Key Takeaways

- Accelerated synergy realization and operational improvements from recent acquisitions are driving significant gains in profitability and margin expansion.

- Enhanced renewable capacity, advanced trading, and regulatory tailwinds position the company for outsized growth in revenue, cash flow, and market leadership.

- High financial leverage, regulatory and operational risks, and market volatility threaten earnings growth, margin stability, and Auren Energia's future investment capacity.

Catalysts

About Auren Energia- Engages in the planning, construction, installation, operation, and maintenance of renewable energy generation assets in Brazil.

- Analyst consensus expects material synergy capture from the AES Brasil acquisition, but the strong pace of realized synergies-already R$56 million in the quarter with a clear run-rate towards R$250 million in annualized savings-suggests cost savings and operational improvements could far exceed initial forecasts, providing a step-change in EBITDA and net margin over the next 12-18 months.

- While the consensus narrative anticipates improved wind asset availability, the rapid and proactive turnaround-with some parks jumping from less than 80% to over 91% availability in a single year-signals a faster-than-expected recovery in renewable output, which could sharply increase revenues and structurally improve margin profiles ahead of 2025 guidance.

- The company's sophisticated trading capabilities, backed by a diversified portfolio and ability to anticipate regional price swings and regulatory changes, position it to capitalize disproportionately on energy market volatility and Brazil's growing electricity demand, driving outperformance in trading revenue and earnings resilience.

- As global decarbonization and electrification intensify, Auren's expanding renewable platform and pipeline of new projects, combined with its increasingly digitalized operations, place it at the forefront of market share gains as demand for clean power accelerates, providing long-term structural revenue growth and superior free cash flow generation.

- The ongoing regulatory push to modernize Brazil's grid and improve market flexibility, alongside mounting corporate ESG requirements, is likely to create tailwinds for long-term power purchase agreements at favorable rates, locking in high-margin, stable cash flows and reducing volatility in earnings over the next decade.

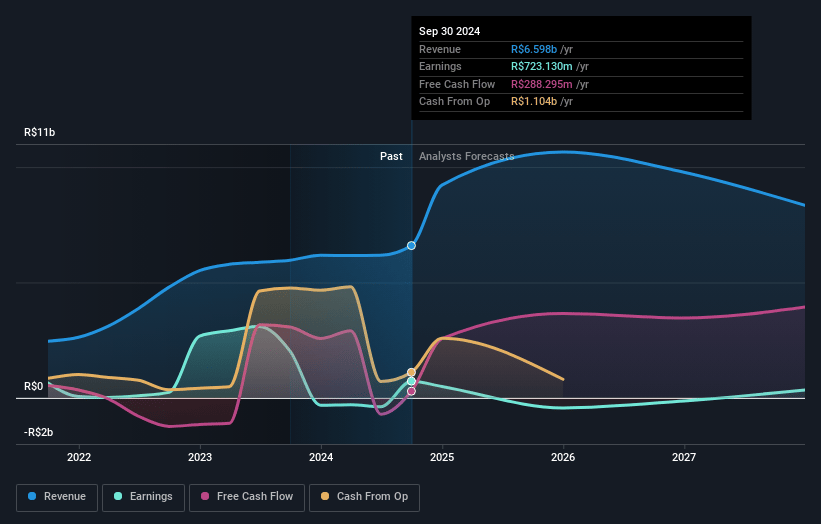

Auren Energia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Auren Energia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Auren Energia's revenue will grow by 1.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.1% today to 11.7% in 3 years time.

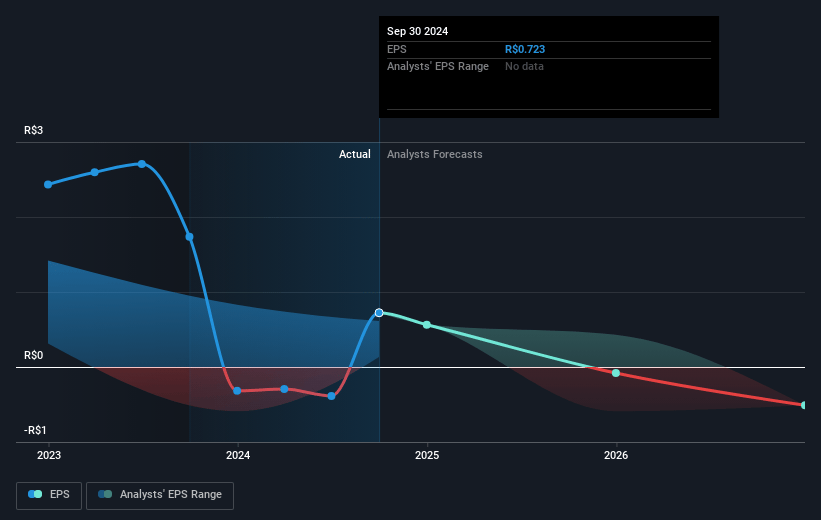

- The bullish analysts expect earnings to reach R$1.2 billion (and earnings per share of R$1.11) by about July 2028, up from R$5.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.5x on those 2028 earnings, down from 1615.3x today. This future PE is lower than the current PE for the BR Renewable Energy industry at 54.5x.

- Analysts expect the number of shares outstanding to grow by 4.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.7%, as per the Simply Wall St company report.

Auren Energia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high leverage and significant capex requirements, especially following the AES acquisition and the need for asset turnarounds in newly acquired wind farms such as Mandacaru, could limit Auren Energia's ability to pursue future growth projects and put pressure on both earnings expansion and the flexibility of its capital allocation.

- High exposure to curtailment in both wind and solar assets, and ongoing uncertainties regarding government reimbursement and market reclassification for curtailed energy, pose risks to revenue stability and could materially reduce net margins if unresolved.

- The company's concentration in Brazil makes Auren Energia vulnerable to local regulatory changes and currency volatility, heightening the risk of earnings swings and putting future net income under persistent pressure.

- The continued reliance on a portfolio with a large proportion of older hydroelectric assets increases exposure to operational deterioration, high maintenance costs, and potentially declining capacity factors, threatening margins and earnings stability over the long term.

- The risk of oversupply in renewables leading to increasingly volatile and depressed power prices-accentuated by regional price differences and cannibalization effects already noted in the Brazilian market-could diminish achievable revenues and compress profitability across the business.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Auren Energia is R$13.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Auren Energia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$13.5, and the most bearish reporting a price target of just R$8.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$10.1 billion, earnings will come to R$1.2 billion, and it would be trading on a PE ratio of 26.5x, assuming you use a discount rate of 24.7%.

- Given the current share price of R$8.99, the bullish analyst price target of R$13.5 is 33.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.