Key Takeaways

- Aggressive AI-driven digital transformation and group cross-selling are set to significantly boost efficiency, net margins, and fee-based income beyond industry peers.

- Strategic focus on retail and SME lending, plus alignment with government policies, positions the bank for structurally higher earnings growth and expanding market share.

- Mounting competitive, demographic, regulatory, and digital disruption pressures threaten Ping An Bank's core profitability, asset quality, and long-term growth prospects.

Catalysts

About Ping An Bank- Provides commercial banking products and services for individual and corporate customers, government agencies, institutions, and other small businesses in China and internationally.

- Analyst consensus expects improved efficiency from digital transformation and new AI initiatives, but this may actually understate the scope and pace of Ping An Bank's technology adoption, as management is aggressively piloting over 130+ generative AI-enabled projects across every business line, likely to deliver step-change improvements in cost-to-income ratio and customer acquisition well beyond industry averages, materially expanding net margins and revenue growth.

- While the consensus notes medium risk, medium-high yield product rollout will stabilize and grow retail banking, management has indicated a sharp inflection is likely as these new credit products gain regulatory tailwinds from recent nationwide consumption stimulus, leading to accelerated retail loan growth and potential outsized recovery in net interest margin and fee income compared to peers.

- Unlike most peers, Ping An Bank is set to uniquely benefit from China's ongoing urbanization and rising middle class by leveraging its integrated Ping An Group ecosystem-accessing over 200 million customers for cross-selling, which could unlock sustained double-digit annualized gains in client assets and wealth management revenue, significantly boosting fee-based income and stickier margin.

- Ping An's decisive shift towards SME lending, green finance, and supply chain loans aligns closely with new government mandates for inclusive and sustainable growth, and management is proactively deploying capital to these sectors with high policy support and superior yields, suggesting future loan mix optimization will drive structurally higher earnings growth and lower credit costs.

- Sector-wide consolidation and stricter regulation are already forcing out weaker competitors, positioning Ping An Bank-with its robust risk systems, top-tier provision coverage, and leading digital capabilities-to capture incremental market share in both corporate and retail banking, accelerating revenue growth and supporting an upward re-rating of both return on equity and valuation multiples.

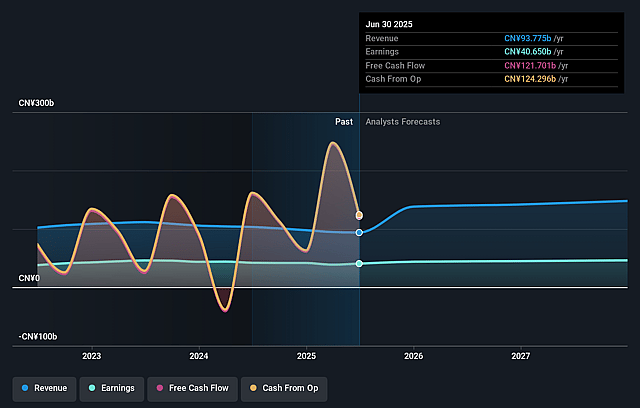

Ping An Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ping An Bank compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ping An Bank's revenue will grow by 27.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 43.3% today to 27.7% in 3 years time.

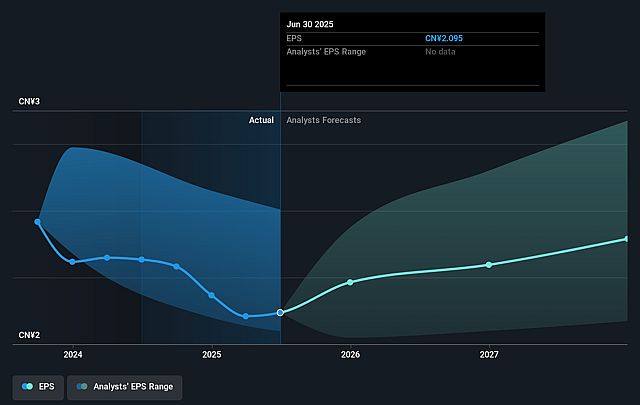

- The bullish analysts expect earnings to reach CN¥53.3 billion (and earnings per share of CN¥2.73) by about September 2028, up from CN¥40.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, up from 5.6x today. This future PE is greater than the current PE for the CN Banks industry at 6.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.98%, as per the Simply Wall St company report.

Ping An Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing compression of net interest margin due to industry-wide competition, regulatory pressures, and an environment of low interest rates directly threatens Ping An Bank's core source of profitability, thereby placing sustained pressure on net margins and earnings in the long run.

- Weak credit demand and the shrinking working-age population associated with demographic aging in China are likely to constrain loan growth, leading to lower revenue opportunities and potentially higher bad debts that weigh on earnings quality and top-line growth.

- Continued reliance on traditional real estate and corporate lending exposes the bank to sector-specific downturns and the risk of increased non-performing loans, which could undermine asset quality, reduce net profits, and necessitate higher provisions that impact earnings.

- Accelerated adoption of digital currencies and heightened fintech competition risk disintermediating traditional banking services, posing a threat to Ping An Bank's fee-based income streams and long-term revenue growth if digital transformation is not successfully monetized.

- Rising regulatory tightening, policy mandates to support lower margin segments such as green finance and inclusive lending, and pressure to align with government initiatives may structurally compress return on equity and reduce the long-term profitability of Ping An Bank's business model.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ping An Bank is CN¥16.56, which represents two standard deviations above the consensus price target of CN¥13.79. This valuation is based on what can be assumed as the expectations of Ping An Bank's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥17.19, and the most bearish reporting a price target of just CN¥11.7.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥192.6 billion, earnings will come to CN¥53.3 billion, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 12.0%.

- Given the current share price of CN¥11.77, the bullish analyst price target of CN¥16.56 is 28.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.