Catalysts

About Klöckner & Co

Klöckner & Co is a leading metals distributor and processor focused on higher value added service center solutions across North America and Europe.

What are the underlying business or industry changes driving this perspective?

- Rapid mix shift toward higher value added and service center activities, now over four fifths of sales and trending toward nearly nine tenths after U.S. site divestments, should structurally lift gross profit margins and stabilize EBITDA across the cycle.

- Capital recycling from low margin U.S. distribution divestments and prior European exits into higher return processing assets, including recent North American acquisitions, is expected to accelerate earnings growth and improve return on invested capital.

- Growing exposure to energy, power transmission and defense shipbuilding projects, which are supported by multi year infrastructure and security investments, underpins a durable volume pipeline that can drive sustained shipment growth and higher revenue visibility.

- Expansion into specialized segments such as electrical steel, solar structural solutions and advanced finishing positions the company to benefit from long term electrification and renewable build out, supporting premium pricing and higher net margins.

- Ongoing automation and digitalization initiatives, evidenced by rising digital quote volumes, are set to enhance operating efficiency, reduce OpEx and working capital intensity, and therefore support stronger free cash flow and earnings over time.

Assumptions

This narrative explores a more optimistic perspective on Klöckner & Co compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

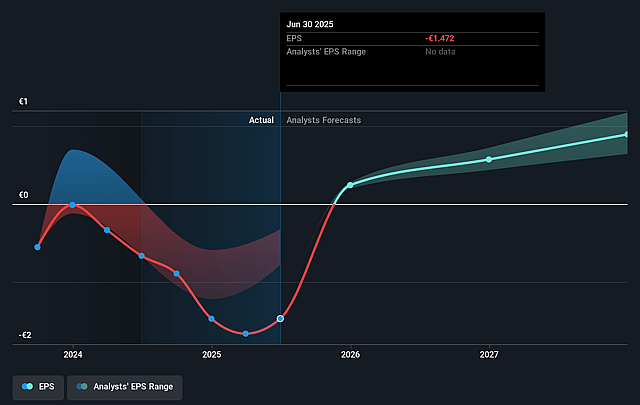

- The bullish analysts are assuming Klöckner & Co's revenue will grow by 9.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.0% today to 2.1% in 3 years time.

- The bullish analysts expect earnings to reach €175.5 million (and earnings per share of €1.77) by about December 2028, up from €-130.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €92.4 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.5x on those 2028 earnings, up from -6.0x today. This future PE is lower than the current PE for the GB Trade Distributors industry at 15.0x.

- The bullish analysts expect the number of shares outstanding to grow by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Persistent structural weakness in metals intensive manufacturing and construction in both North America and Europe, including ongoing ISM contraction and only flat to slightly down construction forecasts, could cap shipment growth and keep pricing power subdued over several years, weighing on revenue and limiting earnings expansion.

- High and rising net financial debt of over EUR 1 billion combined with episodic negative free cash flow and working capital swings increases balance sheet risk if macro conditions deteriorate or tariffs and demand shocks persist, potentially forcing slower investment in higher value added projects and constraining future earnings growth.

- The strategy to reduce dependence on steel price volatility by divesting distribution sites and focusing on higher value added and service center business could backfire if price cycles normalize or demand for premium processing softens, leaving the group with a smaller volume base and insufficient gross profit to offset higher OpEx and restructuring costs, pressuring net margins and EBITDA.

- Reliance on long dated secular themes such as defense shipbuilding, infrastructure, electrification and renewable energy may expose the company to political and regulatory reversals including changes in tariffs, defense budgets or renewable incentives, which could delay project pipelines and undercut the assumed long term volume visibility, reducing revenue and EBITDA stability.

- Currency volatility and region specific headwinds such as a weaker U.S. dollar, European competitive pressure from Asia and lingering uncertainty around tariffs and trade policy could erode the profitability of key growth regions, offsetting the benefits of digitalization and automation and resulting in lower gross margins and earnings than implied in a bullish scenario.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Klöckner & Co is €10.0, which represents up to two standard deviations above the consensus price target of €8.04. This valuation is based on what can be assumed as the expectations of Klöckner & Co's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €10.0, and the most bearish reporting a price target of just €6.15.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €8.5 billion, earnings will come to €175.5 million, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of €7.8, the analyst price target of €10.0 is 22.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Klöckner & Co?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.