Key Takeaways

- Expanding digital commerce and cloud services, combined with AI-driven efficiency, are strengthening recurring revenues and improving margins versus global competitors.

- Effective cross-selling, SaaS scaling, and disciplined cost management are driving higher revenue per customer, stronger free cash flow, and long-term earnings growth.

- Intensifying competition, integration uncertainty, macroeconomic exposure, and software commoditization threaten growth, margins, and long-term financial stability despite expansion and technology initiatives.

Catalysts

About Locaweb Serviços de Internet- Offers hosting, software licensing, and technical support services in Brazil.

- The rapid acceleration of digital commerce and ongoing digitization among SMEs in Brazil, as evidenced by Locaweb's strong e-commerce revenue growth and rising subscriber base, is expanding the company's addressable market and driving recurring revenue streams.

- The launch and commercialization of Locaweb's own cloud infrastructure-aimed at capturing share in Brazil's large and growing public cloud market-could unlock significant new revenue verticals and improve net margins by lowering internal costs and increasing competitiveness against global players.

- Deep integration of AI across both internal operations and customer-facing platforms is already boosting productivity (e.g., 80% productivity gain in code delivery, 50% reduction in customer service ticket resolution), leading to lower operating costs and supporting sustained improvement in net margins and cash generation.

- Strategic cross-selling and scaling of a robust SaaS portfolio with a focus on ARPU growth, enhanced by improved customer journeys and expanded feature offerings, positions Locaweb to further increase revenue per customer and strengthen long-term earnings power.

- Increasing operational leverage through continued cost discipline, automation, and streamlined organization-combined with prudent capital allocation (e.g., buybacks, dividends)-is driving stronger free cash flow and higher profitability, setting a foundation for future earnings growth.

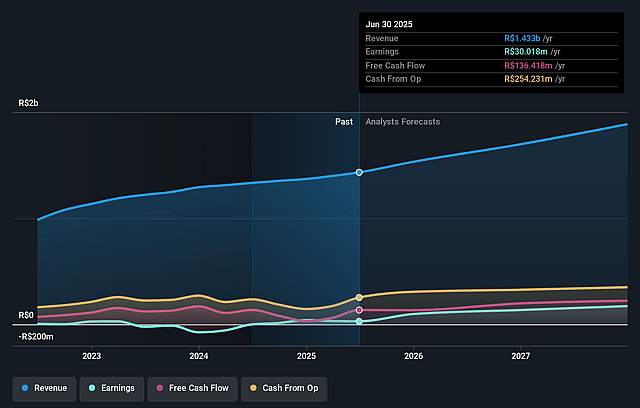

Locaweb Serviços de Internet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Locaweb Serviços de Internet's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 9.5% in 3 years time.

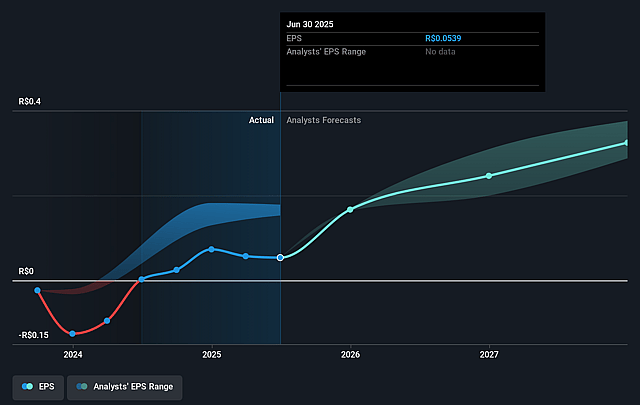

- Analysts expect earnings to reach R$189.1 million (and earnings per share of R$0.31) by about September 2028, up from R$30.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$145 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.9x on those 2028 earnings, down from 74.4x today. This future PE is lower than the current PE for the BR IT industry at 74.4x.

- Analysts expect the number of shares outstanding to decline by 1.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.26%, as per the Simply Wall St company report.

Locaweb Serviços de Internet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's aggressive push into Brazil's public cloud market enters a $3.5 billion segment dominated by global hyperscalers (e.g., AWS, Google Cloud, Microsoft Azure), raising significant concerns about Locaweb's long-term market share, pricing power, and the potential for compressed margins and stagnant revenue growth if it fails to effectively compete at scale.

- Management indicates expansion plans and deeper integration of financial and credit services, but also admits the structure is not yet in place and that success will depend on ability to accurately assess risk and integrate offerings-if execution falters, this could increase credit risk and provisioning costs, negatively impacting net earnings and margins.

- Locaweb's business remains highly concentrated in Brazil, making its cash generation and revenue exposed to local macroeconomic cycles, consumer spending slowdowns, inflation, and currency volatility-which can result in unpredictable earnings and reduced cash flow available for reinvestment or shareholder returns.

- Ongoing announcements of synergies and cost leverage from past M&A activity carry persistent integration risks; management alludes to recent completion of earnouts, continued efforts to monetize large customer bases, and streamlining contracts, but failure to realize full operational synergies may cap margin expansion and elevate operating expenses over the long term.

- Although management emphasizes AI-powered productivity gains and customer service automation, the AI-driven SaaS and cloud segments face secular trends of software commoditization and free or open-source alternatives, which risk increasing customer churn, limiting ARPU growth, and ultimately pressuring both Locaweb's revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$5.5 for Locaweb Serviços de Internet based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$7.5, and the most bearish reporting a price target of just R$4.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$2.0 billion, earnings will come to R$189.1 million, and it would be trading on a PE ratio of 26.9x, assuming you use a discount rate of 21.3%.

- Given the current share price of R$4.07, the analyst price target of R$5.5 is 26.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.