Key Takeaways

- Seamless integration of logistics, AI-driven ERP, and payments is fueling higher customer value and positioning Locaweb as a unified SME digital platform leader.

- Deep automation, M&A, and cloud infrastructure drive margin expansion, high recurring revenue, and solidify Locaweb's dominance in Brazil's digital and e-commerce markets.

- Mounting competition, rising compliance and input costs, and integration challenges threaten Locaweb's margins and growth as clients shift to more scalable global cloud solutions.

Catalysts

About Locaweb Serviços de Internet- Offers hosting, software licensing, and technical support services in Brazil.

- Analysts broadly agree that integrating payments and ERP systems will accelerate growth, but this may be understated-Locaweb's seamless blending of logistics, AI-driven ERP, and payments is creating a fully unified SME digital operating system, likely driving both step-change revenue per customer and sharp increases in average customer lifetime value well beyond consensus expectations.

- Analyst consensus highlights efficiency and margin improvement, but Locaweb's deep investments in automation, AI-driven recommendations, and process unification are setting the stage for margin expansion at a pace and scale that could drive accelerated EBITDA and free cash flow compounding, positioning net margins at a structurally higher level.

- The rise of Latin American SMEs digitalizing operations means Locaweb's subscription SaaS model-already showing strong subscriber and ARPU growth-will benefit from outsized, multi-year expansion of its addressable market, supporting sustained double-digit top-line growth and highly stable, recurring cash flows.

- Locaweb's dominant footprint in Brazil's e-commerce and cloud platforms through constant M&A, fully integrated logistics (such as Melhor Envio), and first-mover social platform partnerships (like TikTok Shop) positions the company to capture share from both legacy offline competitors and pure-play vertical platforms, catalyzing market share gains and driving robust revenue expansion.

- The company's operational scale, unified client segmentation, and product stickiness-backed by high switching costs and continued migration of workloads to scalable cloud infrastructure-will ultimately deliver significant fixed-cost leverage, further boosting earnings growth and positioning Locaweb as a clear consolidator in a fast-growing industry.

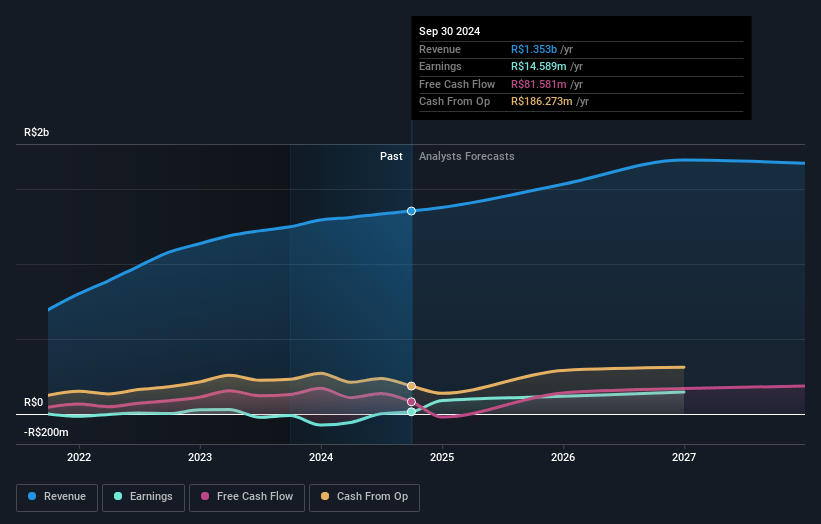

Locaweb Serviços de Internet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Locaweb Serviços de Internet compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Locaweb Serviços de Internet's revenue will grow by 13.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.3% today to 11.8% in 3 years time.

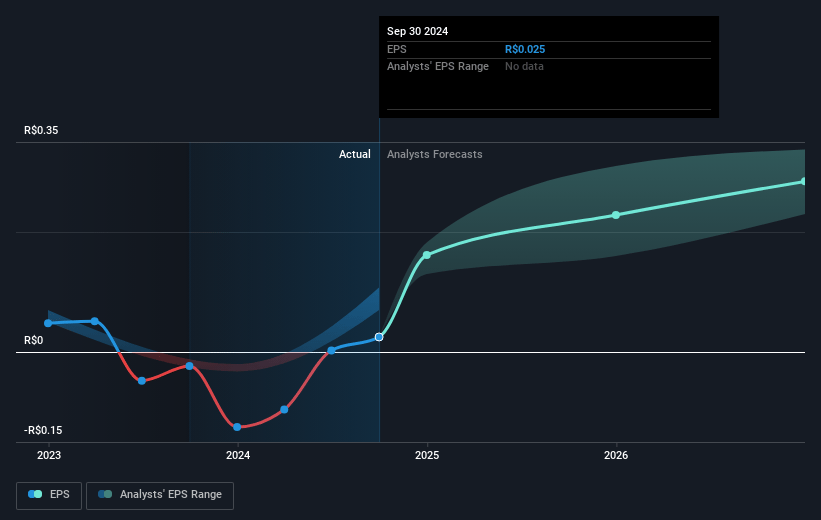

- The bullish analysts expect earnings to reach R$242.6 million (and earnings per share of R$0.44) by about July 2028, up from R$32.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.0x on those 2028 earnings, down from 70.9x today. This future PE is lower than the current PE for the BR IT industry at 70.9x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.42%, as per the Simply Wall St company report.

Locaweb Serviços de Internet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global market consolidation led by hyperscalers like AWS and Microsoft Azure puts Locaweb at risk of declining market share and pricing pressure in cloud infrastructure, which may weigh heavily on its long-term revenue growth trajectory.

- The company's core SaaS and legacy shared hosting segment grew only 0.9 percent year-over-year, reflecting stagnation as SMEs migrate to scalable public cloud and alternative solutions, potentially leading to sustained revenue and EBITDA margin erosion.

- Locaweb's strategy of integrating multiple acquired brands introduces operating inefficiencies and execution risk, which may dilute operational synergies, raise costs, and undermine net margin expansion if not carefully managed.

- Intensifying price competition from both global and local digital commerce and hosting players, coupled with a highly commoditized service landscape, will likely squeeze gross margins and put persistent pressure on net earnings.

- Ongoing increases in regulatory compliance costs due to evolving privacy laws, combined with FX-driven input cost inflation, pose a sustained threat to profitability-particularly as the company may struggle to fully pass these higher costs on to its primarily SME customer base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Locaweb Serviços de Internet is R$7.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Locaweb Serviços de Internet's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$7.3, and the most bearish reporting a price target of just R$4.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$2.1 billion, earnings will come to R$242.6 million, and it would be trading on a PE ratio of 31.0x, assuming you use a discount rate of 20.4%.

- Given the current share price of R$3.95, the bullish analyst price target of R$7.3 is 45.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives