Key Takeaways

- Accelerating regulations, market shifts, and urbanization are eroding demand for luxury vehicles, increasing compliance costs, and pressuring Porsche's long-term growth and profitability.

- Aggressive electrification and heavy competition risk brand dilution, unstable foreign markets, and persistent margin erosion, threatening Porsche's pricing power and earnings sustainability.

- Robust demand for core luxury models, strategic pricing, and focused electrification efforts sustain high margins, despite lower volumes and costs from restructuring activities.

Catalysts

About Dr. Ing. h.c. F. Porsche- Engages in automotive and financial services business in Germany, Europe, North America, China, and internationally.

- Porsche faces accelerating global decarbonization mandates and stricter emissions regulations across its key markets, which are likely to erode demand for performance-centered luxury vehicles, force costly technical adaptations, and significantly limit the company's addressable market; this trend will suppress long-term revenue growth and increase compliance costs, creating ongoing margin pressure.

- The rapid urbanization of developed and developing economies, combined with declining car ownership rates among younger demographics, is expected to structurally reduce the size of the luxury automotive market, making it increasingly difficult for Porsche to sustain historical volume and pricing levels; persistent unit sales declines and underutilization of fixed cost structures will further compress profitability.

- Heightened geopolitical instability-including ongoing trade tensions, shifting U.S.–China relations, and rising tariffs-continues to disrupt Porsche's supply chains, elevate input costs, and restrict market access, especially in China and North America; these disruptions threaten both top-line growth and net earnings as foreign market exposure becomes less reliable.

- Brand dilution driven by aggressive electrification (with core models such as the Macan, Cayenne, and potentially the 911 transitioning to fully electric platforms) risks alienating Porsche's traditional enthusiast base, undermining pricing power and average selling prices, and putting long-term net margins at risk as brand differentiation weakens in a crowded premium EV landscape.

- Intensifying competition from both legacy automakers and aggressive new EV entrants-coupled with rising R&D and raw material costs for batteries, and the risk of failing to match software innovation expected by connected consumers-exposes Porsche to market share losses, persistent margin erosion, and the growing possibility of structural earnings declines over the decade.

