Key Takeaways

- Tecan's ability to scale advanced device production and leverage automation uniquely positions it for outsized growth and market share gains beyond analyst expectations.

- Increased recurring revenues and structural cost efficiencies are set to drive margin stability, strong operating leverage, and sustainable long-term sales growth.

- Weakness in China, U.S. funding risks, pharma spending caution, OEM customer shifts, and diagnostic market trends threaten Tecan's revenue growth and margin prospects.

Catalysts

About Tecan Group- Provides laboratory instruments and solutions in biopharmaceuticals, forensics, and clinical diagnostics in Europe, North America, Asia, and internationally.

- Analyst consensus expects global expansion and FDA approval in Malaysia to support growth, but this likely underestimates Tecan's ability to rapidly scale production of advanced Class III medical devices for both developed and emerging markets, leading to step-change revenue inflection and market share gains over the next several years.

- While analysts broadly recognize the impact of cost reduction programs, Tecan's accelerated site consolidation, vertical integration, and supply chain optimization are likely to drive margin expansion well beyond expectations, structurally lowering the breakeven point and positioning the company for significant operating leverage when demand rebounds.

- With recurring revenues now approaching 60% of Life Sciences segment sales and a rapidly growing installed base, Tecan is set to realize compounding improvements in earnings quality and margin stability, as high-margin consumables and service contracts become a dominant part of the revenue mix.

- The rapid evolution of AI-powered high-throughput screening, multiomics workflows, and the digitalization of pharma R&D massively expands Tecan's addressable market, as pharmaceutical and biotech companies increasingly require integrated automation and data solutions that Tecan is uniquely positioned to supply-leading to sustainable mid-to-high single-digit sales growth and upside to long-term revenue trajectories.

- Demographic shifts toward aging populations and the global proliferation of decentralized diagnostic labs are set to amplify long-term demand for Tecan's platforms far more than consensus appreciates, supporting a multi-year acceleration in both top-line growth and gross margins as proprietary automation solutions become the industry standard.

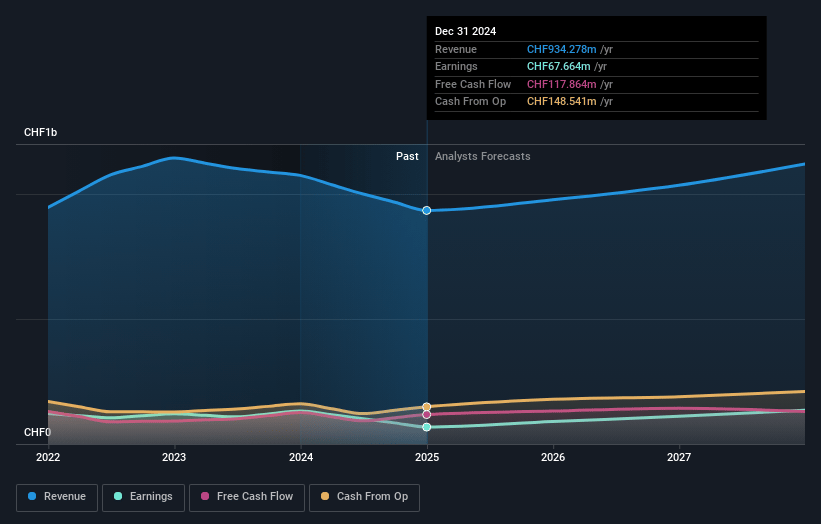

Tecan Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Tecan Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Tecan Group's revenue will grow by 14.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.2% today to 13.7% in 3 years time.

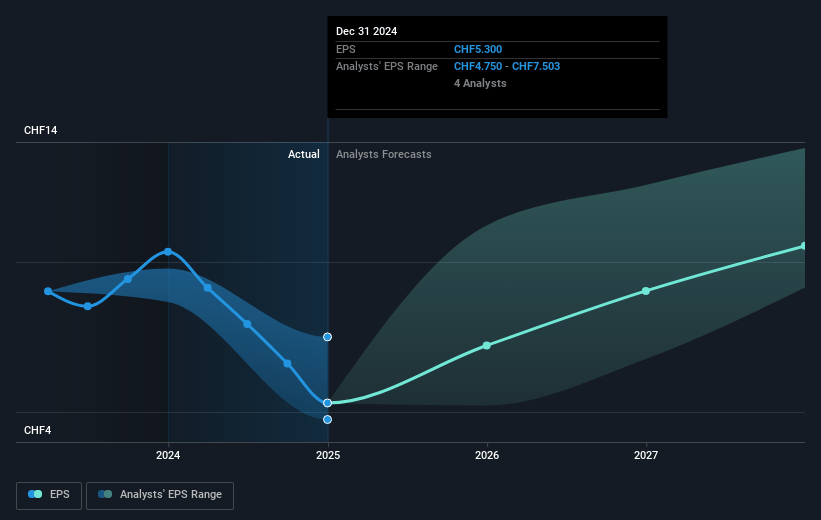

- The bullish analysts expect earnings to reach CHF 190.8 million (and earnings per share of CHF 14.74) by about July 2028, up from CHF 67.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.3x on those 2028 earnings, down from 30.2x today. This future PE is lower than the current PE for the GB Life Sciences industry at 33.3x.

- Analysts expect the number of shares outstanding to decline by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.6%, as per the Simply Wall St company report.

Tecan Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness in China, with Tecan's revenues in the country down by one third to CHF 100 million in 2024, and ongoing uncertainty around stimulus funding and regulatory issues, poses a structural risk to long-term revenue growth and recovery in the region.

- Academic and governmental account revenues, which represent about 5–6% of sales, are highly exposed to U.S. budget uncertainties and NIH funding reductions that could halve the CHF 50 million contributed by this segment, negatively impacting Tecan's top-line if political headwinds persist.

- Ongoing shifts in biopharma customer strategies and cautious spending-driven by political initiatives like the Inflation Reduction Act and global supply chain reshoring-may dampen a recovery in pharma automation demand, constraining revenue and earnings growth.

- Intensifying competition and supplier diversification by Tecan's largest OEM customer, compounded by a transition to a new model with lower sales per unit, could pressure future revenue growth and limit margin expansion if Tecan loses market share or product mix deteriorates.

- The broader secular trend towards decentralized, AI-enabled, and point-of-care diagnostics threatens to erode the addressable market for centralized lab automation, potentially undermining long-term revenue growth and placing downward pressure on gross margins if Tecan cannot adapt its product mix.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Tecan Group is CHF351.26, which represents two standard deviations above the consensus price target of CHF225.02. This valuation is based on what can be assumed as the expectations of Tecan Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF384.0, and the most bearish reporting a price target of just CHF165.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF1.4 billion, earnings will come to CHF190.8 million, and it would be trading on a PE ratio of 25.3x, assuming you use a discount rate of 4.6%.

- Given the current share price of CHF160.7, the bullish analyst price target of CHF351.26 is 54.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.