Key Takeaways

- Strategic focus on divisional optimization and cost containment is set to enhance revenue and improve net margins by reducing expenses.

- Acquisitions in high-growth areas and sustainability initiatives are anticipated to strengthen market position and drive revenue growth.

- Geopolitical challenges, competition, and inflation could constrain Brenntag’s revenue growth and earnings, while asset sales highlight risks in its business portfolio.

Catalysts

About Brenntag- Brenntag SE purchases and supplies various industrial and specialty chemicals, and ingredients in Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

- Brenntag's continued focus on the execution of divisional strategies and disentanglement of divisions with high value creation potential are expected to optimize the business operations, potentially improving revenue by enabling more strategic focus and differentiation.

- The company's targeted cost containment measures aim to save €300 million annually by 2027, which will positively impact net margins and earnings by reducing operating expenses.

- Optimization of Brenntag Specialties' business portfolio through industry and geographical focus, along with enhancing supplier relationships, is likely to drive revenue growth by improving the quality of the product portfolio.

- The strategic acquisitions made by Brenntag, particularly in high-growth regions and industry segments, are expected to enhance their market position and contribute to increased revenue and earnings.

- Brenntag's digital and sustainability initiatives, including the development of CO2Xplorer and the digital sales channel Brenntag Connect, are expected to enhance operational efficiencies, potentially impacting net margins positively by attracting environmentally-conscious clients and optimizing costs.

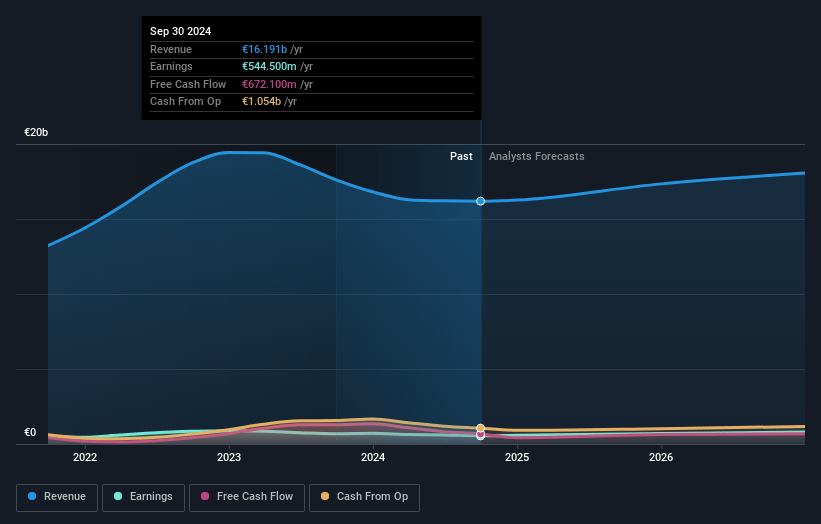

Brenntag Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Brenntag's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 5.1% in 3 years time.

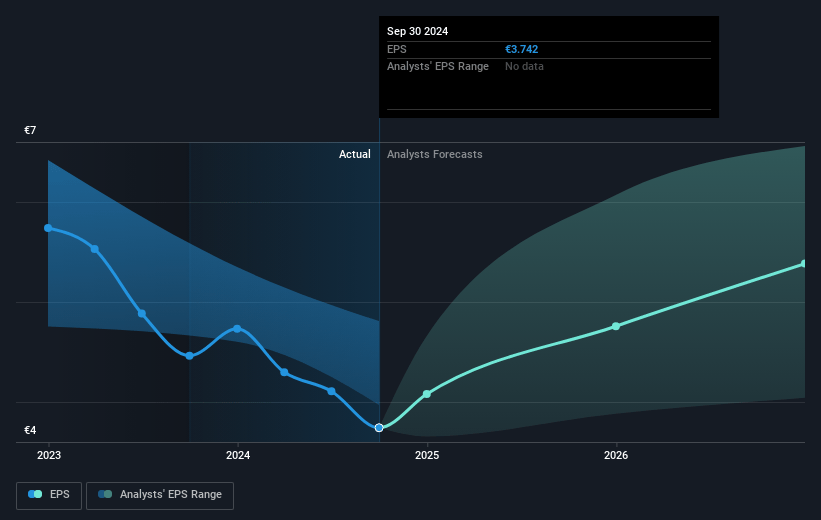

- Analysts expect earnings to reach €888.9 million (and earnings per share of €6.12) by about January 2028, up from €544.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €585.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, down from 15.9x today. This future PE is greater than the current PE for the GB Trade Distributors industry at 12.1x.

- Analysts expect the number of shares outstanding to grow by 0.19% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.03%, as per the Simply Wall St company report.

Brenntag Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The highly competitive environment and sustained pressure on selling prices in the industrial chemical markets could negatively affect Brenntag's revenue and gross profit per unit.

- The ongoing geopolitical challenges and economic uncertainties could undermine consumer confidence, impacting Brenntag's revenue growth and earnings stability.

- Brenntag's decision to sell non-core assets like Raj Petro Specialties in India at a loss highlights risks in its business portfolio, potentially affecting net margins and earnings.

- The slow progress in closing the performance gap with pure-play specialty peers and the associated costs of business portfolio optimization might hinder improvements in earnings and valuation re-rating.

- Inflationary impacts and volume-driven cost increases are contributing to a lower overall bottom line, which could limit growth in net margins and operating earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €74.19 for Brenntag based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €92.0, and the most bearish reporting a price target of just €58.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €17.6 billion, earnings will come to €888.9 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 6.0%.

- Given the current share price of €59.84, the analyst's price target of €74.19 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

KG

kgmaik89

Community Contributor

Recovery with global economy in 25-26

Gewinnwarnung 2024: Gestiegende Transportkosten Preissensititivät d. Kunden Geringes Wirtschaftswachstum 2-4 % CAGR "Low End of Guidance hard to achive" Gewinnwarnungen auch von Produzenten BASF, Lanxess, Evonik Umsatzwachstum "nur" 5,1 % (< erwartete 9...10%) stagnierender Marktausblick Chemieindustrie (gestiegende Energiekosten), ggf.

View narrative€80.94

FV

21.2% undervalued intrinsic discount5.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

7 months ago author updated this narrative