Key Takeaways

- Successful new project ramp-ups and operational efficiency measures position the company for increased production, revenue, and margin stability despite industry cost pressures.

- Strong balance sheet and permitting expertise enable sustained internal growth, exploration, and resilience amid macroeconomic uncertainty and challenging regulatory environments.

- Heavy dependence on risky jurisdictions, project execution, exploration success, and financial strategy exposes the company to multiple threats to growth, margins, and earnings stability.

Catalysts

About B2Gold- Operates as a gold producer company in Canada.

- The ramp-up of Goose to commercial production in Q3, alongside progress at Fekola Regional (potential exploitation license within 60 days and production startup shortly after), is set to materially expand B2Gold's overall gold output in the near term-driving top-line revenue and EBITDA growth that may not yet be fully factored into the stock price.

- With gold prices supported by ongoing macroeconomic uncertainty (inflation, monetary policy, geopolitical tensions), B2Gold's strong production growth profile and leverage to gold provides upside potential in both revenues and cash flows as these secular drivers continue to bolster sustained high gold prices.

- Continued investments in operational efficiency (e.g., use of solar power, early procurement strategies, optimizing mine sequencing) and cost management efforts position B2Gold to preserve or improve net margins even as new projects come online-countering concerns about industry-wide cost inflation, and potentially supporting higher future earnings than currently anticipated.

- The company's robust balance sheet-with $330 million in cash and $800 million undrawn on its revolver-enables B2Gold to execute on internal growth projects, continue high-impact exploration, and advance feasible studies like Gramalote without dilutive equity issuance, setting the stage for sustainable earnings and NAV per share growth.

- Progress on permitting at Fekola Regional, a consolidated land package under Mali's updated mining code, demonstrates B2Gold's ability to navigate increasingly complex permitting environments-suggesting ongoing success in project development and potential premium valuation for maintaining growth in jurisdictions considered challenging.

B2Gold Future Earnings and Revenue Growth

Assumptions

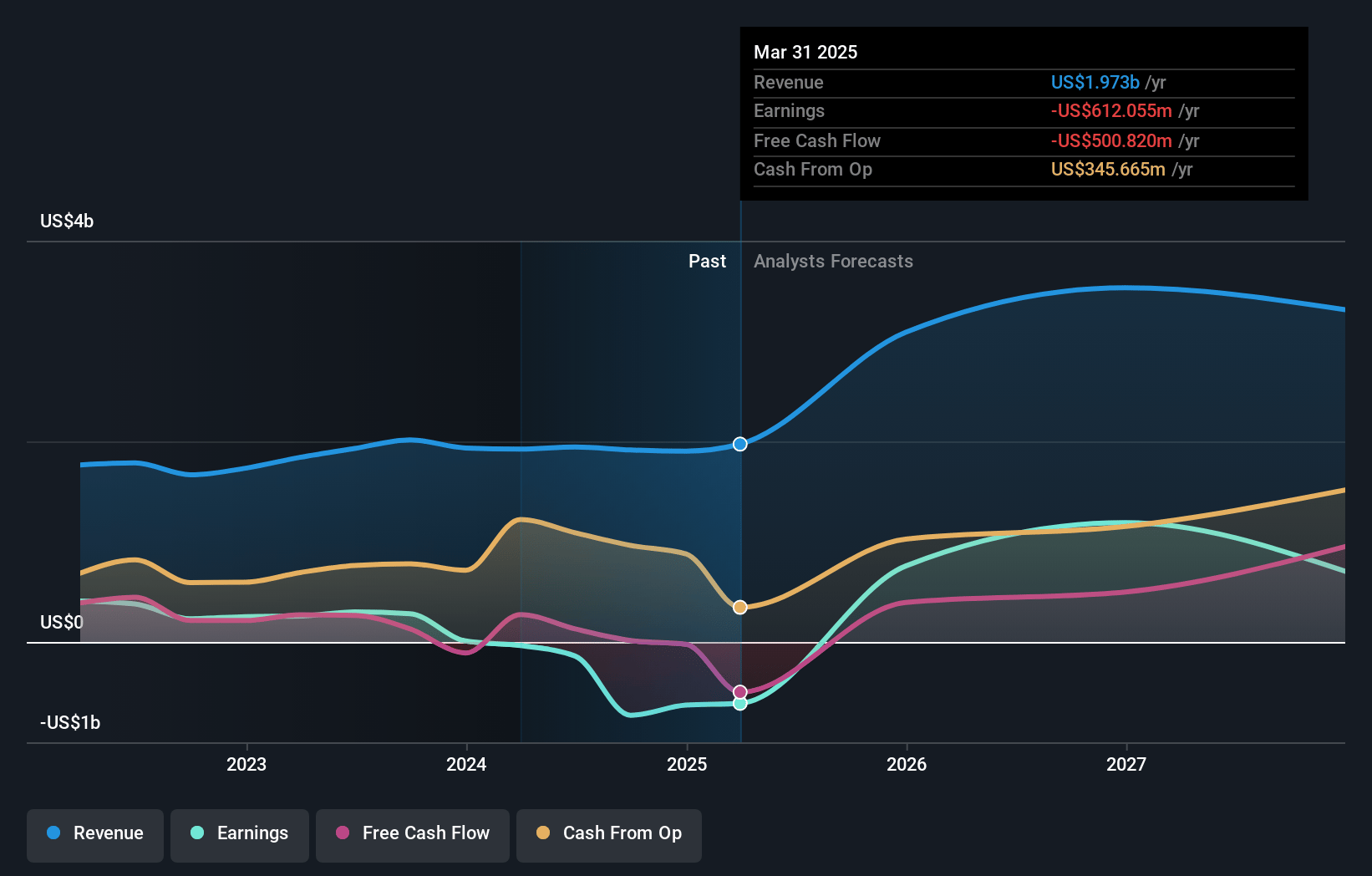

How have these above catalysts been quantified?- Analysts are assuming B2Gold's revenue will grow by 19.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -31.0% today to 42.9% in 3 years time.

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $0.67) by about July 2028, up from $-612.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.7x on those 2028 earnings, up from -7.6x today. This future PE is lower than the current PE for the US Metals and Mining industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

B2Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- B2Gold's key growth and production expansion is heavily reliant on timely permitting and government approvals in jurisdictions such as Mali and Colombia, which are geopolitically risky and expose the company to potential regulatory delays, expropriation risk, and changes in mining codes-having a direct negative impact on revenues and earnings stability if projects are delayed or nationalized.

- The company's long-term production growth depends on completion and ramp-up of multiple large-scale projects (Goose, Fekola Regional, Gramalote); execution risk or project overruns-including unforeseen technical or construction challenges-could inflate capital costs, depress margins, and defer cash flow generation, impacting both net margins and ROI.

- Heavy concentration of B2Gold's asset base in several emerging markets (Mali, Namibia, the Philippines) increases exposure to resource nationalism, higher taxation, royalties, and operational disruptions, all of which could erode profitability and future free cash flow.

- The anticipated increase in mine life and production is strongly dependent on ongoing exploration success and sustaining reserve replacement; if new ore discoveries or reserve upgrades fall short, the company could face declining grades, shrinking output, and rising unit costs, negatively affecting long-term revenues and net margins.

- B2Gold's financing strategy-including recent convertible note issuance and reliance on undrawn credit facilities-could dilute shareholders in the future if additional equity is required for major projects, and rising interest expenses in a volatile rate environment may compress net earnings even if gold prices stay elevated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$6.856 for B2Gold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$8.25, and the most bearish reporting a price target of just CA$4.68.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 5.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$4.82, the analyst price target of CA$6.86 is 29.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives