Key Takeaways

- Over-reliance on the Brazilian market and increased regulatory and integration risks may squeeze margins and create income volatility despite sector growth.

- Intensifying competition from global SaaS providers threatens Locaweb's efforts to expand its market share and sustain recurring revenue amid slowing core growth.

- Intensifying global competition, heavy dependence on Brazil, and slowing SaaS growth threaten Locaweb's profitability and market position amid ongoing price pressures and integration risks.

Catalysts

About Locaweb Serviços de Internet- Offers hosting, software licensing, and technical support services in Brazil.

- While Locaweb continues to benefit from accelerating digital transformation and a growing e-commerce sector in Brazil, its heavy reliance on the domestic market exposes it to ongoing local macroeconomic volatility and currency fluctuations, which could create unpredictable swings in reported revenue and net income despite secular tailwinds.

- Although integrated AI-driven tools in the Bling ERP and deepened journeys across payments and logistics may foster long-run cross-sell and customer retention-potentially supporting recurring revenue-competition from global SaaS and cloud vendors with more scalable infrastructure remains a threat to Locaweb's ability to capture and sustain a larger share of the expanding addressable market.

- Despite ongoing expansions into cloud-based and SaaS offerings that should raise net margins, slowing organic growth in the core Brazilian SME base suggests that customer acquisition costs could become elevated and revenue growth may be dampened as digitization penetration rises and the market approaches maturity.

- While management cites operational synergies from M&A and platform integration, the complexity of past acquisitions raises the risk that integration challenges or efficiency targets may not fully materialize, resulting in margin pressure and potential impairments that could limit earnings growth.

- Ongoing regulatory evolution around data privacy and cybersecurity enhances the value of trusted local providers, but compliance costs and operational complexity are expected to rise disproportionately for mid-sized firms like Locaweb, potentially eroding margin gains over time.

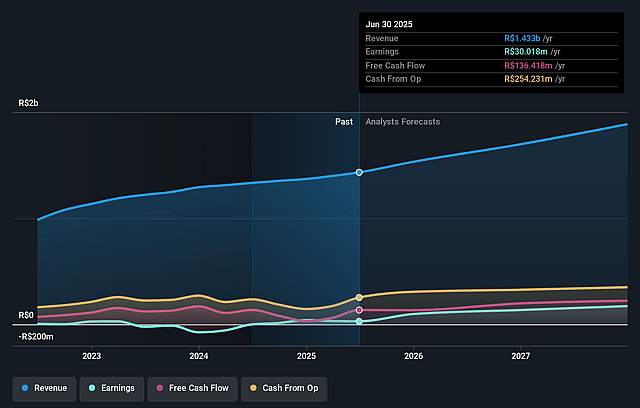

Locaweb Serviços de Internet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Locaweb Serviços de Internet compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Locaweb Serviços de Internet's revenue will grow by 11.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.3% today to 9.1% in 3 years time.

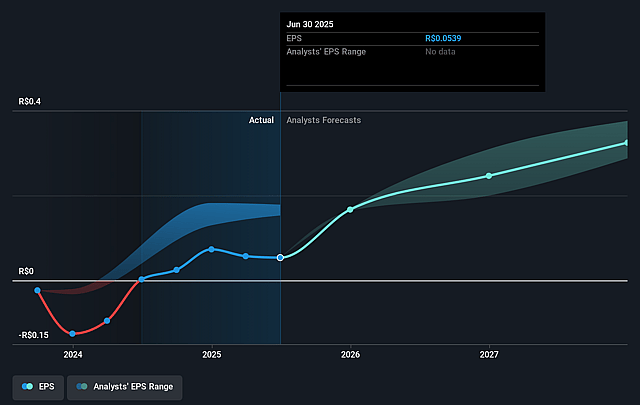

- The bearish analysts expect earnings to reach R$174.4 million (and earnings per share of R$0.35) by about August 2028, up from R$32.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 69.3x today. This future PE is lower than the current PE for the BR IT industry at 69.3x.

- Analysts expect the number of shares outstanding to decline by 1.53% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.25%, as per the Simply Wall St company report.

Locaweb Serviços de Internet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing dominance and aggressive expansion of global cloud and SaaS giants such as AWS, Google Cloud, and Microsoft Azure in Latin America could intensify price competition and customer attrition for Locaweb, putting long-term pressure on revenue growth and market share.

- Locaweb's business remains highly concentrated in Brazil and its performance is closely tied to local macroeconomic conditions and regulatory changes, making it vulnerable to economic volatility or unfavorable shifts in data privacy and payroll tax laws, which could lead to unpredictable swings in revenue and net income.

- Profitability improvements have recently relied on cost controls and M&A-driven synergies, but future integration challenges or inability to monetize acquired assets-particularly in blending brands and cultures-pose a risk of margin pressure and potential goodwill write-downs, ultimately affecting net margins and earnings.

- Organic growth in higher-margin SaaS segments appears to be plateauing, with BeOnline/SaaS revenue increasing by only 0.9% year-over-year, suggesting slower market expansion and potentially rising customer acquisition costs, which may limit long-term top-line growth and profitability.

- Persistent commoditization of core services like web hosting and basic digital products exposes Locaweb to ongoing price erosion and limits differentiation, likely resulting in margin compression and constraining future earnings growth if the company cannot continuously innovate or scale value-added offerings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Locaweb Serviços de Internet is R$4.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Locaweb Serviços de Internet's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$7.3, and the most bearish reporting a price target of just R$4.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$1.9 billion, earnings will come to R$174.4 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 21.2%.

- Given the current share price of R$4.08, the bearish analyst price target of R$4.1 is 0.5% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.