Key Takeaways

- Significant deferred production output and accelerating order deliveries are set to drive multi-year, outsized earnings and margin growth beyond current market expectations.

- Leadership in green propulsion and global expansion position the company to capture structurally rising demand and recurring, high-margin service revenue on a global scale.

- Heavy dependence on European public contracts, mounting competition, and costly technological demands threaten Stadler Rail's profitability, growth prospects, and margin stability.

Catalysts

About Stadler Rail- Through its subsidiaries, engages in the manufacture and sale of trains in Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

- While analysts broadly agree that Stadler Rail's strong order backlog provides solid forward revenue visibility, they may underappreciate the magnitude of the forthcoming earnings surge: with nearly CHF 1 billion in production output deferred due to conservative revenue recognition, there is an embedded multi-year revenue and profit catch-up, likely resulting in outsized EPS growth through 2027 as delivered orders rapidly accelerate.

- Consensus is positive about Stadler's leadership in alternative propulsion systems, but the scale of incoming demand is likely understated; regulatory, societal, and funding momentum for green transport-coupled with Stadler's dominant position in battery and hydrogen trains-positions the company to capture a disproportionate share of a structurally expanding market, leading to potential super-normal revenue and margin expansion as existing diesel fleets are replaced globally.

- Stadler's ongoing global footprint expansion-evidenced by capacity increases in the United States, Spain, Hungary, and strategic targeting of North America, UK, and the Middle East-will enable it to capture accelerating infrastructure spend outside its traditional European base, shielding it from regional cyclicality and adding substantial new revenue streams over the coming decade.

- The transformation of its service and signaling business from a component to a strategic pillar-bolstered by multi-billion CHF order backlogs, high-margin recurring contracts, and full digitalization of maintenance-will structurally lift group EBIT margins and provide annuity-like cash flow stability, with significant multi-year upside as this segment's contribution grows.

- Investments in digitalization, automation, and harmonized group-wide processes will drive sustained, double-digit operational efficiency gains, lowering unit production costs, enhancing delivery reliability, and materially expanding net margins beyond what current forecasts assume.

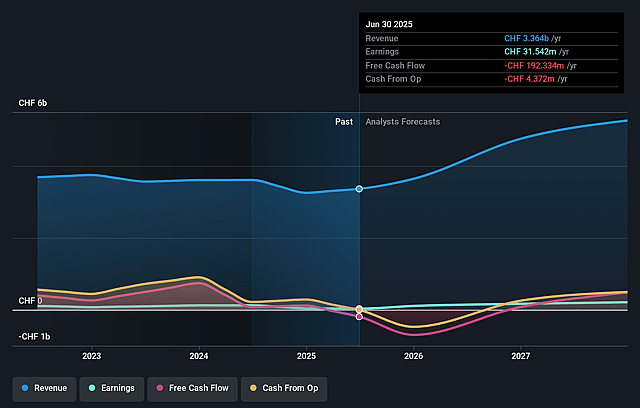

Stadler Rail Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Stadler Rail compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Stadler Rail's revenue will grow by 22.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.9% today to 5.8% in 3 years time.

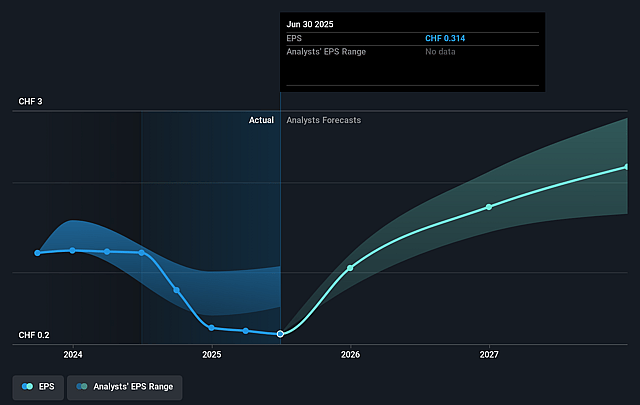

- The bullish analysts expect earnings to reach CHF 359.8 million (and earnings per share of CHF 3.62) by about September 2028, up from CHF 31.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, down from 64.0x today. This future PE is lower than the current PE for the CH Machinery industry at 21.6x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.01%, as per the Simply Wall St company report.

Stadler Rail Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent exposure to weak economic development in core European markets, such as Germany and Switzerland, heightens the risk of cyclical downturns or regulatory changes, which could create volatility in revenues and compress net margins for Stadler Rail over time.

- The company's heavy reliance on public sector infrastructure spending in Europe means that long-term trends of stagnant or declining government investment, driven by fiscal constraints, could reduce new project opportunities and weaken Stadler Rail's future revenue pipeline and earnings growth.

- Intensifying global competition, especially from larger and well-capitalized players like Alstom, Siemens Mobility, and CRRC, may force Stadler Rail to compete more aggressively on price or increase spending on R&D and compliance, thus eroding profitability and placing downward pressure on net margins.

- The growing pace and cost of railway electrification and digitalization require ongoing substantial capital investments and R&D spending; if these outlays outpace Stadler Rail's investment capacity or operational agility, the company risks falling behind technologically, putting both revenue growth and long-term earnings at risk.

- Supply chain complexity and exposure to natural disasters, as exemplified by recent production delays in Valencia and challenges with suppliers, could result in recurring cost overruns, delivery postponements, or quality issues, which may raise operating expenses and negatively impact net income and margin stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Stadler Rail is CHF26.7, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Stadler Rail's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF26.7, and the most bearish reporting a price target of just CHF18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF6.2 billion, earnings will come to CHF359.8 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 6.0%.

- Given the current share price of CHF20.2, the bullish analyst price target of CHF26.7 is 24.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Stadler Rail?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.