Key Takeaways

- Cost-cutting and operating improvements may deliver stronger profitability and earnings surprises as market underestimates Knaus Tabbert's pricing power and production normalization benefits.

- Strong secular demand for outdoor travel and leadership in smart, eco-friendly RVs position the company for sustainable growth and higher-margin market share expansion.

- Overdependence on legacy products, traditional markets, and outdated consumer trends exposes the company to competitive, regulatory, and structural risks impacting long-term growth and profitability.

Catalysts

About Knaus Tabbert- Manufactures and sells recreational vehicles in Germany, Europe, and internationally.

- While analysts broadly agree that cost optimization and personnel reduction will support profitability, the scale and speed of these changes-such as reducing the workforce by over 14% and aggressively lowering operating expenses-could result in a much faster and larger uplift to net margins and EBITDA than the market currently anticipates.

- Analyst consensus sees product rationalization and renewed management focus as margin and revenue accretive, but they may be underestimating the pricing power and operating leverage Knaus Tabbert can extract as excess inventories are digested industry-wide, which could drive significant upside surprise in both top-line growth and earnings as production normalizes.

- The structural increase in experiential and outdoor travel across Europe, combined with ongoing demographic shifts toward retirees and flexible remote workers, is likely to fuel a durable, multi-year expansion of Knaus Tabbert's addressable market, providing a long runway for robust, sustainable revenue growth.

- Knaus Tabbert's leadership in electrified and smart RVs, bolstered by strategic investments in premium product lines and lean manufacturing, positions the company for share gains in higher-margin segments and could accelerate both revenue CAGR and structural margin improvement as demand for eco-friendly and technologically advanced models intensifies.

- Reinforced pan-European distribution and aftersales capabilities are enabling deeper customer relationships and stickier aftermarket revenue streams, which are set to provide both recurring revenues and greater earnings resilience even against cyclical headwinds.

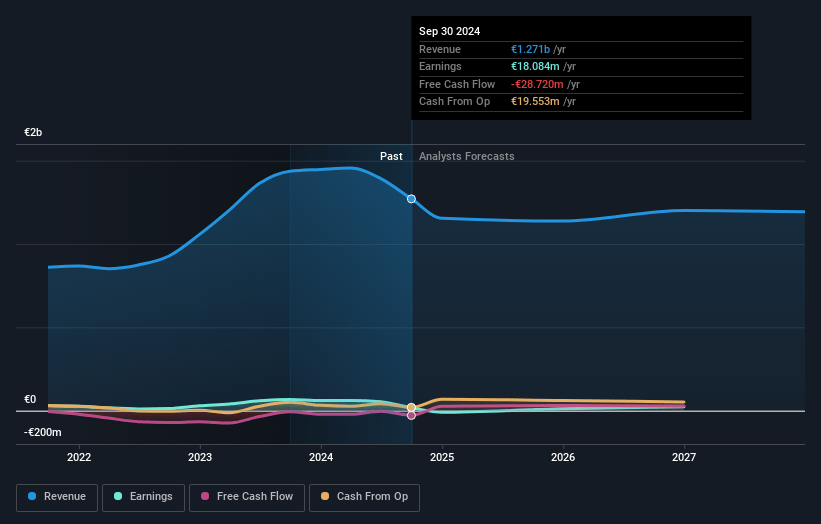

Knaus Tabbert Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Knaus Tabbert compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Knaus Tabbert's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -7.0% today to 4.5% in 3 years time.

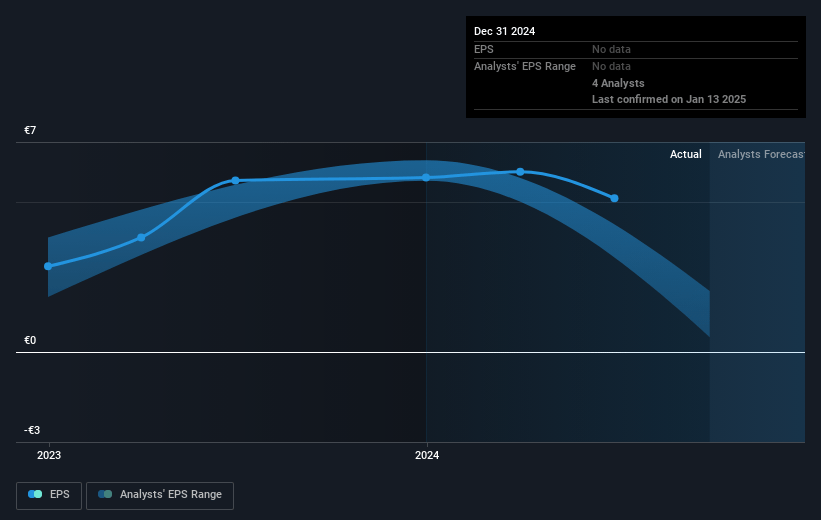

- The bullish analysts expect earnings to reach €53.5 million (and earnings per share of €5.03) by about July 2028, up from €-70.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.9x on those 2028 earnings, up from -2.0x today. This future PE is greater than the current PE for the DE Auto industry at 7.0x.

- Analysts expect the number of shares outstanding to grow by 2.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.93%, as per the Simply Wall St company report.

Knaus Tabbert Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Knaus Tabbert's heavy reliance on the German and broader European market leaves the company exposed to local economic turbulence, regulatory changes, and shifting consumer demand in these geographies, which could result in volatile or shrinking revenues over the long term.

- The secular trend toward environmental regulation and electrification poses a structural threat, as Knaus Tabbert's core product portfolio is still focused on traditional caravans and ICE motorhomes, and significant investment will be required to remain compliant and competitive, likely squeezing net margins if costs cannot be passed to customers.

- The company is suffering from a pronounced drop in demand, seen in a 21.5 percent year-on-year decline in revenue and ongoing inventory/demand imbalances at the dealer level, indicating ongoing headwinds around dealer health and end-user demand that could pressure both revenue and earnings if sustained.

- Changing consumer preferences, particularly among younger cohorts who are favoring urban living, shared mobility, and experience-based spending instead of RV/caravan ownership, threaten the long-term growth prospects for the core business, creating a risk of long-term industry contraction and impacting future revenues.

- Intensifying competition-especially from manufacturers embracing electric vehicles, smart features, and lightweight materials-may force Knaus Tabbert to increase R&D and marketing expenditures to defend its position, which could reduce net margins and undermine earnings if they are unable to gain market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Knaus Tabbert is €29.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Knaus Tabbert's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €29.0, and the most bearish reporting a price target of just €15.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €1.2 billion, earnings will come to €53.5 million, and it would be trading on a PE ratio of 7.9x, assuming you use a discount rate of 9.9%.

- Given the current share price of €13.52, the bullish analyst price target of €29.0 is 53.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.