21.84x to about 21.89x, suggesting a modestly higher valuation being applied to forward earnings.

Key Takeaways

- Strong demand for fuel-efficient engines and expanding aftermarket services drive recurring revenue, while MTU's technological leadership secures future growth opportunities.

- Diversification across commercial, military, and strategic partnerships enhances stability and positions the company for resilient margins despite geopolitical and regulatory uncertainties.

- Heavy reliance on key new engine programs, supply chain fragility, and rising geopolitical and R&D costs threaten margins, profit stability, and financial flexibility.

Catalysts

About MTU Aero Engines- Engages in the development, manufacture, marketing, and maintenance of commercial and military aircraft engines, and aero-derivative industrial gas turbines in Germany, other European countries, North America, Asia, and internationally.

- The surge in global air travel demand and robust order intake for new, fuel-efficient engines like the GTF (highlighted by record deals with airlines such as Wizz Air, Frontier, and LOT) are expected to continue driving strong OEM and MRO revenue growth and expanding order backlog, translating to higher long-term revenue and earnings visibility.

- Airlines' fleet modernization efforts and the growing focus on fuel efficiency and lower emissions support multi-decade replacement cycles; MTU's leadership in advancing geared turbofan technology and joint R&D for hydrogen-powered propulsion positions the company for continued margin expansion and future revenue streams from next-generation platforms.

- Expansion of high-margin aftermarket and MRO services, with capacity enhancements at facilities like EME Aero and the Fort Worth site, will support recurring revenue and improved net margins as narrow-body and wide-body engines enter heavy maintenance cycles, leveraging ongoing fleet utilization growth.

- The company's growing footprint in both commercial and military engine programs (with ramp-ups in EJ200 and T408 engines and involvement in strategic European defense collaborations) provides resilient, diversified revenue streams that reduce cyclicality and underpin stable long-term earnings.

- Heightened focus on supply chain localization, operational excellence, and European partnerships improves MTU's strategic value during an era of geopolitical and regulatory uncertainty, supporting more stable contract flows and potential margin resilience even amid rising protectionist risks.

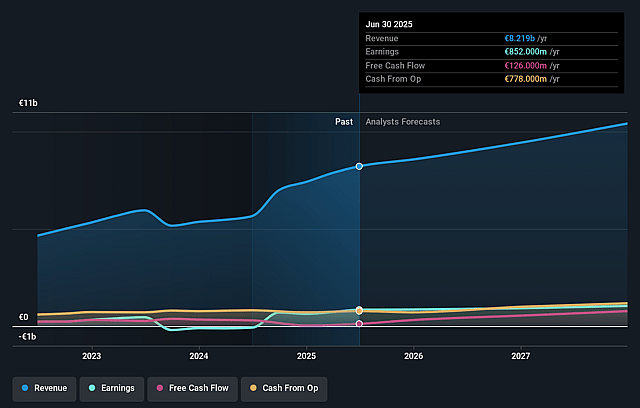

MTU Aero Engines Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MTU Aero Engines's revenue will grow by 9.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.4% today to 10.3% in 3 years time.

- Analysts expect earnings to reach €1.1 billion (and earnings per share of €20.97) by about September 2028, up from €852.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, down from 23.9x today. This future PE is lower than the current PE for the GB Aerospace & Defense industry at 106.7x.

- Analysts expect the number of shares outstanding to decline by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.7%, as per the Simply Wall St company report.

MTU Aero Engines Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing geopolitical tensions and evolving U.S./EU tariff regimes pose a significant, unpredictable risk, with management explicitly unable to quantify the ultimate impact of U.S. tariffs and potential countermeasures; escalation could disrupt MTU's market access, increase costs, and compress profit margins, thereby threatening both revenue growth and net margins over the long term.

- High revenue concentration in next-generation engine programs, particularly the GTF (PW1100G) engine family, exposes MTU to heightened operational and financial risks if material availability issues, technical failures, or warranty/compensation costs persist, which could erode net margins and dent earnings stability for years.

- Large, front-loaded profits in H1 are tied to exceptionally strong sales of spare and lease engines, with management warning of a normalization (decline) in these sales in H2 and beyond; this creates a risk of margin compression and volatile earnings as extraordinary contributions fade, potentially leading to lower profit growth or unexpected shortfalls.

- Ongoing supply chain fragility, including recent shortages stemming from incidents (e.g., SPS facility fire) and persistent delays for spare parts of mature platforms, underline MTU's vulnerability to long-term inflationary pressures, production bottlenecks, and the risk of future delivery shortfalls, all of which could constrain revenue and free cash flow.

- Rising R&D and capacity expansion costs-such as the USD 120 million investment in Fort Worth, 30-year license payments for LEAP engine access, and intensified commitments in hydrogen technology-raise the risk that high, recurring capital outlays may outpace cash generation if market uptake slows or competitive dynamics worsen, thereby pressuring net margins and reducing financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €394.75 for MTU Aero Engines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €485.0, and the most bearish reporting a price target of just €296.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €10.9 billion, earnings will come to €1.1 billion, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 5.7%.

- Given the current share price of €379.0, the analyst price target of €394.75 is 4.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on MTU Aero Engines?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.