Key Takeaways

- Faster-than-expected fiber market penetration and operational scale could substantially boost margins, revenue growth, and long-term earnings potential.

- Strategic partnerships and digital transformation lower risk and costs, positioning BCE for accelerated network expansion and strong recurring cash flow growth.

- Structural weaknesses in cash flow, declining legacy revenues, intense competition, capital constraints, and unfavorable regulatory and demographic trends threaten BCE's financial outlook and investor confidence.

Catalysts

About BCE- A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

- While the analyst consensus anticipates value from BCE's U.S. fiber expansion and the Ziply Fiber acquisition, there is potential for significantly faster and greater penetration within Ziply's target footprint; early signs already show penetration rates and revenue growth above original plans, suggesting a possible step-change in group EBITDA and long-term revenue well ahead of expectations as BCE leverages its operational scale and the favorable U.S. fiber market's low-cost, high-ARPUs dynamics.

- Analysts broadly agree that the digital media pivot and cost transformation will improve margins, but BCE's ambitious $1.5 billion cost-savings target and continued rapid digitization-driven by automation, AI, and workflow integration-have already delivered margin expansion in Media and CTS segments; if these gains compound at the current pace, BCE could see structural upward revision in net margins and earnings power over the next five years.

- BCE's partnership-driven expansion model-evidenced by the PSP Investments collaboration-not only de-risks U.S. fiber deployment but significantly reduces BCE's required capital, enabling much more aggressive network buildout across both Canada and the U.S. without balance sheet strain; this positions BCE to capitalize disproportionately on increasing demand for high-speed data and connectivity, accelerating recurring service revenue and sustainable free cash flow growth.

- The ongoing demographic shifts and urbanization trends in BCE's core and adjacent markets, combined with robust inbound immigration, provide a volume growth tailwind that can drive both ARPU and subscriber growth at pace, particularly as BCE already holds the technological and capacity lead in premium fiber and 5G services.

- BCE's integrated, one-stop approach for enterprise technology (as seen with Ateko) positions the company at the nexus of digital transformation, cloud migration, and workflow automation for major Canadian and U.S. organizations; this unique positioning targets rising enterprise IT budgets and could support double-digit, high-margin revenue growth in the business solutions segment, lifting the overall group's earnings trajectory.

