Catalysts

About Leonteq

Leonteq designs, structures and distributes technology enabled investment and pension solutions for financial intermediaries and retail investors.

What are the underlying business or industry changes driving this perspective?

- Although recurring revenues from actively managed certificates and quantitative investment strategies are growing in response to rising demand for customized, rules based solutions, scaling these platforms across regions may be slower than planned. This could cap the targeted 7% compound revenue growth and delay earnings acceleration.

- While deployment of the LYNQS digital platform and expansion of electronic retail flow in Switzerland and abroad can lift turnover at low marginal cost, intensifying competition and ongoing margin pressure in the structured products market risk offsetting volume gains. This may limit improvement in net fee income and net margins.

- Although the transition to the new market risk framework and a CET1 ratio expected at or above 14% should support capital efficiency, the complexity of full FRTB implementation and potential model adjustments may keep risk weighted assets elevated. This could constrain the pace of capital return and dilute future return on tangible equity.

- Despite further nearshoring of non sales functions to Lisbon and exits from underperforming initiatives aimed at keeping the underlying cost base broadly flat, IT and regulatory cost inflation could erode planned savings. This may restrict operating leverage and weigh on profit before tax.

- While resolving legacy compliance issues and refocusing on core structured product capabilities are intended to rebuild client trust and increase wallet share with key partners, any lingering reputational and regulatory headwinds may continue to suppress large ticket volumes. This could hold back fee income growth and overall earnings.

Assumptions

This narrative explores a more pessimistic perspective on Leonteq compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

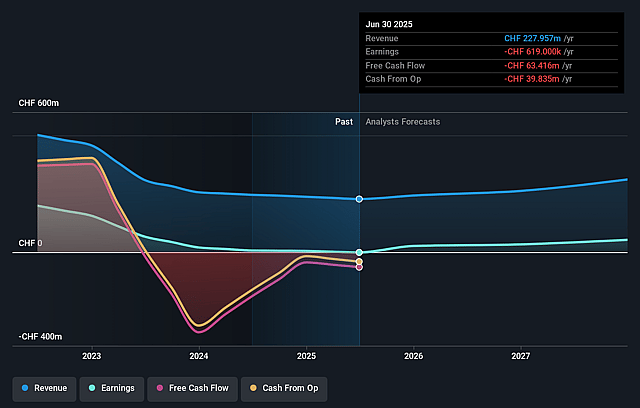

- The bearish analysts are assuming Leonteq's revenue will grow by 11.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.3% today to 22.3% in 3 years time.

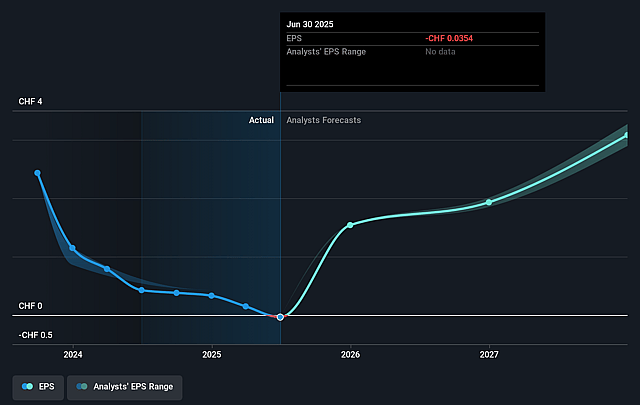

- The bearish analysts expect earnings to reach CHF 69.6 million (and earnings per share of CHF 3.98) by about December 2028, up from CHF -619.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.5x on those 2028 earnings, up from -371.9x today. This future PE is lower than the current PE for the GB Capital Markets industry at 17.4x.

- The bearish analysts expect the number of shares outstanding to grow by 1.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- If management delivers on its strategy to resize, optimize and expand, achieving the targeted compound revenue growth of 7% between 2024 and 2027, the resulting higher client turnover, stronger contribution from new partners and broader issuer base could drive sustained top line expansion and support a higher share price through stronger revenue and earnings.

- Resolution of legacy compliance issues by the end of 2025, together with restored client confidence and renewed activity in large ticket transactions that have historically generated between CHF 8 million and CHF 12 million in fee income per period, could lift net fee income, expand net margins and push earnings above current expectations.

- The scaling of high demand businesses such as actively managed certificates, the QIS platform and the retail flow franchise across Switzerland, Germany and Italy, combined with wider deployment of the LYNQS digital platform, may increase recurring and capital light fee streams, improving net margins and growing earnings faster than implied by a flat share price assumption.

- Ongoing cost discipline, including nearshoring more than 30% of non sales and non trading roles to Lisbon and exiting loss making initiatives like the Japanese entity and the bench pension platform, could keep the cost base broadly flat while revenues grow, thereby enhancing operating leverage, lifting profit before tax and supporting a rerating of the share price.

- The maintenance of a strong CET1 ratio of at least 14% under FRTB, combined with a new dividend payout ratio of roughly 30% of group net profit and an explicit intention to return excess capital through share buybacks once CET1 is meaningfully above 15%, may lead to higher total shareholder returns and a firmer valuation multiple, contradicting expectations that the share price will remain flat based on earnings and capital returns.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Leonteq is CHF14.1, which represents up to two standard deviations below the consensus price target of CHF16.05. This valuation is based on what can be assumed as the expectations of Leonteq's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF18.0, and the most bearish reporting a price target of just CHF14.1.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be CHF312.0 million, earnings will come to CHF69.6 million, and it would be trading on a PE ratio of 4.5x, assuming you use a discount rate of 6.5%.

- Given the current share price of CHF13.04, the analyst price target of CHF14.1 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Leonteq?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.