Key Takeaways

- Declining legacy service revenues and high infrastructure costs are straining profitability, despite investments in fiber and 5G expansion.

- Heightened competition, demographic headwinds, and regulatory risks threaten revenue growth, pricing power, and long-term margins.

- Expansion in fiber and 5G, digital media growth, and cost discipline bolster margins, cash flow, and financial resilience, supporting investment and shareholder returns.

Catalysts

About BCE- A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

- The ongoing transition away from traditional cable TV and landline services is rapidly eroding BCE's legacy service revenues, and accelerating cord-cutting will likely lead to steady declines in overall top-line revenue even as investments are made in growth areas.

- The high capital intensity required to aggressively expand next-generation fiber and 5G networks, both in Canada and the US, places persistent downward pressure on free cash flow and net margins, especially as ongoing build requirements and the Ziply transaction demand massive outlays for years to come.

- Demographic shifts, such as Canada's aging population and a clamp-down on immigration, risk slowing the long-term growth in data consumption and shrinking the addressable market for premium and bundled telecom products, dampening future revenue and ARPU growth.

- Intensifying competition from agile low-cost mobile virtual network operators (MVNOs) and the rising prevalence of over-the-top (OTT) streaming platforms threaten to drive price wars and further erode BCE's pricing power, compressing industry-wide profit margins and putting BCE's earnings at risk.

- Political and regulatory scrutiny of incumbent telecoms may introduce stricter price controls, forced network sharing, or mandated wholesale fiber access, eventually undermining BCE's ability to pass costs onto consumers and further pressuring long-term profitability and return on capital.

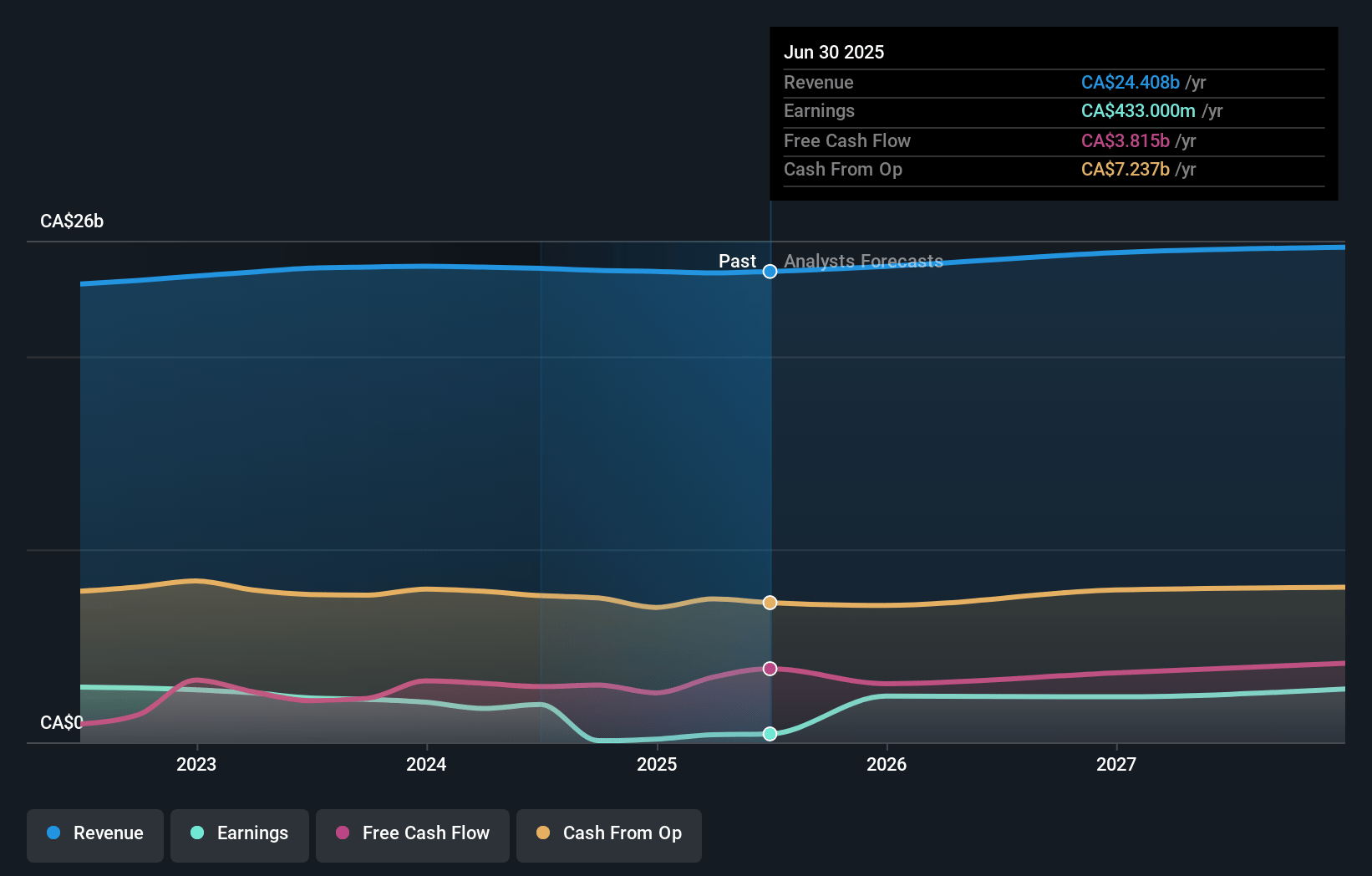

BCE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on BCE compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming BCE's revenue will decrease by 0.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.6% today to 12.0% in 3 years time.

