Key Takeaways

- Dollarama's disciplined growth, urban alignment, and proven market expansion are driving higher revenue and market share potential than widely recognized.

- Enhanced logistics, persistent margin expansion, and growing industry dominance position Dollarama for stronger profitability and resilience versus competitors.

- Limited domestic growth, international expansion risks, digital disruption, rising input costs, and shifting demographics threaten Dollarama's traditional business model and future revenue prospects.

Catalysts

About Dollarama- Operates a chain of stores and provides related logistical and administrative support activities.

- Analyst consensus anticipates an uplift from store expansion and the Australian acquisition, but may be underestimating Dollarama's disciplined execution, rapid payback on Canadian stores, and proven success in scaling new markets like Colombia and Peru-suggesting a much higher long-run revenue growth trajectory and market share potential than currently priced in.

- Analysts broadly recognize margin improvements from supply chain efforts, but Dollarama's enhanced logistics, the upcoming Calgary distribution hub, and persistent shrink reduction initiatives are paving the way for sustained structural margin expansion, placing medium-term EBITDA and net margin growth above consensus forecasts.

- Longer-term, accelerating immigration-driven urbanization in Canada will further boost the addressable market and generate outsized traffic increases, accelerating comp-sales and revenue growth as Dollarama's dense urban footprint and format are uniquely aligned to new consumer settlement patterns.

- As cost-of-living pressures persist well into the next economic cycle, Dollarama's mix of private label consumables and direct sourcing positions it to disproportionately benefit from consumer trade-down behavior, reinforcing gross margin durability and sustained high inventory turnover even as other retailers face demand pressure.

- Industry consolidation and the exit of weaker rivals are set to rapidly concentrate market power with Dollarama, enabling stronger pricing power, vendor terms, and dominant customer loyalty-directly supporting upside to long-term EPS growth overlooked by the current market valuation.