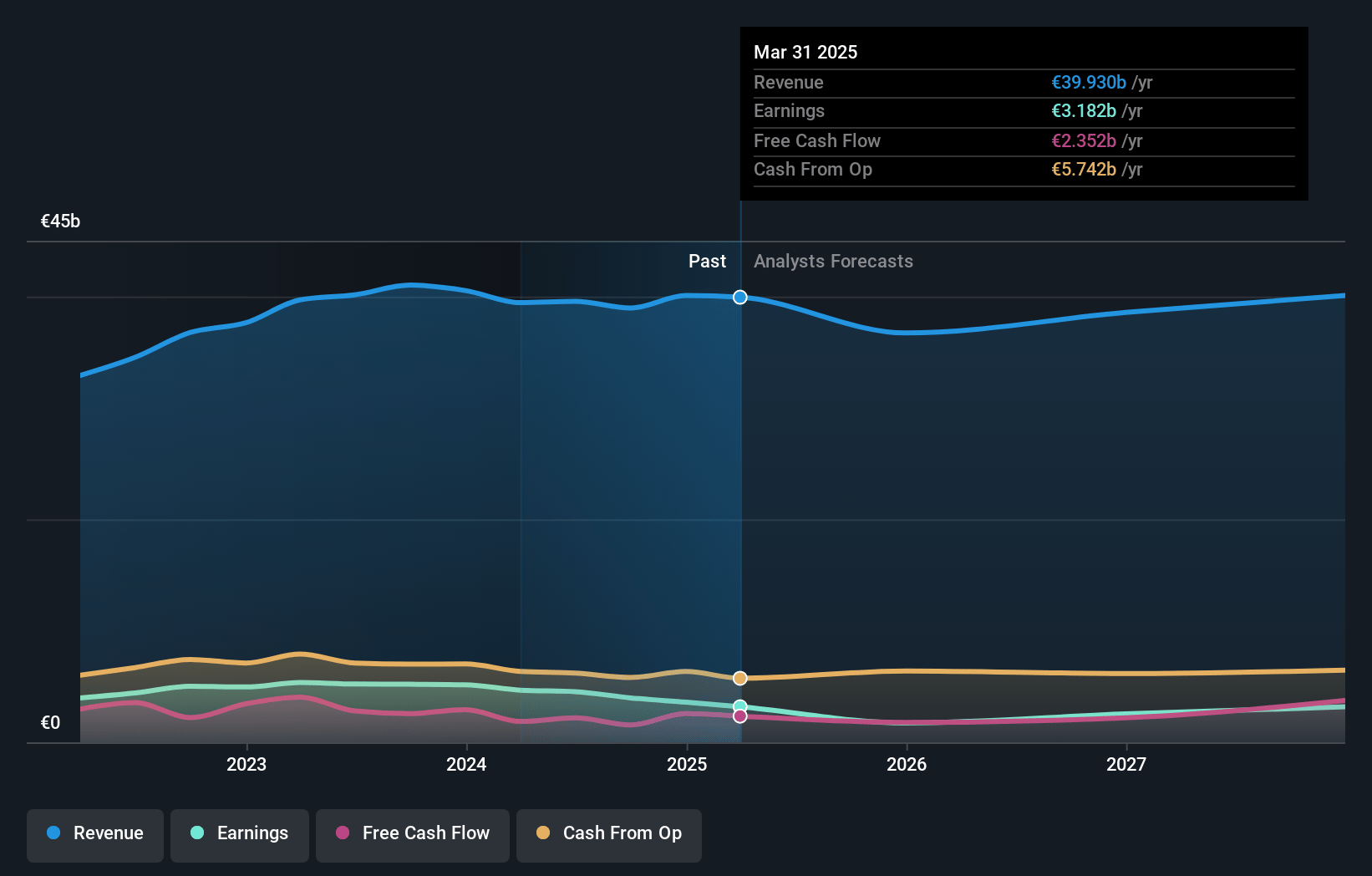

Dr. Ing. h.c. F. Porsche Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Dr. Ing. h.c. F. Porsche compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Dr. Ing. h.c. F. Porsche's revenue will decrease by 1.1% annually over the next 3 years.

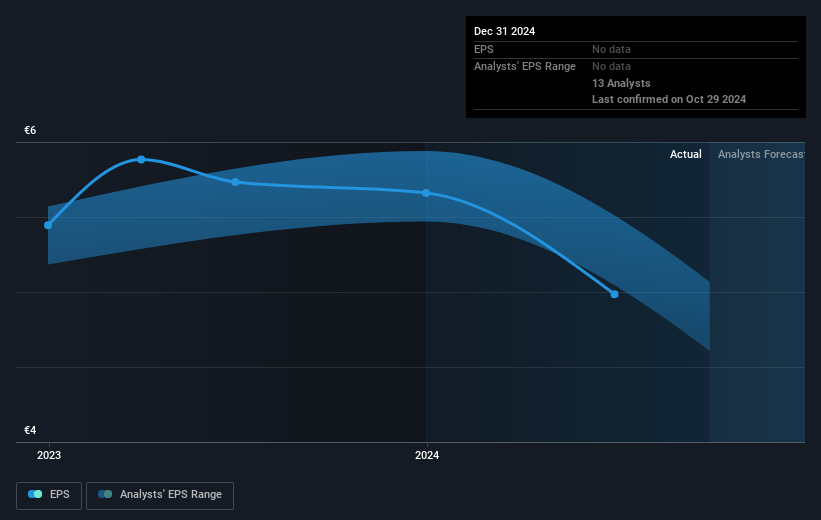

- The bearish analysts assume that profit margins will shrink from 8.0% today to 6.7% in 3 years time.

- The bearish analysts expect earnings to reach €2.6 billion (and earnings per share of €nan) by about July 2028, down from €3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, up from 12.0x today. This future PE is greater than the current PE for the DE Auto industry at 6.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.93%, as per the Simply Wall St company report.

Dr. Ing. h.c. F. Porsche Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demand for Porsche's core 911 and luxury products remains robust globally, with order books exceeding expectations and higher customer willingness to pay for personalization, supporting sustained high average selling prices and protecting revenues and margins.

- Porsche's long-standing value-over-volume strategy and disciplined pricing enable it to cut production rather than discount, maintaining brand exclusivity and providing resilience to margin pressure in downturns, which can help defend profits even as volumes fluctuate.

- Despite a challenging BEV transition, Porsche is accelerating investment in electrification and platform strategies, with successful models like the all-electric Macan demonstrating customer acceptance and revenue potential in the premium EV segment.

- The mix and quality of the sales portfolio are improving, with strong performance from high-margin, individualized vehicles, which has led to rising average sales prices and partially offset lower volumes, thereby cushioning the impact on both revenue and net margins.

- Strategic cost and organizational restructurings, including workforce adjustment and realignment of battery activities, are expected to mostly be one-off charges this year, while operational efficiencies and refreshed product launches are positioned to restore double-digit EBIT margins and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Dr. Ing. h.c. F. Porsche is €37.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Dr. Ing. h.c. F. Porsche's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €64.0, and the most bearish reporting a price target of just €37.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €38.6 billion, earnings will come to €2.6 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 9.9%.

- Given the current share price of €42.07, the bearish analyst price target of €37.0 is 13.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.