Catalysts

About ElringKlinger

ElringKlinger is a supplier of advanced gasket technology, lightweight components, and e-mobility solutions for the global automotive industry.

What are the underlying business or industry changes driving this perspective?

- Acceleration of e-mobility adoption globally, with ElringKlinger ramping up production at new hubs in the Americas and China. This is expected to drive higher revenue as serial orders scale up in 2026 and beyond.

- Normalization of capital expenditures after a phase of heavy investment is likely to support improved free cash flow and higher net margins over the medium term.

- Implementation of comprehensive cost-reduction programs, including the STREAMLINE initiative targeting at least 30 million EUR in annual personnel cost savings, is expected to result in a persistent uplift in operating margins and profitability by 2027.

- Market share gains in the Aftermarket and Engineered Plastics segments, which are posting robust growth and higher EBIT margins, are expected to further stabilize earnings and diversify the revenue base.

- Reshaping of the company's product portfolio, with a focus on profitable components and divestment of unprofitable or non-strategic assets, positions ElringKlinger for durable margin improvement and a strengthened balance sheet.

Assumptions

How have these above catalysts been quantified?

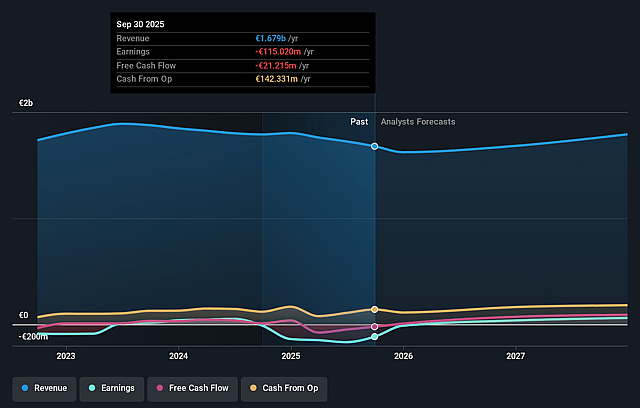

- Analysts are assuming ElringKlinger's revenue will grow by 3.5% annually over the next 3 years.

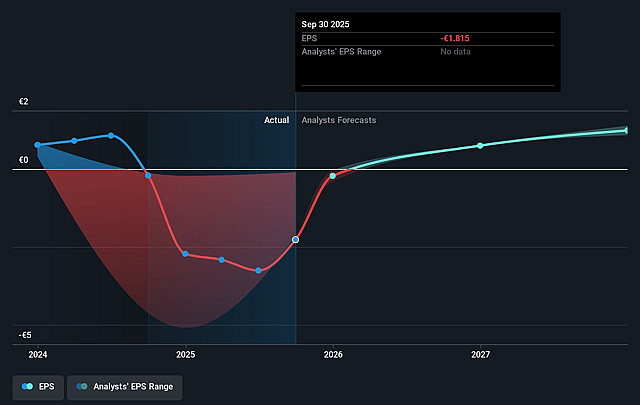

- Analysts assume that profit margins will increase from -6.9% today to 6.6% in 3 years time.

- Analysts expect earnings to reach €122.0 million (and earnings per share of €1.93) by about December 2028, up from €-115.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €139.7 million in earnings, and the most bearish expecting €109.8 million.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, up from -2.2x today. This future PE is lower than the current PE for the GB Auto Components industry at 7.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.98%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Prolonged weakness in ElringKlinger's main geographic markets, especially Europe and North America, could suppress overall demand for automotive components and limit top line revenue growth despite global gains elsewhere.

- Delays or setbacks in scaling new e-mobility production lines in the Americas and China, or slower-than-expected market adoption, could postpone revenue contribution from strategic projects and dampen earnings momentum in the medium term.

- Continued pressure from adverse currency movements and headwinds from divestments may offset organic sales gains, resulting in ongoing volatility in reported revenue and net margins.

- Persistent losses or insufficient turnaround in the Original Equipment (OE) segment and the EKPO subsidiary could undermine the improvement in group profitability, hampering efforts to expand EBIT margins and generate sustainable earnings growth.

- If restructuring measures, including the STREAMLINE program, fail to deliver full targeted cost savings or result in additional unplanned expenses, this could weigh on net margins and prolong the company’s transition to higher profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of €6.0 for ElringKlinger based on their expectations of its future earnings growth, profit margins and other risk factors.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €7.8, and the most bearish reporting a price target of just €4.2.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be €1.9 billion, earnings will come to €122.0 million, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 10.0%.

- Given the current share price of €4.02, the analyst price target of €6.0 is 33.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.