Key Takeaways

- Expansion and optimization of gold and copper assets, along with efficiency initiatives, are driving improved margins, production stability, and long-term earnings growth.

- Disciplined asset management and strong capital returns support operational resilience, attractive shareholder payouts, and potential for additional value creation through future projects.

- Political instability, ESG compliance, declining ore grades, resource constraints, and shifting demand trends present significant risks to profitability, operational stability, and long-term market valuation.

Catalysts

About Barrick Mining- Engages in the exploration, development, production, and sale of mineral properties.

- Significant ongoing expansion of both gold and copper production capacity-particularly at Lumwana and via organic growth at Fourmile and Reko Diq-positions Barrick to capture elevated long-term demand for gold (as a financial hedge during geopolitical uncertainty/inflation) and copper (driven by electrification and infrastructure investment), supporting top-line revenue growth over the coming decade.

- Continued focus on Tier 1, long-life assets in stable jurisdictions, and the divestment of non-core projects (e.g., Donlin Gold), enhance operational resilience and production predictability, which are likely to result in stronger, more consistent free cash flow and net earnings.

- Ongoing investment in operational efficiency-including automation, innovation, and digitization-is translating into reduced all-in sustaining costs across core assets, directly improving net margins and profitability as production volumes scale.

- Demonstrated ability to extend or expand existing mine lives (e.g., Pueblo Viejo stockpile optimization, resource conversion at Fourmile, new mining permits at Zaldivar) increases production visibility and the value of Barrick's high-quality resource base, supporting higher asset valuations and sustained earnings growth.

- Barrick's robust balance sheet and disciplined capital return strategy enable continued shareholder-friendly actions (dividends, buybacks) without diluting equity, while future catalysts-such as successful financing for Reko Diq and new exploration results-could further unlock value, improving investor return profiles and narrowing the gap between asset and market value.

Barrick Mining Future Earnings and Revenue Growth

Assumptions

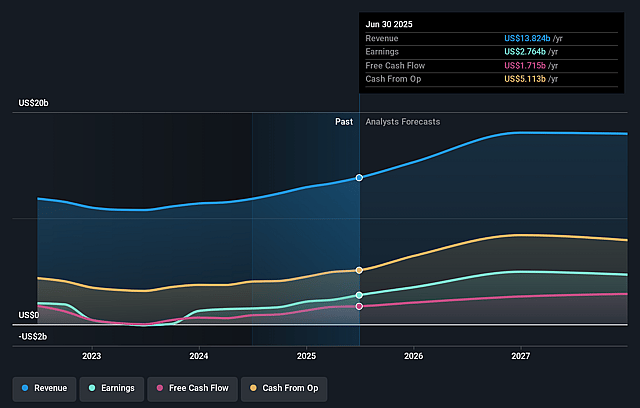

How have these above catalysts been quantified?- Analysts are assuming Barrick Mining's revenue will grow by 11.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.0% today to 27.4% in 3 years time.

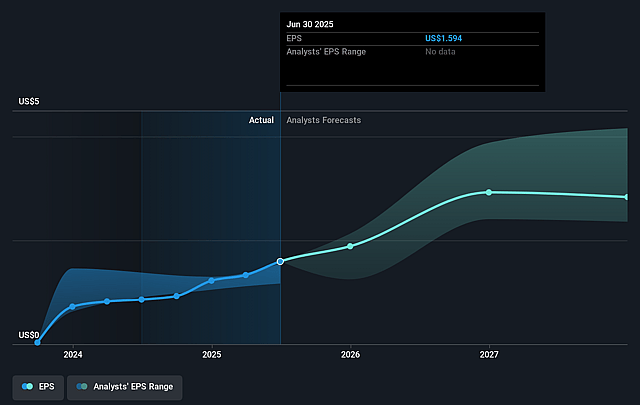

- Analysts expect earnings to reach $5.3 billion (and earnings per share of $3.2) by about August 2028, up from $2.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $7.0 billion in earnings, and the most bearish expecting $2.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.8x on those 2028 earnings, down from 14.7x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.0x.

- Analysts expect the number of shares outstanding to decline by 2.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.64%, as per the Simply Wall St company report.

Barrick Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing risks in politically and economically unstable regions, such as the unresolved situation in Mali with Loulo-Gounkoto and continued reliance on African and Middle Eastern assets, could introduce volatility in revenue streams and threaten earnings due to potential asset expropriation, operational disruptions, and costly legal disputes.

- Heightened global scrutiny of large-scale mining projects and evolving ESG (Environmental, Social, Governance) requirements may drive up long-term capex and opex for complying with sustainability standards and securing permits, directly impacting net margins and free cash flow.

- Declining average ore grades at some of Barrick's key assets, along with the reliance on processing significant (aging) stockpiled ore at operations like Pueblo Viejo, risk increasing future cash costs and compressing gross and net margins, especially if gold/copper prices normalize.

- Long-term water and energy supply constraints, particularly in power-challenged regions like Zambia, pose operational risks and may result in higher energy costs and/or intermittent production disruptions, which would pressure margins and could force production cuts, affecting overall output and profitability.

- Growing global trends toward decarbonization and the rise of alternative materials and green technologies could gradually erode traditional gold and copper demand, ultimately suppressing Barrick's long-term revenue growth and market valuation if commodity prices weaken or sentiment shifts away from resource-intensive industries.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$37.371 for Barrick Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$50.89, and the most bearish reporting a price target of just CA$30.86.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $19.4 billion, earnings will come to $5.3 billion, and it would be trading on a PE ratio of 9.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$32.84, the analyst price target of CA$37.37 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.