Key Takeaways

- Strategic investments in specialty steel, digitalization, and key acquisitions position Klöckner & Co for higher-margin growth driven by infrastructure, defense, and evolving customer demands.

- Expansion into underpenetrated regions and digital channels increases operational efficiency, market share, and resilience against shifting global steel demand and supply chain dynamics.

- Sustained weak demand, steel price volatility, trade policy risks, and slow progress in higher-value initiatives threaten profit recovery and revenue growth, especially in core European markets.

Catalysts

About Klöckner & Co- Distributes steel and metal products in Germany, Switzerland, France, the united states, and internationally.

- Targeted investment in new fabrication and service centers for electrical steel in North America positions Klöckner & Co to capture outsized demand from electric grid modernization, renewable energy, and data centers-key sources of multi-year infrastructure spending that should drive strong revenue growth and improving gross margin mix.

- The company's clear shift toward higher-value-added and specialty steel products-illustrated by a record gross profit margin increase from 16.6% to 19.5%-reflects its success in diversifying away from traditional distribution, supporting sustained net margin and EBITDA improvement as global demand for engineered and low-carbon solutions rises.

- Expansion and acceleration of digitalization, illustrated by a 5.4% year-over-year increase in digital quotes, supports operational efficiency and market share gains as industrial customers increasingly prefer seamless, automated procurement channels, driving incremental gains in both gross profits and operating leverage.

- Participation in the defense and infrastructure build-out cycles-backed by recent acquisitions and integrations (such as Ambo Stahl in Germany)-offers a runway for higher-margin, stickier revenue streams and improved resilience in EBITDA, especially as government-backed spending accelerates between 2026-2027.

- Ongoing execution of strategic initiatives in underpenetrated segments and regional growth markets (e.g., expansion in Mexico and Switzerland), alongside anticipated stabilization in trade policy and supply chains, offer meaningful future uplift in shipment volumes and earnings as normalization returns to global steel demand.

Klöckner & Co Future Earnings and Revenue Growth

Assumptions

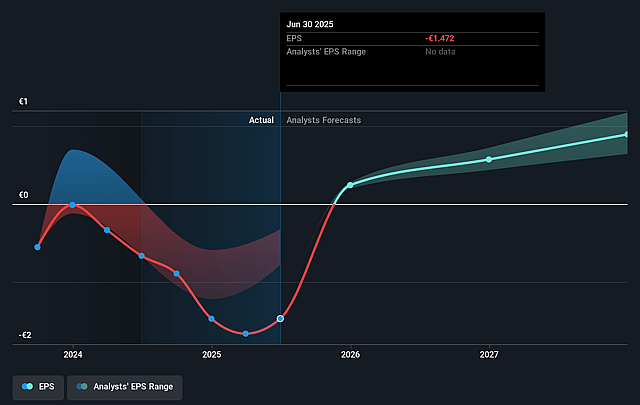

How have these above catalysts been quantified?- Analysts are assuming Klöckner & Co's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.3% today to 2.0% in 3 years time.

- Analysts expect earnings to reach €149.2 million (and earnings per share of €0.89) by about September 2028, up from €-146.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, up from -3.7x today. This future PE is lower than the current PE for the GB Trade Distributors industry at 13.0x.

- Analysts expect the number of shares outstanding to decline by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.54%, as per the Simply Wall St company report.

Klöckner & Co Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing weakness in core European markets-including persistently negative demand, declining shipments, and negative EBITDA in the European segment-raises structural concerns about Klöckner & Co's ability to sustainably grow revenue and return to profitability in this region, especially as the anticipated benefits from infrastructure and defense spending are expected to materialize only gradually from 2026-2027 onward.

- The company's year-over-year sales decline in spite of stable shipment volumes-driven by a considerably lower average price level-highlights Klöckner & Co's vulnerability to steel price volatility and margin compression, especially if tariff-driven price supports in North America dissipate or if global pricing weakens further, threatening both top line and profitability.

- High uncertainty in global trade policies, ongoing geopolitical tensions, and unresolved tariff disputes continue to create an unpredictable environment for Klöckner & Co, introducing downside risks to volumes and average selling prices as potential new or retaliatory trade measures could restrict cross-border flows and squeeze distributor margins.

- Key customer sectors such as automotive and manufacturing remain depressed, particularly in Europe (with auto production still 20% below pre-COVID levels), making Klöckner & Co's growth outlook heavily reliant on cyclical recovery which may not materialize in the near to medium term, thereby suppressing revenues and earnings.

- Although digitalization and higher value-add initiatives are underway, rising OpEx, negative foreign exchange effects, and only marginal improvement in the scale of value-added business (especially defense contracts, which are currently a "one-digit" million revenue stream in Europe) risk limiting the pace of structural margin expansion and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €8.35 for Klöckner & Co based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.0, and the most bearish reporting a price target of just €6.9.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €7.5 billion, earnings will come to €149.2 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 9.5%.

- Given the current share price of €5.41, the analyst price target of €8.35 is 35.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.