Key Takeaways

- Large-scale expansion projects, operational efficiencies, and strategic asset focus position Barrick for industry-leading margin growth and sustained earnings outperformance.

- Strong gold reserve base and exploration pipeline enable Barrick to capture upside from gold demand while minimizing costs and maximizing shareholder returns.

- Elevated geopolitical, operational, and cost risks threaten Barrick's profitability and revenue growth, while shifting gold demand and reserve challenges may undermine long-term performance.

Catalysts

About Barrick Mining- Engages in the exploration, development, production, and sale of mineral properties.

- While analyst consensus views the expansions at Lumwana and Reko Diq as major growth drivers, the market is likely underestimating just how transformative their scale, low-cost profiles, and multidecade life will be in a supply-constrained copper and gold environment-these projects could double Barrick's copper output and catalyze substantial step-changes in revenue and cash flow as global demand for copper accelerates into the 2030s.

- Analysts broadly agree that ongoing cost efficiencies and disciplined capital allocation should improve margins, but operational commentary suggests deeper, structural cost reductions are coming from automation, mine optimization, and reprocessing tailings for critical minerals-positioning Barrick for an industry-leading margin expansion and sustained earnings outperformance as volumes ramp up.

- The accelerating global shift to de-dollarization and high inflation volatility is likely to drive an enduring surge in gold investment demand, setting a multi-year high-price regime; Barrick's unmatched Tier 1 gold reserve base enables it to maximize free cash flow and earnings leverage in a prolonged gold bull market.

- Unacknowledged in the consensus is Barrick's pipeline of brownfield exploration and the potential to unlock multi-decade organic resource upside at existing assets-near-mine discoveries at Fourmile, Kibali (ARK-KCD corridor), and Phoenix could provide low-risk production growth and dramatically suppress sustaining capital needs, further bolstering mid-to-long-term net margins.

- By divesting high-cost noncore mines and concentrating on large, long-life assets, Barrick is set to sharply lower unit costs and complexity, freeing up exploration and management resources to focus on next-generation large-scale projects-supporting higher returns on both invested capital and shareholder distributions through enhanced buybacks and special dividends.

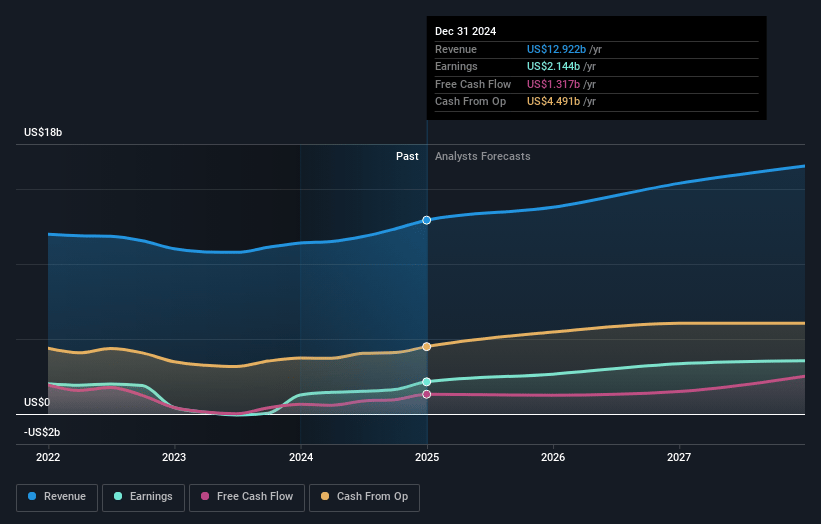

Barrick Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Barrick Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Barrick Mining's revenue will grow by 20.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.5% today to 33.3% in 3 years time.

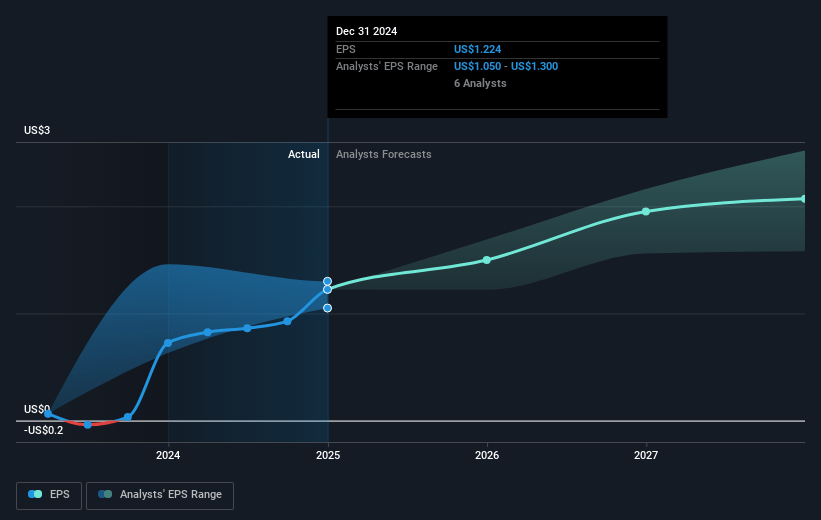

- The bullish analysts expect earnings to reach $7.7 billion (and earnings per share of $4.58) by about July 2028, up from $2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, down from 16.1x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 1.9% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.81%, as per the Simply Wall St company report.

Barrick Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing geopolitical instability and resource nationalism-especially in jurisdictions such as Mali (where Loulo-Gounkoto operations remain suspended and there are ongoing arbitration proceedings)-could disrupt operations, impose higher taxes, or result in temporary asset losses, negatively impacting revenues and earnings in the long run.

- The global shift towards clean energy and electrification, which may structurally reduce gold's role as a long-term store of value, poses a risk to sustained demand and could impair Barrick's pricing power and revenue growth, especially as projects are predicated on continued high gold prices.

- Barrick's dependence on a limited set of large, flagship assets (e.g., Nevada Gold Mines, Pueblo Viejo, Kibali, Reko Diq, Lumwana) increases concentration risk-any operational setbacks, regulatory delays, or local disruptions at these sites could disproportionately affect group-wide net margins and free cash flow.

- Industry-wide rising input costs-including labor, energy, and equipment-are highlighted as a challenge, and despite Barrick's efforts to lower certain unit costs, persistent inflation could outpace gold price gains, eroding sector-wide and company-specific profitability.

- While Barrick emphasizes reserve replacement through exploration rather than M&A, the declining quality of new resource additions and higher costs to develop new projects may pressure long-term production growth and compress net margins, leading to potential underperformance in earnings relative to historical levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Barrick Mining is CA$48.71, which represents two standard deviations above the consensus price target of CA$36.72. This valuation is based on what can be assumed as the expectations of Barrick Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$50.77, and the most bearish reporting a price target of just CA$30.65.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $23.1 billion, earnings will come to $7.7 billion, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of CA$29.58, the bullish analyst price target of CA$48.71 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.