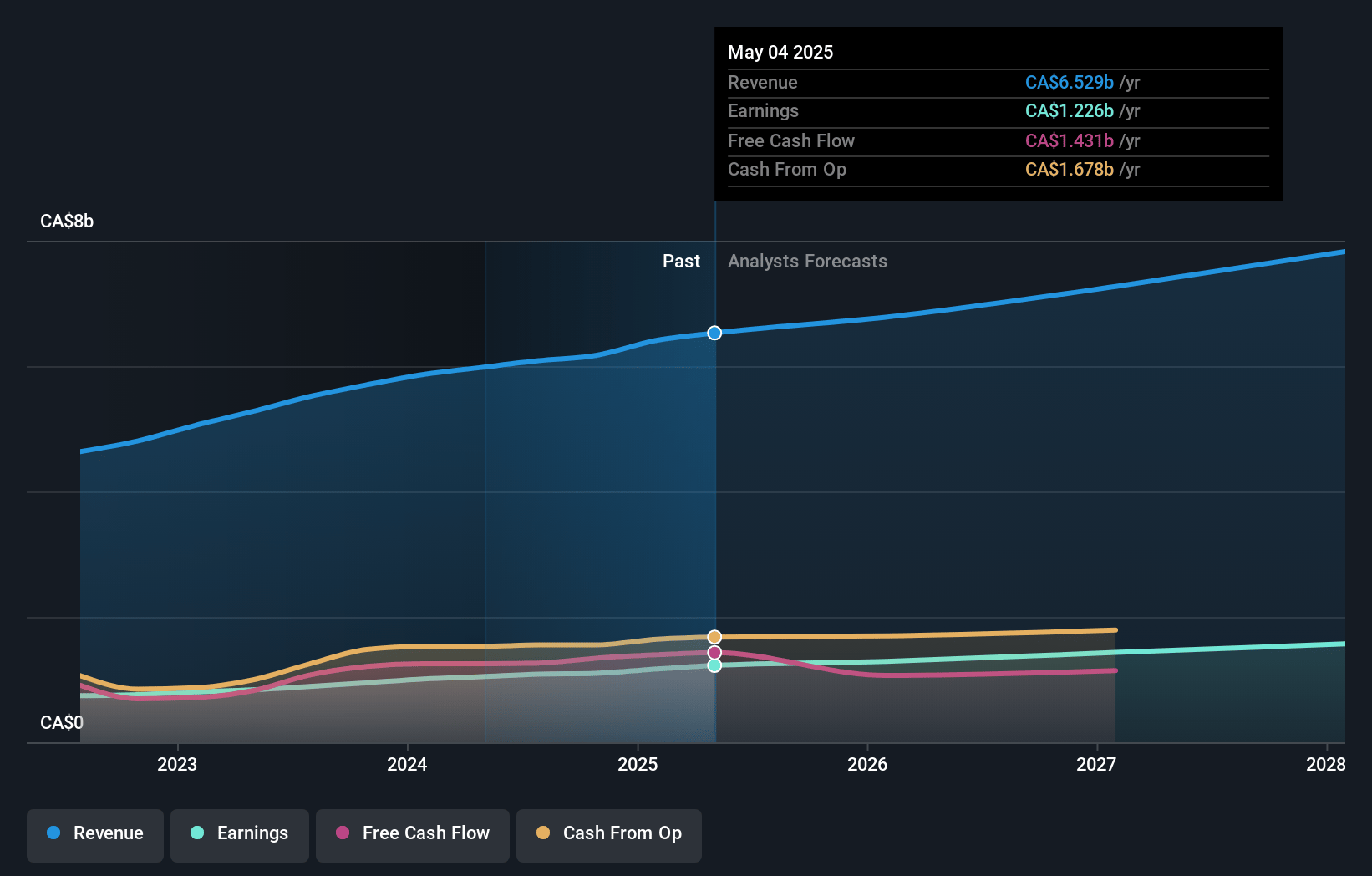

Dollarama Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Dollarama compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Dollarama's revenue will grow by 7.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.8% today to 20.1% in 3 years time.

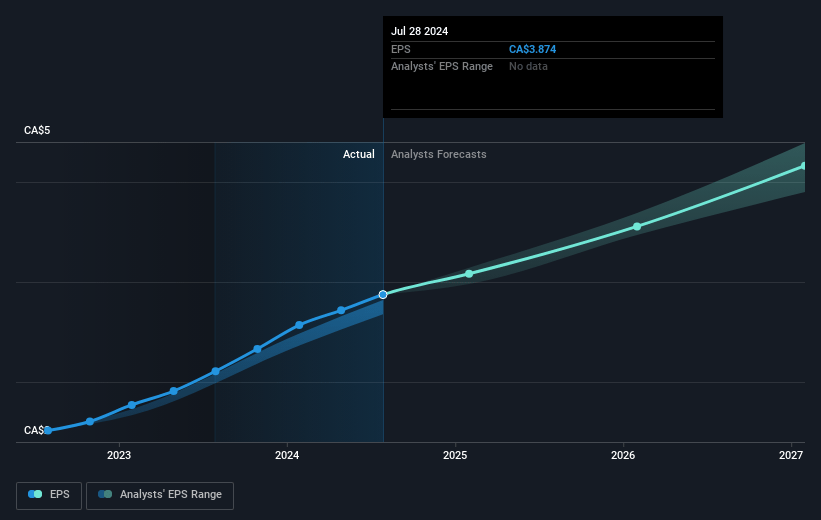

- The bullish analysts expect earnings to reach CA$1.6 billion (and earnings per share of CA$6.27) by about July 2028, up from CA$1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 44.4x on those 2028 earnings, up from 43.0x today. This future PE is greater than the current PE for the CA Multiline Retail industry at 27.5x.

- Analysts expect the number of shares outstanding to decline by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

Dollarama Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Market saturation in Canada combined with an already high store density limits Dollarama's domestic growth prospects, which could cap long-term revenue and constrain future earnings growth.

- Accelerating expansion into international markets, including Latin America, Mexico, and Australia, exposes Dollarama to significant execution risks such as economic instability, political uncertainty, currency fluctuations, and increased competition, any of which could dampen or erode earnings from these ventures.

- Increasing digital adoption and the growth of e-commerce could gradually divert consumer spending away from Dollarama's physical stores, ultimately reducing foot traffic and slowing revenue growth as more consumers shop online.

- Heightened input cost pressures from shipping rates, currency movement, tariffs, and potential regulatory requirements on product quality or environmental standards could squeeze gross margins over time if Dollarama cannot successfully pass through higher costs to its price-sensitive consumers.

- Demographic changes such as an aging population and shrinking household sizes, along with shifting consumer preferences toward sustainability, locally sourced, or higher-quality goods, pose a risk of declining demand for Dollarama's traditional low-cost, mass-market product mix, potentially leading to stagnating revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Dollarama is CA$223.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Dollarama's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$223.0, and the most bearish reporting a price target of just CA$115.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CA$8.2 billion, earnings will come to CA$1.6 billion, and it would be trading on a PE ratio of 44.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of CA$190.07, the bullish analyst price target of CA$223.0 is 14.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.