Catalysts

About Aris Mining

Aris Mining is a growing Americas focused gold producer developing a multi mine platform with significant embedded expansion and project optionality.

What are the underlying business or industry changes driving this perspective?

- Segovia's ongoing ramp up to roughly 3,000 tonnes per day, supported by strong grades and recoveries, is set to drive higher gold output and scale efficiencies, which should lift revenue and expand all in sustaining cost margins.

- The Marmato Bulk Mining Zone build out, with critical long lead items on site and first gold targeted for 2026, positions the company for a step change in production from an already funded project, supporting sustained revenue growth and higher consolidated EBITDA.

- The Soto Norte project, with high grade reserves, very low projected all in sustaining costs and meaningful third party processing for community miners, offers the potential for structurally higher consolidated margins and materially higher earnings once permitted and constructed.

- The Toroparu project in Guyana, underpinned by large scale, long life resources and attractive economics at current gold prices, provides a clear pathway to further geographic diversification and incremental production, enhancing long term revenue visibility and cash generation.

- A robust balance sheet with rising cash, low net leverage and no significant maturities until 2029 enables Aris Mining to internally fund much of its growth pipeline, which reduces financing risk and supports future free cash flow and equity value accretion.

Assumptions

This narrative explores a more optimistic perspective on Aris Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

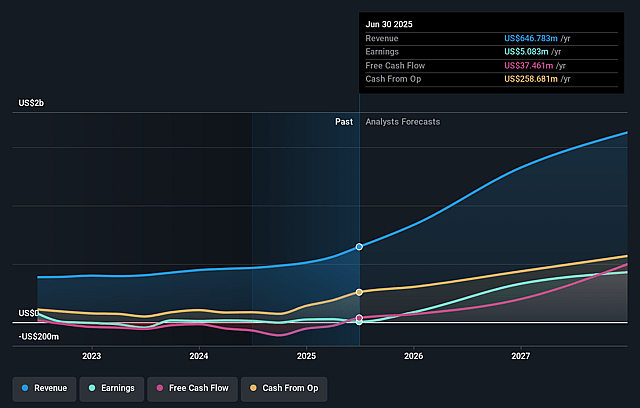

- The bullish analysts are assuming Aris Mining's revenue will grow by 50.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.4% today to 50.3% in 3 years time.

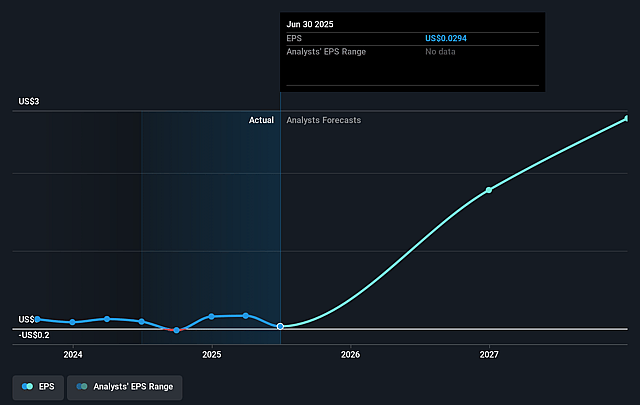

- The bullish analysts expect earnings to reach $1.3 billion (and earnings per share of $5.85) by about December 2028, up from $49.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.1 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 5.3x on those 2028 earnings, down from 65.2x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 21.5x.

- The bullish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.49%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The growth strategy depends heavily on high and rising gold prices, as illustrated by Soto Norte economics at a base case gold price of 2,600 dollars per ounce and Toroparu at 3,000 dollars per ounce. Any prolonged downturn in the gold price cycle would compress AISC margins and materially reduce project net present value and future earnings power, putting pressure on cash generation and net margins.

- Execution and cost overrun risk is rising as Marmato capital spending sharply increases and Toroparu and Soto Norte move toward construction, with a combined initial capital requirement of more than 1.4 billion dollars. Any inflationary surprise, contractor underperformance or schedule delay would elevate all in sustaining costs, weaken free cash flow and increase reliance on external financing, diluting earnings per share and net margins.

- The long dated nature of Soto Norte and Toroparu, both targeting environmental licenses and pre feasibility milestones years before full production, exposes Aris Mining to shifts in regulatory, tax and social license frameworks in Colombia and Guyana. Tighter environmental standards, slower permits or higher royalties could delay production ramps and compress long term revenue growth and after tax earnings.

- The business model increasingly relies on contract mining partners and community miners at Segovia, Marmato and ultimately Soto Norte, which introduces structural exposure to third party operational, social and safety risks that could affect feed quality or continuity. This could lead to lower throughput or grades and therefore lower revenue and reduced segment margins over time.

- Despite currently low net leverage, the combination of large growth capital at Marmato, Toroparu and Soto Norte and an expectation that Aris Mining will fund much of this organically creates a risk that any operational setback, lower grades or temporary production shortfall at Segovia or Marmato would force higher debt or equity issuance. This could erode return on equity and dilute earnings and cash flow per share.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Aris Mining is CA$31.04, which represents up to two standard deviations above the consensus price target of CA$27.4. This valuation is based on what can be assumed as the expectations of Aris Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$31.04, and the most bearish reporting a price target of just CA$21.16.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 5.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of CA$21.6, the analyst price target of CA$31.04 is 30.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Aris Mining?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.