Last Update11 Sep 25Fair value Increased 1.03%

With both Ping An Bank’s future P/E and discount rate remaining essentially unchanged, analysts’ outlook and valuation assumptions have held steady, resulting in only a marginal increase in the consensus price target from CN¥13.65 to CN¥13.79.

What's in the News

- Ping An Bank announced an interim cash dividend of CNY 2.36 per 10 shares for the first half of the year.

- The bank entered into a three-year Financial Services Framework Agreement to provide deposit and settlement services, constituting a connected transaction subject to reporting and annual review requirements but exempt from shareholder approval.

Valuation Changes

Summary of Valuation Changes for Ping An Bank

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from CN¥13.65 to CN¥13.79.

- The Future P/E for Ping An Bank remained effectively unchanged, moving only marginally from 7.68x to 7.79x.

- The Discount Rate for Ping An Bank remained effectively unchanged, moving only marginally from 11.83% to 11.99%.

Key Takeaways

- Digital transformation and fintech initiatives are expected to improve operational efficiency, service quality, and optimize costs, enhancing net margins.

- Emphasis on medium risk, yield products, and risk management strategies aims to stabilize revenue, improve asset quality, and shareholder value.

- Challenges with NIM compression, high-risk loans, and economic uncertainties risk undermining Ping An Bank's revenue and long-term earnings stability.

Catalysts

About Ping An Bank- Provides commercial banking products and services for individual and corporate customers, government agencies, institutions, and other small businesses in China and internationally.

- Ping An Bank's strategy to enhance medium risk, medium high-yield products is aimed at boosting competitiveness and stabilizing retail banking, which could positively impact revenue and improve net margins by increasing the quality of loan portfolios.

- The bank's digital transformation initiatives, including fintech and AI applications, are likely to enhance operational efficiency and customer service. This can contribute to cost reduction and potentially improve net margins by optimizing interest expense ratios.

- Efforts in corporate banking to strengthen service quality, focus on high-quality sectors, and optimize loan placements are expected to drive revenue growth and improve asset quality, contributing positively to future earnings.

- The solid internal capital generation plans and maintaining a robust capital adequacy ratio while increasing dividends suggest an emphasis on sustainable growth, which could lead to improved shareholder value and potentially increase earnings per share (EPS).

- Ping An Bank's proactive risk management strategies, including adequate provision coverage and a focus on risk mitigation measures, are expected to maintain strong risk coverage capabilities, thereby stabilizing net profit margins and supporting steady earnings growth.

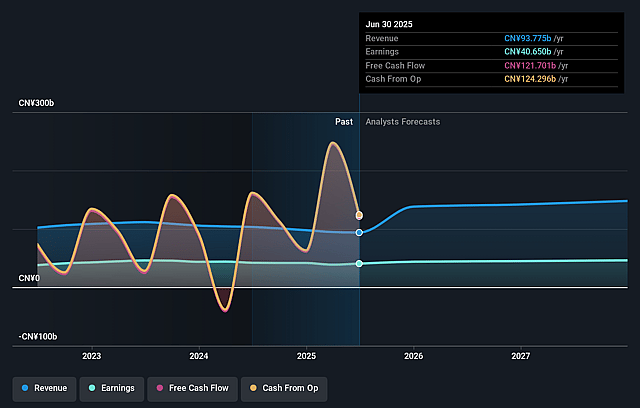

Ping An Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ping An Bank's revenue will grow by 20.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 43.3% today to 29.6% in 3 years time.

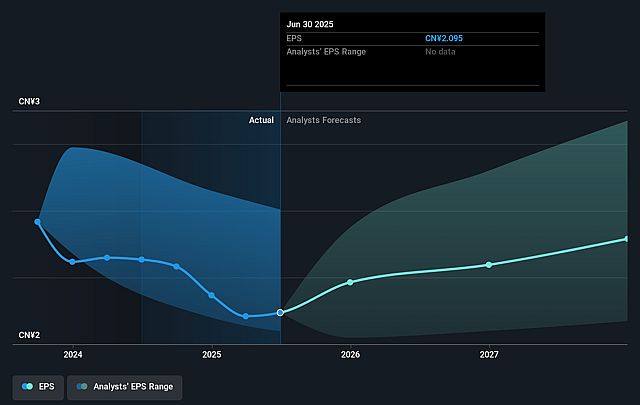

- Analysts expect earnings to reach CN¥48.2 billion (and earnings per share of CN¥2.38) by about September 2028, up from CN¥40.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥40.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, up from 5.6x today. This future PE is greater than the current PE for the CN Banks industry at 6.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.83%, as per the Simply Wall St company report.

Ping An Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The operating income of Ping An Bank decreased by 10.9% year-on-year in 2024, while net profit also fell by 4.2%, indicating pressure on revenue and earnings.

- The bank experienced a significant decrease in personal loans, nearly 11%, due to the proactive reduction of high-risk businesses, potentially impacting revenue from this segment.

- Continued net interest margin (NIM) compression and insufficient effective credit demand were highlighted as ongoing challenges, which can affect the bank's earnings potential.

- Retail banking performance has been under pressure, with high-risk credit loans and property loans needing substantial adjustment and posing risks to future revenues.

- The turning point in economic cycles and uncertainties in the external environment require strategic patience and efficient execution, but carry risks of inconsistent operational performance affecting long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CN¥13.646 for Ping An Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥17.19, and the most bearish reporting a price target of just CN¥11.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥163.1 billion, earnings will come to CN¥48.2 billion, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 11.8%.

- Given the current share price of CN¥11.75, the analyst price target of CN¥13.65 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.