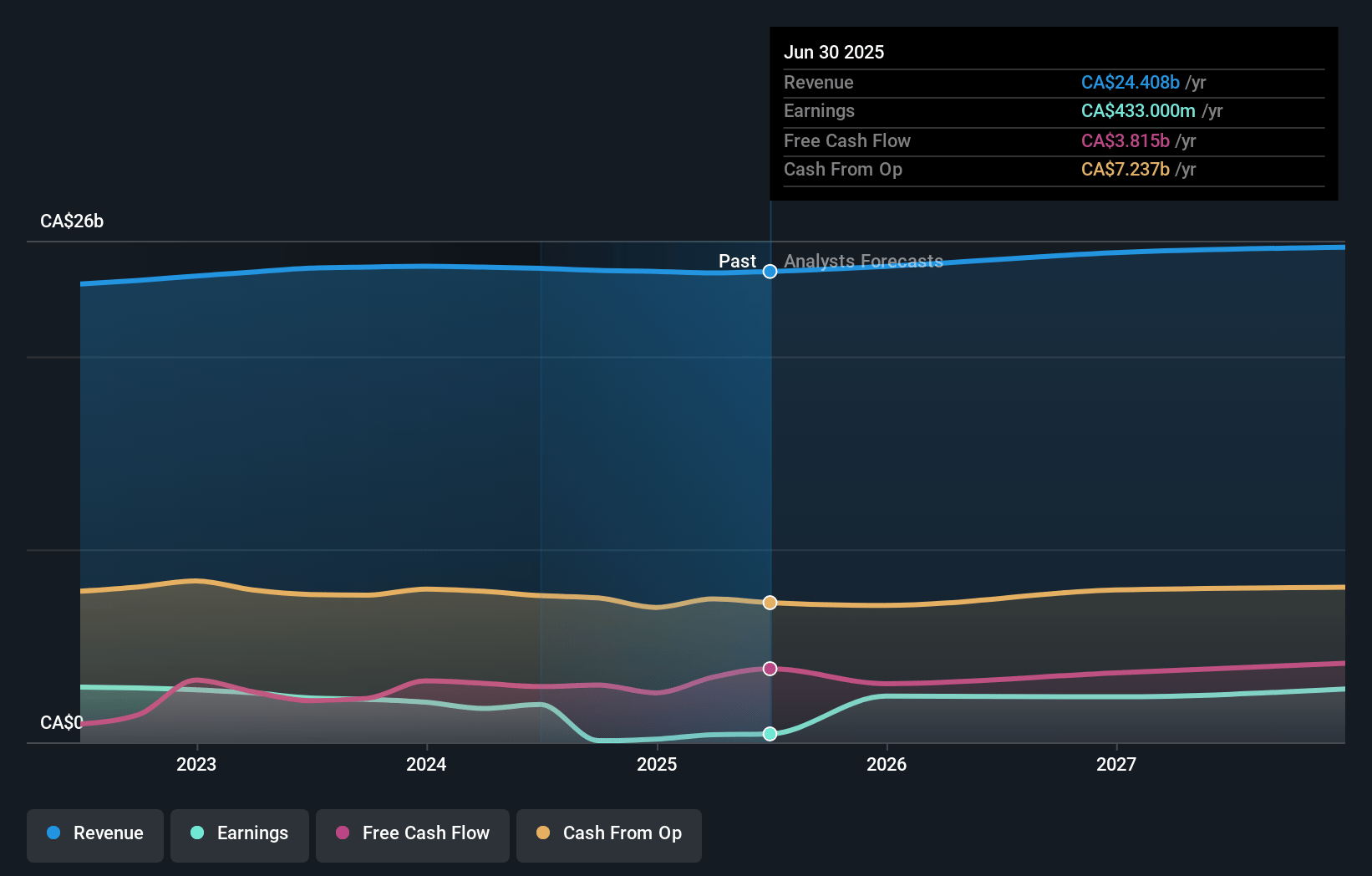

BCE Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on BCE compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming BCE's revenue will grow by 2.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.6% today to 12.2% in 3 years time.

