Key Takeaways

- Strong growth in order backlog and leadership in green technologies position Stadler Rail for sustained revenue growth and increased market share amid global decarbonization trends.

- Strategic market expansion and efficiency initiatives are set to boost margins and recurring revenue, supporting long-term profitability and resilience.

- Adverse weather disruptions, high investment needs, and reliance on large, delayed orders create risks of financing strain, earnings volatility, and margin pressure for Stadler Rail.

Catalysts

About Stadler Rail- Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

- Massive growth in order backlog (now CHF 29.4 billion, up from previous periods) and high visibility on future revenues-driven by increased urbanization, government-led investment in public transport, and strong decarbonization momentum in Europe-foreshadows significant near-term revenue growth as large projects convert to sales.

- Industry leadership in alternative drives (battery and hydrogen trains, with over 300 sold and options for 200+ more) directly aligns with the accelerating modal shift from road/air to rail and regulatory support for green mobility; reinforces future order volumes, market share, and pricing power, supporting both top-line growth and margin improvement.

- Strategic expansion in North America and other international markets, including substantial capacity investments (e.g., Salt Lake City plant), increases geographic diversification and positions Stadler to benefit from secular reinvestment in rolling stock and the replacement cycle, ensuring a stable, growing revenue base.

- Strong expansion in the higher-margin Services & Components segment (17% revenue growth, now 26% of order backlog) and growing Signalling business support long-term improvements in gross and net margins through recurring revenues and operating leverage.

- Execution of efficiency programs, digital transformation, and modular production (reducing lead times, cost, and complexity) positions the company to capture operating margin gains in coming years, with management targeting a 4-5% EBIT margin in 2025 and 6-8% mid-term, which could drive significant earnings growth if current market skepticism persists.

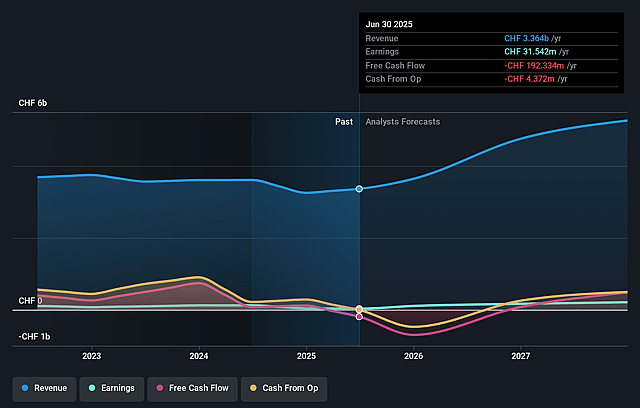

Stadler Rail Future Earnings and Revenue Growth

Assumptions

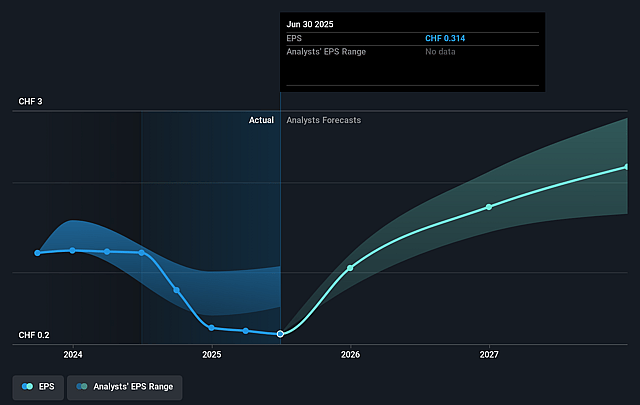

How have these above catalysts been quantified?- Analysts are assuming Stadler Rail's revenue will grow by 15.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 5.5% in 3 years time.

- Analysts expect earnings to reach CHF 286.7 million (and earnings per share of CHF 2.17) by about September 2028, up from CHF 31.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, down from 64.0x today. This future PE is lower than the current PE for the CH Machinery industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.0%, as per the Simply Wall St company report.

Stadler Rail Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Delays and disruptions caused by the adverse weather events in 2024, particularly in Valencia and Lower Austria, continue to negatively impact production, revenue recognition, and EBIT, with compensation for these effects not expected until at least 2026-2027, creating risk of uneven or delayed revenue and earnings increases.

- Increasing investments in capacity expansion (CHF 250 million in 2025 and CHF 200 million/year for the next two years), together with sharply negative free cash flow (minus CHF 744 million for H1 2025) and a decrease in net cash position, could lead to financing risk and pressure on net margins, especially if expected order intake does not materialize as forecasted.

- The company's heavy reliance on large, lumpy orders and the long lead times between contract signing, production, and revenue recognition (due to the conservative units-of-delivery method) make revenues and earnings susceptible to timing risks, project execution challenges, and cyclical fluctuations, potentially causing volatility in reported financial metrics and weakening short

- to mid-term earnings visibility.

- Margin pressure remains a risk due to inflationary headwinds in materials and labor, especially in the U.S., and while contracts include indexation clauses and some tariff cost protections, unforeseen increases in input costs or failure to pass on extra costs to customers could erode gross and EBIT margins.

- Although Stadler is expanding its international presence (notably in the U.S. and Europe), it remains exposed to weak economic development in key markets such as Germany, ongoing supply chain vulnerabilities, and uncertainty in the order pipeline, which may impair future revenue growth and operating leverage if new order intake falters.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF21.85 for Stadler Rail based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF26.7, and the most bearish reporting a price target of just CHF18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF5.2 billion, earnings will come to CHF286.7 million, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 6.0%.

- Given the current share price of CHF20.18, the analyst price target of CHF21.85 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.