Key Takeaways

- Exposure to climate volatility, execution challenges, and policy risks threatens earnings stability, margin performance, and long-term revenue visibility.

- Industry competition, supply chain risks, and increased capital costs may compress returns and limit expansion opportunities within the renewable sector.

- Robust operational performance, diversified renewable portfolio, and strengthened financial position drive earnings momentum, reduced risk, and position the company for long-term growth in Brazil's energy market.

Catalysts

About Auren Energia- Engages in the planning, construction, installation, operation, and maintenance of renewable energy generation assets in Brazil.

- Rising global interest rates and tighter financial conditions could significantly increase Auren Energia's cost of capital, making both refinancing and funding for new renewable projects more expensive over the long-term. This would likely reduce future expansion capacity, compress returns on investment, and suppress earnings growth even as operational performance improves.

- The company's high dependency on hydroelectric assets, combined with mounting climate volatility and the recent record-low hydrological inflows, exposes Auren Energia to unpredictable and irregular generation volumes, leading to potential revenue disruption and increased earnings instability over time.

- Structural execution challenges in expanding wind and solar generation, such as persistent asset curtailment issues, delayed maintenance recoveries, and the need for significant turnaround CapEx-most notably in recently acquired assets like Mandacaru-could result in project delays, cost overruns, and deterioration of net margins.

- Political uncertainty and risk of unfavorable regulatory changes-including evolving government policies around curtailment compensation, PPAs, or renewable incentives-could reduce the long-term visibility and stability of revenues, eroding the company's ability to lock in high-margin contracts and undermining investor confidence in forward earnings.

- Intensifying competition from both domestic and global players in the Brazilian renewable sector, paired with rising distributed generation adoption and supply chain risks for key inputs such as turbines and solar panels, may lead to margin compression, loss of pricing power, and lower future returns on capital for Auren Energia as industry conditions become less favorable for scale players.

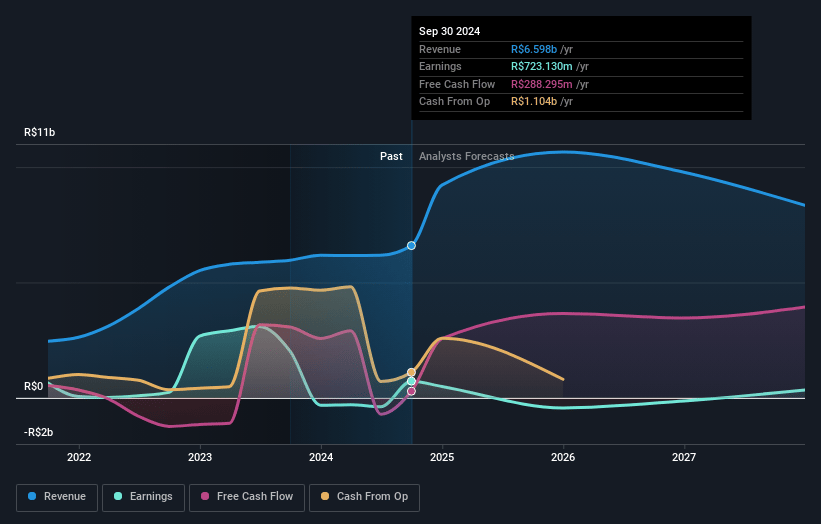

Auren Energia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Auren Energia compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Auren Energia's revenue will decrease by 9.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.1% today to 2.9% in 3 years time.

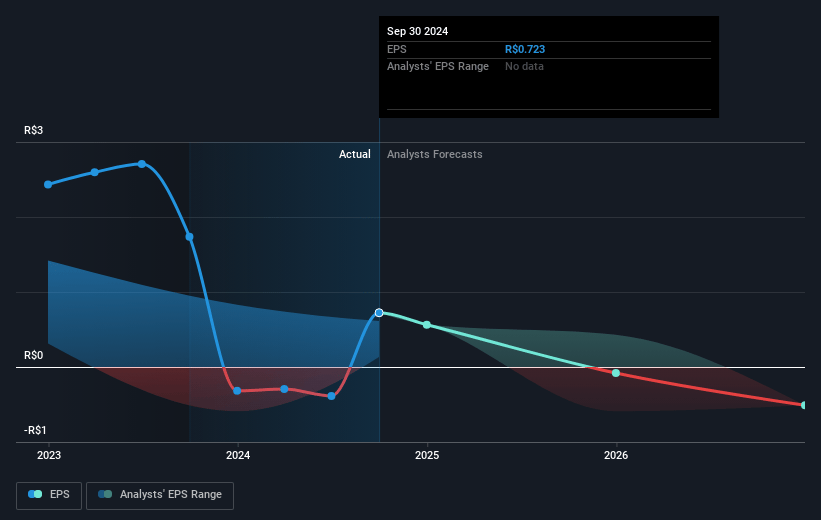

- The bearish analysts expect earnings to reach R$200.9 million (and earnings per share of R$0.19) by about July 2028, up from R$5.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 91.9x on those 2028 earnings, down from 1692.5x today. This future PE is greater than the current PE for the BR Renewable Energy industry at 54.7x.

- Analysts expect the number of shares outstanding to grow by 4.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.62%, as per the Simply Wall St company report.

Auren Energia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong and consistent growth in EBITDA, highlighted by a 66% year-over-year increase and record results in both the generation and trading segments, points to robust revenue and earnings momentum that could support share price appreciation over the long term.

- Rapid deleveraging and successful refinancing activities have lowered Auren Energia's net debt to EBITDA ratio, improved its capital structure, secured competitive long-term financing rates, and maintained investment grade credit ratings, which could result in lower financing costs and improved net margins.

- Operational improvements and high asset availability, with company-wide wind asset availability rising to over 90% and a goal of reaching 95% by year-end, demonstrate effective integration and turnaround of acquired assets, which can drive higher generation output and bolster recurring revenues.

- Diversification and geographic dispersion of the generation portfolio, including continued expansion in wind and solar alongside a strong hydro base, mitigate concentration and weather-related risks while positioning Auren Energia to capture upside from Brazil's growing electricity demand, supporting both top-line growth and earnings resilience.

- Advancements in regulatory discussions over curtailment and ongoing government and industry engagement may facilitate more favorable market conditions, reduce future lost generation, and improve sales visibility for renewables, thereby reducing market risk and enhancing long-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Auren Energia is R$8.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Auren Energia's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$13.5, and the most bearish reporting a price target of just R$8.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$7.0 billion, earnings will come to R$200.9 million, and it would be trading on a PE ratio of 91.9x, assuming you use a discount rate of 24.6%.

- Given the current share price of R$9.42, the bearish analyst price target of R$8.0 is 17.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.