Last Update 22 Aug 25

Fair value Decreased 6.10%Despite slightly improved revenue growth forecasts and a modest decline in the future P/E ratio, analysts have lowered Leonteq’s consensus price target from CHF20.50 to CHF19.25.

What's in the News

- Leonteq approved significant changes to its Articles of Association and a substantial reduction in maximum executive committee compensation for 2026.

- At an Extraordinary General Meeting, major proposals including bylaw changes were approved.

- Leonteq expanded its partnership with BX Swiss, becoming the exclusive market maker for ETPs and completing the transfer of market maker activities from Lang & Schwarz.

- Leonteq entered a new partnership with Emirates Islamic to co-develop and distribute Shari’a-compliant structured products in the UAE, leveraging its issuance platform and technology.

Valuation Changes

Summary of Valuation Changes for Leonteq

- The Consensus Analyst Price Target has fallen from CHF20.50 to CHF19.25.

- The Consensus Revenue Growth forecasts for Leonteq has risen slightly from 13.4% per annum to 13.9% per annum.

- The Future P/E for Leonteq has fallen slightly from 6.80x to 6.57x.

Key Takeaways

- Improved compliance and digitalization initiatives are expected to boost client confidence, drive operating efficiency, and support revenue and margin growth.

- Expansion into new products and markets aims to diversify revenue streams, reduce earnings volatility, and position the company for sustained profitability.

- Margin compression, failed diversification efforts, rising compliance costs, partner concentration risk, and regulatory challenges threaten Leonteq's revenue stability and long-term earnings growth.

Catalysts

About Leonteq- Provides derivative investment products and services in Switzerland, Europe, and Asia, and internationally.

- Resolution of legacy compliance issues is expected to remove a key overhang impacting client activity and confidence, likely supporting a rebound in client engagement and higher fee/transaction volumes, thus driving revenue and earnings growth in the coming quarters.

- Demand for actively managed certificates (AMCs) and quantitative investment strategies is accelerating as investors seek more personalized and sophisticated investment solutions, positioning Leonteq's expanding product offering and digital platforms to capture increased product flows, which should positively impact revenue and recurring fee income.

- The rollout and monetization of Leonteq's technology platforms (notably LYNQS) across new markets, combined with further digitalization and automation efforts, is set to enhance operating efficiency and scalability, supporting higher net margins and improving cost-to-income over time.

- Strategic expansion of the retail flow business and third-party product distribution leverages Leonteq's wide distribution network and fintech capabilities, opening new capital-light revenue streams and increasing the share of stable, recurring income that supports earnings growth and reduces cyclicality.

- Ongoing optimization and resizing initiatives-including right-sizing personnel, nearshoring to Lisbon, and exiting underperforming businesses-support a commitment to a flat cost base while targeting 7% compound annual revenue growth through 2027, setting the stage for higher operating leverage, sustained profitability, and potential capital returns (dividends/share buybacks) by 2027.

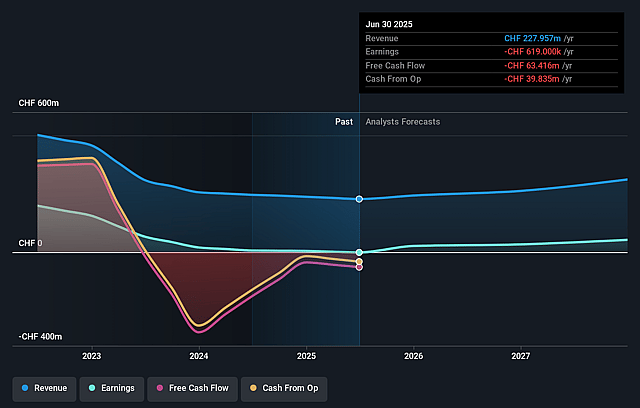

Leonteq Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Leonteq's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 18.7% in 3 years time.

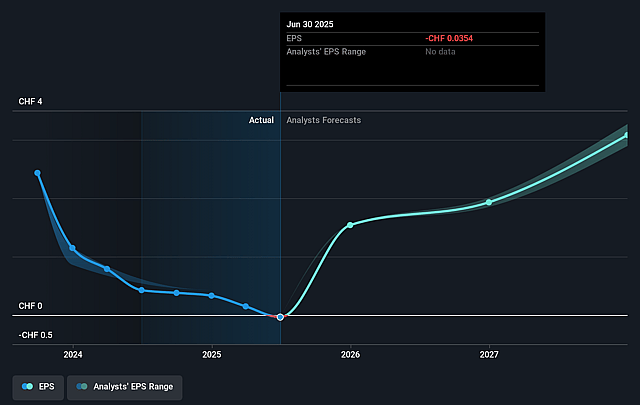

- Analysts expect earnings to reach CHF 61.2 million (and earnings per share of CHF 3.51) by about September 2028, up from CHF -619.0 thousand today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.8x on those 2028 earnings, up from -464.3x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 1.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.39%, as per the Simply Wall St company report.

Leonteq Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent industry-wide margin compression due to increased competition and technology-driven product commoditization is lowering fee income and reducing product margins, which could structurally constrain Leonteq's revenue growth and net margins over the long term.

- Failure of certain diversification and business initiatives-such as the exit from the Japanese market and discontinuation of the bench pension savings platform following weak demand-suggests challenges in expanding outside core structured products, potentially resulting in stagnant topline growth and limited earnings diversification.

- Heavy ongoing investment in compliance, risk management, and technology (including preparation for new regulatory regimes like FRTB and automation projects) may drive up operating expenses and strain net margins if revenue growth fails to keep pace or if further regulatory requirements arise.

- Reliance on a handful of major distribution and white labeling partners, with turnover from historic partners declining and increasing dependence on new partners, exposes the firm to concentration and partnership risk, making revenue and earnings more volatile in the face of underperformance or shifts in partner appetite.

- Heightened regulatory complexity and legacy compliance issues continue to weigh on client activity and fee income, while the risk of escalating regulatory scrutiny or new cross-border compliance demands could further suppress growth prospects and increase operational costs, negatively impacting future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF19.25 for Leonteq based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF326.5 million, earnings will come to CHF61.2 million, and it would be trading on a PE ratio of 6.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of CHF16.28, the analyst price target of CHF19.25 is 15.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.