Key Takeaways

- Increasing exposure to catastrophic events, climate risks, and reinsurance costs threatens sustained underwriting profitability and pressures long-term margins and earnings.

- Lagging digital transformation and reliance on traditional investment strategies heighten vulnerability to market shifts, technological disruption, and unpredictable emerging market risks.

- Resilient insurance operations, global premium growth, conservative investing, decentralized management, and robust capital position support sustainable profitability and shareholder value creation.

Catalysts

About Fairfax Financial Holdings- Through its subsidiaries, provides property and casualty insurance and reinsurance, and investment management services in the United States, Canada, the Middle East, Asia, and internationally.

- Fairfax's significant exposure to catastrophic events was highlighted by $692 million in wildfire losses during a single quarter, reinforcing the growing risk that rising frequency and severity of natural disasters will continue to depress underwriting profits and raise combined ratios, particularly as reinsurance costs climb and climate risk intensifies, ultimately exerting long-term pressure on net earnings and net margins.

- While fixed income yields contributed positively this quarter, the sizeable allocation to government bonds with shorter duration leaves investment income highly vulnerable to a possible new era of persistent low or even negative real interest rates globally, threatening future revenue streams and overall profitability.

- An accelerating shift toward fintech and insurtech, alongside rising adoption of automated and AI-driven underwriting, could erode Fairfax's competitive position; substantial technology investments may be required to maintain efficiency and relevance, but there is little evidence of sufficient internal progress in digitization, which risks margin compression and stagnating premium growth over the coming years.

- The company's ongoing reliance on a value-oriented, contrarian investment approach exposes it to chronic underperformance should capital markets favor growth or technology-driven strategies for an extended period, reducing the potential for outsized investment returns and pressuring average return on equity.

- Fairfax's expanding presence in emerging markets carries high exposure to political instability, regulatory intervention, and currency volatility, presenting a growing risk of unpredictable earnings swings and potential downside to both revenue growth and net margins in the medium to long term.

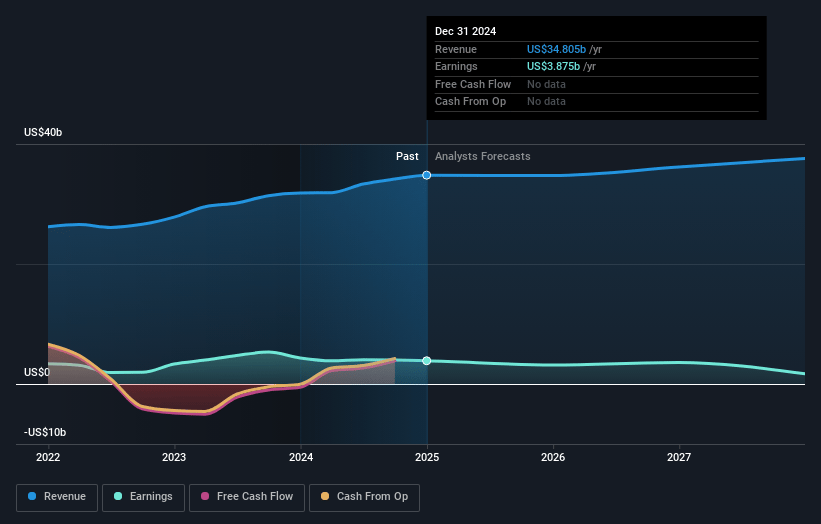

Fairfax Financial Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fairfax Financial Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fairfax Financial Holdings's revenue will grow by 4.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.2% today to 7.1% in 3 years time.

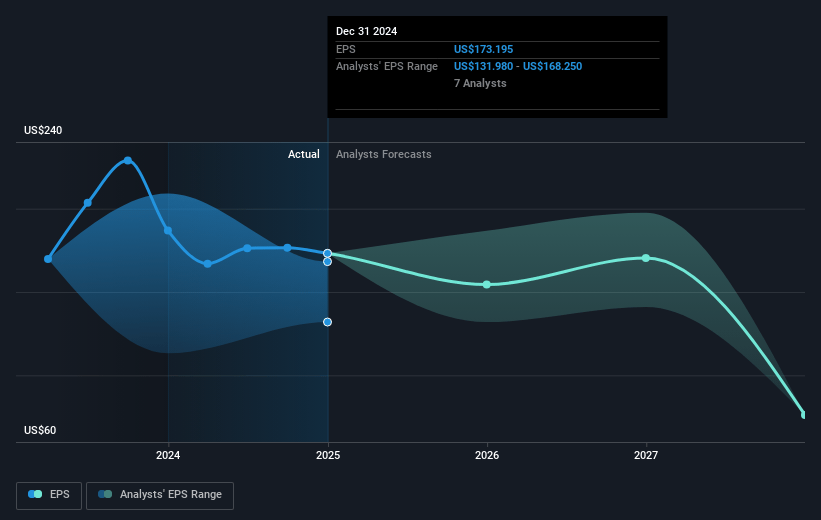

- The bearish analysts expect earnings to reach $3.0 billion (and earnings per share of $135.58) by about July 2028, down from $4.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, down from 9.4x today. This future PE is lower than the current PE for the CA Insurance industry at 15.0x.

- Analysts expect the number of shares outstanding to decline by 2.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.03%, as per the Simply Wall St company report.

Fairfax Financial Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite significant catastrophe losses such as the California wildfires, Fairfax's insurance and reinsurance operations demonstrated resilience by still posting underwriting profits, suggesting strong risk management and scale that can help protect and grow future net margins and earnings.

- Fairfax's global insurance business reported solid premium growth across most major operating segments, with international operations in underpenetrated and high-growth markets like Asia, Latin America, Africa, and Eastern Europe expected to provide a sizable, long-term revenue and earnings tailwind.

- The investment portfolio remains conservatively positioned, with a large allocation to safe, high-yielding government bonds, significant liquidity, and a disciplined value-oriented approach that has generated substantial realized and unrealized investment gains, indicating potential support for long-term book value and profitability.

- The company's decentralized structure and strong, experienced management teams, especially in its overseas operations, facilitate strong underwriting discipline and operational efficiency, which can drive sustainable improvements in combined ratios and net margins over the long run.

- A solid capital position evidenced by increasing book value per share, ample holding company cash, significant unrealized investment gains not yet reflected in book value, and active share repurchases point to Fairfax's ability to support shareholder value through capital returns and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fairfax Financial Holdings is CA$1590.3, which represents two standard deviations below the consensus price target of CA$2511.06. This valuation is based on what can be assumed as the expectations of Fairfax Financial Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$2907.8, and the most bearish reporting a price target of just CA$1523.96.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $41.8 billion, earnings will come to $3.0 billion, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$2448.07, the bearish analyst price target of CA$1590.3 is 53.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.