Key Takeaways

- Heightened regulatory risks, geopolitical tensions, and shifting supply chains are poised to restrict market access, elevate costs, and dampen growth prospects.

- Intensifying competition, technological disruption, and over-reliance on major OEM partners threaten Tecan's market share, pricing power, and long-term earnings stability.

- Expanding recurring revenues, strong innovation pipeline, resilient customer relationships, biopharma recovery, and effective cost control position the company for sustained growth and profitability.

Catalysts

About Tecan Group- Provides laboratory instruments and solutions in biopharmaceuticals, forensics, and clinical diagnostics in Europe, North America, Asia, and internationally.

- The company faces mounting regulatory and political risks, including tightening international compliance standards, persistent U.S. government budget reductions and heightened uncertainty in China, which are expected to slow product launches, limit market access, and significantly increase operational costs, undermining both revenue growth and net margins over the next several years.

- Persistent geopolitical tensions and protectionist dynamics-such as bans on instrument sales to China and the risk that Western biopharma clients will further restrategize supply chains-threaten to disrupt Tecan's core growth markets, prolonging lower sales and depressing profitability well beyond 2025.

- The accelerating digitalization of life sciences and the entry of new competitors leveraging more advanced AI and automation platforms may cause Tecan Group's product portfolio to lag technologically, eroding its market share and diminishing its pricing power, which will negatively impact top-line growth and compress future margins.

- A growing dependence on a small number of large OEM partnerships-especially with its single largest customer undergoing model transitions and supplier diversification-exposes Tecan to ongoing customer concentration risk and order volatility, severely jeopardizing the stability of both revenue and earnings.

- Intensifying commoditization within core automation and liquid handling markets, coupled with an industry-wide shift toward decentralized and point-of-care diagnostics, is liable to shift demand away from Tecan's centralized laboratory systems, resulting in structurally lower sales growth and sustained margin pressure.

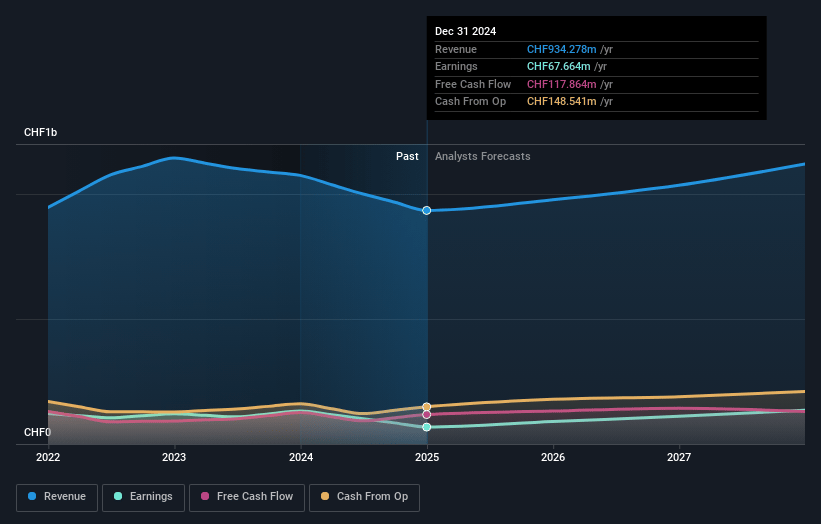

Tecan Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tecan Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tecan Group's revenue will grow by 2.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.2% today to 9.9% in 3 years time.

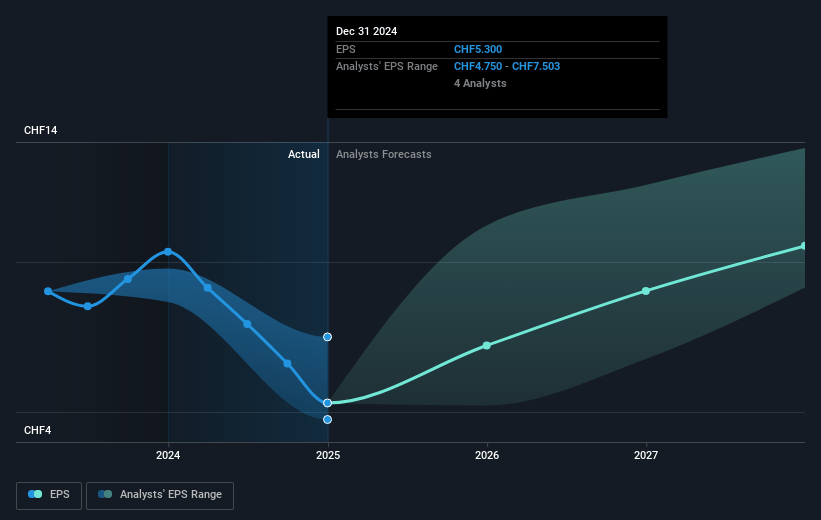

- The bearish analysts expect earnings to reach CHF 98.4 million (and earnings per share of CHF 7.69) by about July 2028, up from CHF 67.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 23.1x on those 2028 earnings, down from 30.2x today. This future PE is lower than the current PE for the GB Life Sciences industry at 33.2x.

- Analysts expect the number of shares outstanding to decline by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.6%, as per the Simply Wall St company report.

Tecan Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing strong growth in recurring revenues, with the Life Sciences division reporting 57.6 percent of segment sales as recurring, which could drive more stable revenues and support margin expansion and earnings growth over time.

- Despite challenging conditions, there is a positive outlook on new product launches and innovation, including major launches in genomics, proteomics, and the new multiomics liquid handling workstation, Veya, which has been well received and could spur future revenue growth.

- Tecan maintains a robust, long-term relationship with its largest customer, expecting stable sales in 2025 despite a transitional year, and management is confident of returning to strong growth rates with this customer into 2026 and beyond, supporting longer-term revenue and profit growth.

- The company is seeing improving funnel activity and engagement from the biopharma sector as strategies emerge post-restructuring, suggesting a potential rebound in instrument demand and revenue in the medium term as global biopharma investment and drug discovery accelerate.

- Tecan's comprehensive cost reduction initiatives, global expansion, and increased operational resilience have substantially lowered its breakeven point, which reduces financial risk and increases the likelihood of expanding EBITDA margins and net profit as sales recover.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tecan Group is CHF165.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tecan Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF384.0, and the most bearish reporting a price target of just CHF165.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CHF992.5 million, earnings will come to CHF98.4 million, and it would be trading on a PE ratio of 23.1x, assuming you use a discount rate of 4.6%.

- Given the current share price of CHF160.7, the bearish analyst price target of CHF165.2 is 2.7% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.