Key Takeaways

- Strong AI-driven engagement, direct traffic strategies, and platform investments position VerticalScope for above-expected user growth, retention, and monetization.

- Ownership of niche communities and privacy trends favor stronger digital advertising, affiliate, and subscription revenue streams for sustainable, diversified earnings expansion.

- Heavy dependence on forum traffic, programmatic ads, and aging demographics, amid AI disruptions and rising costs, threatens revenue stability, margins, and sustainable growth.

Catalysts

About VerticalScope Holdings- A technology company, operates a cloud-based digital community platform for online enthusiast communities in the United States, Canada, the United Kingdom, and internationally.

- Analyst consensus points to MAU growth and AI translations as positive drivers, but this could be significantly understated-VerticalScope's demonstrated early traction and strong user engagement with AI-powered translated experiences suggests the company could unlock an even greater wave of non-English user adoption, potentially driving revenue and ARPU above current expectations.

- While analysts broadly note app improvements and AI-driven engagement, the full impact of VerticalScope's deep reinforcement of direct, app-based, and newsletter traffic channels is likely underestimated; as reliance on search wanes, this direct engagement can support much higher user retention and monetization, fueling sustainable net margin and earnings growth surpassing consensus.

- VerticalScope's ownership of highly engaged, vertical-specific communities-coupled with the withdrawal of third-party cookies and increased privacy regulations-positions the company to rapidly become a preferred partner for targeted digital advertising, driving both premium CPMs and long-term advertising revenue expansion.

- The company's extensive platform investments and agile M&A strategy allow it to quickly onboard, integrate, and extract operational synergies from new communities, unlocking margin improvements and compounding earnings growth well beyond simple scale effects seen by peers.

- With rising consumer demand for authentic, user-generated content-especially in high-value verticals where product decisions require trusted social proof-VerticalScope stands to benefit from an industry-wide shift that redirects major brand and e-commerce spend to its platforms, unlocking untapped affiliate, subscription, and transactional revenues that provide a more stable and diversified earnings base.

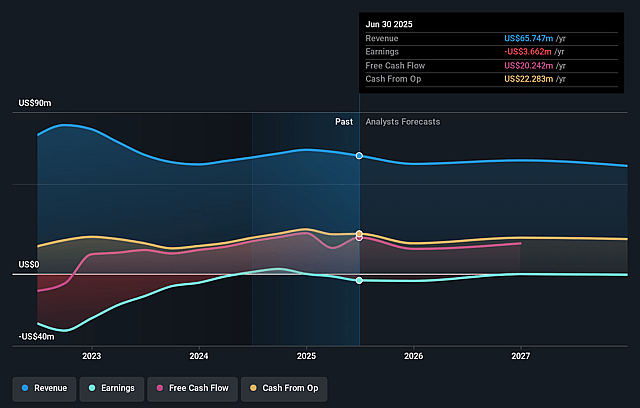

VerticalScope Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on VerticalScope Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming VerticalScope Holdings's revenue will decrease by 3.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -2.1% today to 2.5% in 3 years time.

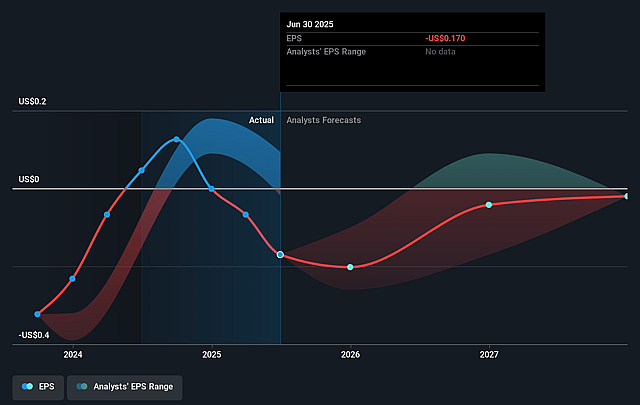

- The bullish analysts expect earnings to reach $1.5 million (and earnings per share of $0.07) by about August 2028, up from $-1.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 116.0x on those 2028 earnings, up from -40.1x today. This future PE is greater than the current PE for the CA Interactive Media and Services industry at 10.0x.

- Analysts expect the number of shares outstanding to decline by 0.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.77%, as per the Simply Wall St company report.

VerticalScope Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained declines in monthly active users caused by Google's shift to prioritizing AI overviews and its own platforms in search results have already led to an 8 percent YoY revenue drop, and further algorithm changes could cause prolonged organic traffic losses, directly weakening top-line revenue growth.

- The proliferation of generative AI and content summarization tools is reducing the need for users to visit forums for answers, which can erode user engagement and diminish advertising impressions, ultimately impacting revenue stability and growth rates.

- VerticalScope's increasing investments in AI, SEO, mobile app enhancements, and direct marketing campaigns are driving up operating expenses at a time when core revenue streams are under pressure, resulting in lower net margins and tighter earnings.

- Reliance on programmatic digital advertising, especially high-margin video CPMs, leaves the company vulnerable to ongoing pricing volatility and industry-wide shifts toward video-centric and social formats like TikTok and YouTube Shorts, potentially shrinking the total addressable market for display ad revenue.

- Challenges in integrating and monetizing newly acquired online communities at scale-coupled with an aging forum demographic and difficulty capturing younger audiences-risk declining monthly users and operational inefficiencies, which threaten recurring revenues and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for VerticalScope Holdings is CA$8.85, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of VerticalScope Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$8.85, and the most bearish reporting a price target of just CA$4.41.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $61.1 million, earnings will come to $1.5 million, and it would be trading on a PE ratio of 116.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of CA$3.71, the bullish analyst price target of CA$8.85 is 58.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.