Key Takeaways

- Heavy reliance on search engine traffic and intensifying platform competition threaten user growth, revenue, and margins despite investments in AI and operational efficiencies.

- Expansion into e-commerce and ad tech faces headwinds from dominant industry players, shifting user behavior, and stricter privacy regulations, limiting sustainable growth and earnings quality.

- Heavy reliance on organic traffic, shifts in ad models, and rising acquisition and technology costs threaten revenue growth, margins, and long-term profitability.

Catalysts

About VerticalScope Holdings- A technology company, operates a cloud-based digital community platform for online enthusiast communities in the United States, Canada, the United Kingdom, and internationally.

- While VerticalScope is making investments in AI-driven features and language translation to improve user experience and engagement-which could partially mitigate user declines and support long-term revenue per user-the company is highly exposed to ongoing shifts in search engine algorithms and the increasing tendency of platforms like Google to prioritize their own AI-generated content, creating a sustained risk of lower monthly active users and pressuring both top-line revenue and net margins.

- Despite industry-wide growth in digital advertising and the company's efforts to reposition towards direct sales and premium CPMs, dominant players such as Google, Meta and Amazon are steadily consolidating advertiser spend, making it more difficult for niche vertical content networks to grow market share, which could lead to stagnant or declining advertising revenues.

- Although the company's expansion into e-commerce and affiliate marketing via acquisitions like Ritual Technologies offers potential for diversification and higher-margin recurring revenue streams, any meaningful recovery is likely to be hampered by the secular migration of product discovery and community engagement to larger video-first and private platforms, putting long-term pressure on VerticalScope's unique value proposition and earnings quality.

- While the company highlights operational leverage from its ongoing acquisition and platform consolidation strategy, persistent dependence on Google's organic traffic for a significant portion of site visits introduces high volatility and makes any EBITDA margin expansion vulnerable to further algorithm changes or search ecosystem disruptions, thereby limiting sustainable improvement in future profitability.

- Even as VerticalScope accelerates efforts to collect first-party data and deploy advanced ad tech for premium monetization, the risk remains that increased privacy regulation and downward pressure on ad rates for programmatic inventory will outweigh these benefits, risking net margin compression and diminished long-term cash flow conversion.

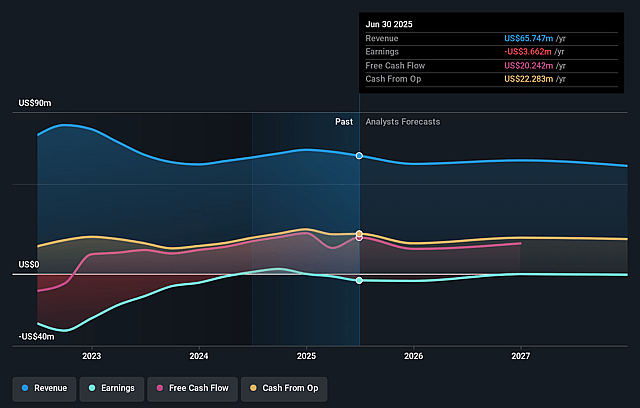

VerticalScope Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on VerticalScope Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming VerticalScope Holdings's revenue will decrease by 3.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.1% today to 2.3% in 3 years time.

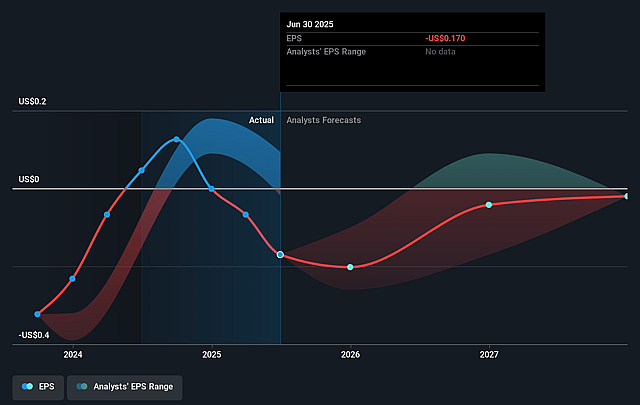

- The bearish analysts expect earnings to reach $1.4 million (and earnings per share of $0.07) by about July 2028, up from $-1.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 61.6x on those 2028 earnings, up from -44.6x today. This future PE is greater than the current PE for the CA Interactive Media and Services industry at 10.0x.

- Analysts expect the number of shares outstanding to decline by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.71%, as per the Simply Wall St company report.

VerticalScope Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- VerticalScope's heavy reliance on organic search traffic makes it vulnerable to search engine algorithm changes, as shown by the decline in monthly active users following Google's recent core update, which could lead to ongoing reductions in site traffic and therefore pressure advertising revenues and overall earnings.

- Increasing use of AI by search engines to answer user queries before displaying organic results presents the risk of a semi-permanent loss in organic traffic, potentially leading to lower user engagement and declining ad impressions, directly impacting both revenue and net earnings.

- Efforts to offset declining search traffic by ramping up direct traffic sources and investing in the Fora mobile app and AI-driven features involve significant incremental costs, which management acknowledged will put pressure on company margins and may reduce net profitability if payback is slow or insufficient.

- Display and programmatic ad revenues, particularly from video, have already been negatively affected by changes in ad unit classification and lower CPMs, and as ad formats face further commoditization and downward pricing trends, high-margin advertising revenues may remain under pressure, adversely impacting EBITDA and net margins.

- Persistent dependence on M&A for growth, with limited evidence of strong organic user acquisition, raises risks around integration, elevated acquisition costs, and uncertainty about achieving expected synergies, which could weaken returns on invested capital and ultimately affect long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for VerticalScope Holdings is CA$4.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of VerticalScope Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$8.83, and the most bearish reporting a price target of just CA$4.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $61.1 million, earnings will come to $1.4 million, and it would be trading on a PE ratio of 61.6x, assuming you use a discount rate of 8.7%.

- Given the current share price of CA$4.09, the bearish analyst price target of CA$4.4 is 7.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on VerticalScope Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.