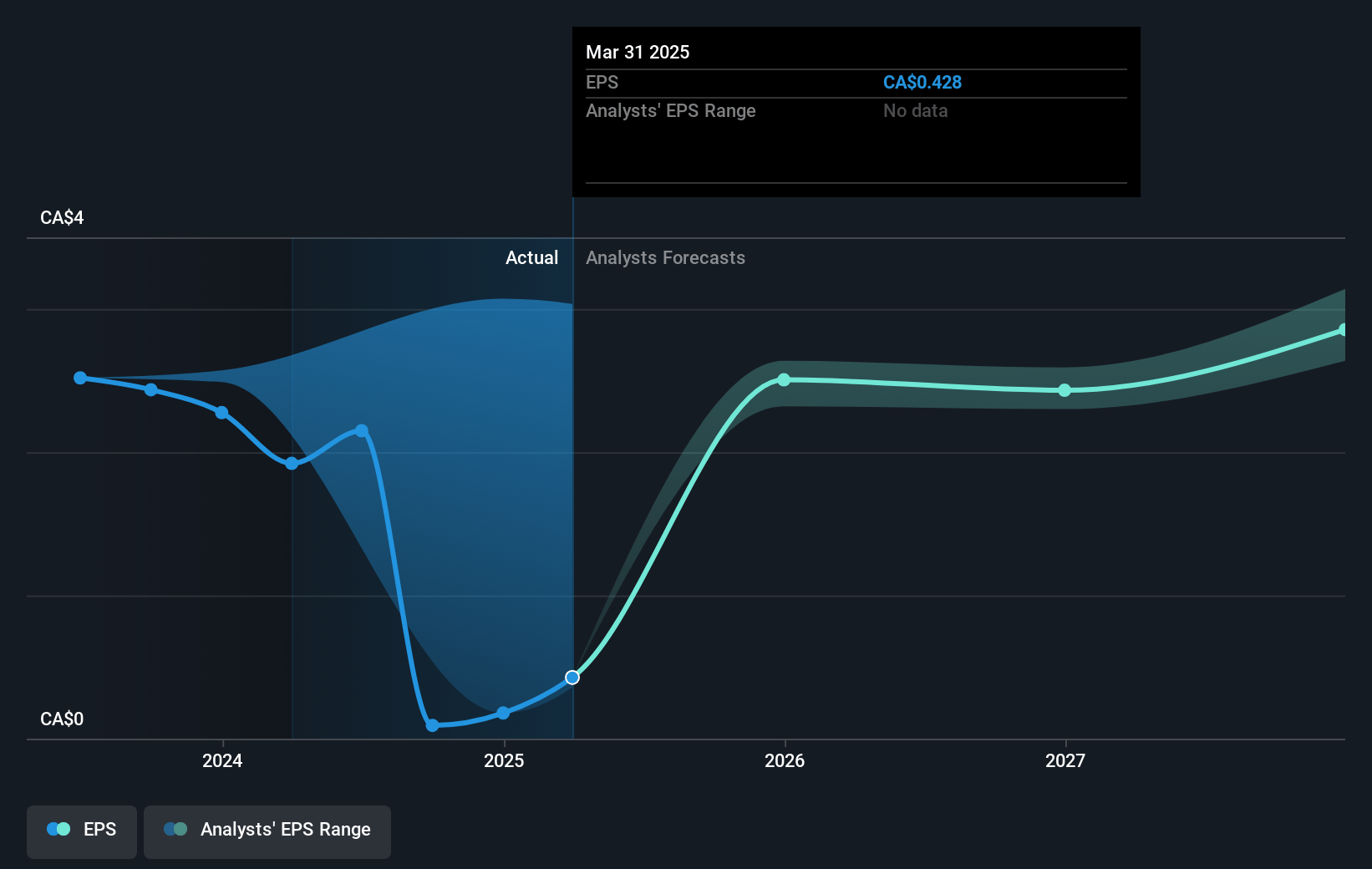

- The bullish analysts expect earnings to reach CA$3.2 billion (and earnings per share of CA$3.52) by about July 2028, up from CA$391.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, down from 76.8x today. This future PE is greater than the current PE for the CA Telecom industry at 12.7x.

- Analysts expect the number of shares outstanding to grow by 1.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.14%, as per the Simply Wall St company report.

BCE Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The announced reduction of BCE's annual dividend from $3.99 to $1.75 per share signals significant pressure on free cash flow and a need to prioritize deleveraging, reflecting structural weakness in cash generation that may reduce both investor confidence and future earnings potential.

- BCE's largest businesses, legacy wireline and traditional media, are experiencing ongoing revenue and subscriber declines due to cord-cutting and sustained drops in satellite TV and voice services, which will continue to weigh on top-line revenue growth and profit margins.

- Persistent competitive pressures, including "frothy pricing activity" in wireless, competitive threats from new low-cost entrants, and the risk of further Average Revenue Per User (ARPU) erosion, are likely to compress net margins and slow BCE's ability to recover revenue in its core markets.

- Despite substantial investment and growth in fiber and wireless, the company faces sustained high capital expenditure requirements for network buildouts in both Canada and the US; this capital intensity, while partially offset by partnerships, will continue to constrain free cash flow and limit financial flexibility.

- The company acknowledges a challenging regulatory and demographic environment, with demographics shifting toward younger, less loyal customers and greater potential for government intervention in pricing and network access, both of which risk accelerating customer churn, increasing price competition, and further eroding BCE's long-term net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for BCE is CA$43.1, which represents two standard deviations above the consensus price target of CA$34.25. This valuation is based on what can be assumed as the expectations of BCE's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$45.0, and the most bearish reporting a price target of just CA$29.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CA$26.2 billion, earnings will come to CA$3.2 billion, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 6.1%.

- Given the current share price of CA$32.57, the bullish analyst price target of CA$43.1 is 24.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.