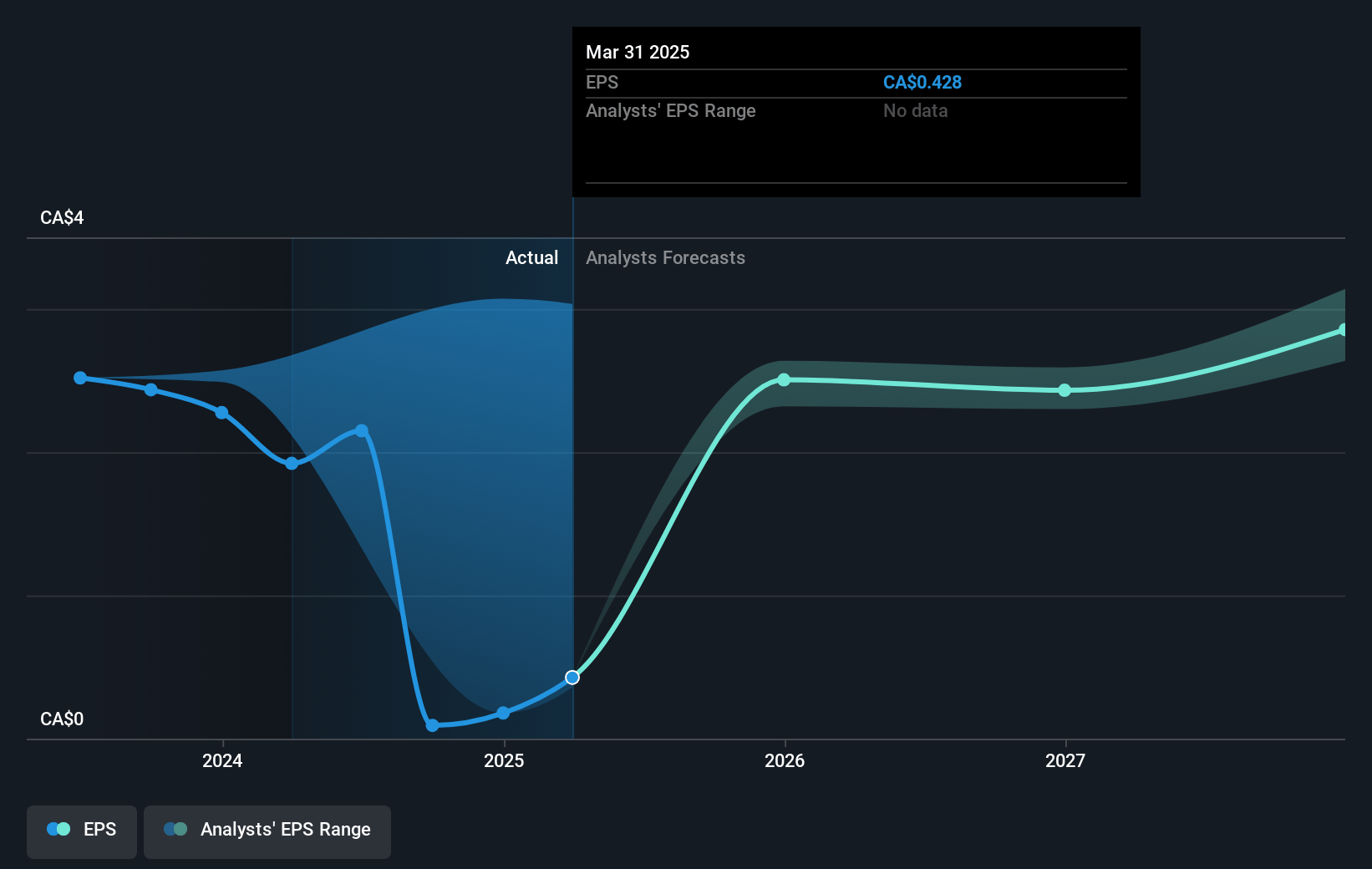

- The bearish analysts expect earnings to reach CA$2.9 billion (and earnings per share of CA$2.96) by about July 2028, up from CA$391.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.5x on those 2028 earnings, down from 78.8x today. This future PE is lower than the current PE for the CA Telecom industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 1.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.18%, as per the Simply Wall St company report.

BCE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BCE's aggressive expansion into fiber and 5G networks, particularly with leading market share and high penetration rates in Canada, positions the company to benefit from secular growth in broadband usage and data consumption, which can drive sustained revenue and EBITDA growth over the long term.

- The partnership with PSP Investments substantially reduces BCE's own capital funding needs for U.S. fiber expansion, thereby improving BCE's free cash flow profile by over $1 billion from 2026 to 2028 and supporting both deleveraging and future earnings growth.

- BCE's digital and media transformation, including a pivot to streaming with strong subscriber gains for Crave and initiatives to capture growing digital advertising markets, is contributing to rising revenue, improved EBITDA, and wider margins, helping to offset declines in legacy media.

- The company has demonstrated significant operational discipline through a major transformation program targeting $1.5 billion in cost savings by 2028, which is already boosting margins and supporting profitability even in a challenging pricing environment.

- BCE's healthy balance sheet, strategic divestitures, and new flexible dividend policy targeting a 40% to 55% payout ratio on free cash flow enable continued investment in growth and shareholder returns while accelerating progress toward a targeted net leverage ratio of 3.0 times adjusted EBITDA, underpinning the company's financial resilience and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for BCE is CA$29.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BCE's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$45.0, and the most bearish reporting a price target of just CA$29.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CA$23.8 billion, earnings will come to CA$2.9 billion, and it would be trading on a PE ratio of 11.5x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$33.42, the bearish analyst price target of CA$29.0 is 15.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.