Key Takeaways

- Rapid international expansion, scalable digital services, and strong cross-sector wins position Bemobi for outsized recurring revenue growth and margin expansion in emerging markets.

- Dominance in microfinance, proprietary technology, and network effects could make Bemobi a default digital transformation partner, driving long-term earnings and lower customer churn.

- Regulatory pressures, shifting consumer behaviors, and dependence on telecom partnerships threaten Bemobi's growth prospects, margins, and the sustainability of its core business models.

Catalysts

About Bemobi Mobile Tech- A technology company, offers solutions and mobile platforms for digital payments, customer engagement, microfinance, and digital services in Brazil and internationally.

- Analyst consensus highlights international expansion as a key driver, but this may vastly understate Bemobi's global earnings potential-the speed and low cost of launching digital services in new geographies, especially with local senior teams already in place, indicates the company could unlock exponential revenue growth and operating leverage as emerging markets accelerate smartphone/web adoption.

- While analysts expect Payments and SaaS to rise to 70-80% of revenue, the accelerating success in acquiring dominant clients across telecom, utilities, and especially the fast-growing education sector suggests Bemobi could surpass even optimistic projections for segment mix and margins, leading to sustained EBITDA margin expansion and cash generation.

- With proprietary technology, robust data analytics, and proven cross-vertical execution, Bemobi is exceptionally well-positioned to capture the shift from traditional services to mobile apps, opening up premium pricing, higher ARPU, and further recurring revenue growth, directly benefiting revenue and net margins.

- The company's success in scaling turnkey, vertical-specific solutions-demonstrated by recent wins in multiple education and utility segments-creates a strong network effect, positioning Bemobi as the default partner for digital transformation in additional sectors such as insurance and healthcare, which could rapidly lift long-term earnings and reduce churn.

- Few investors appear to appreciate the full upside from rapidly growing digital microfinance and microcredit businesses in underbanked markets, which, coupled with advanced payment and scoring products, puts Bemobi at the center of financial inclusion megatrends, with the potential for double-digit revenue growth and superior margin expansion once scale is achieved.

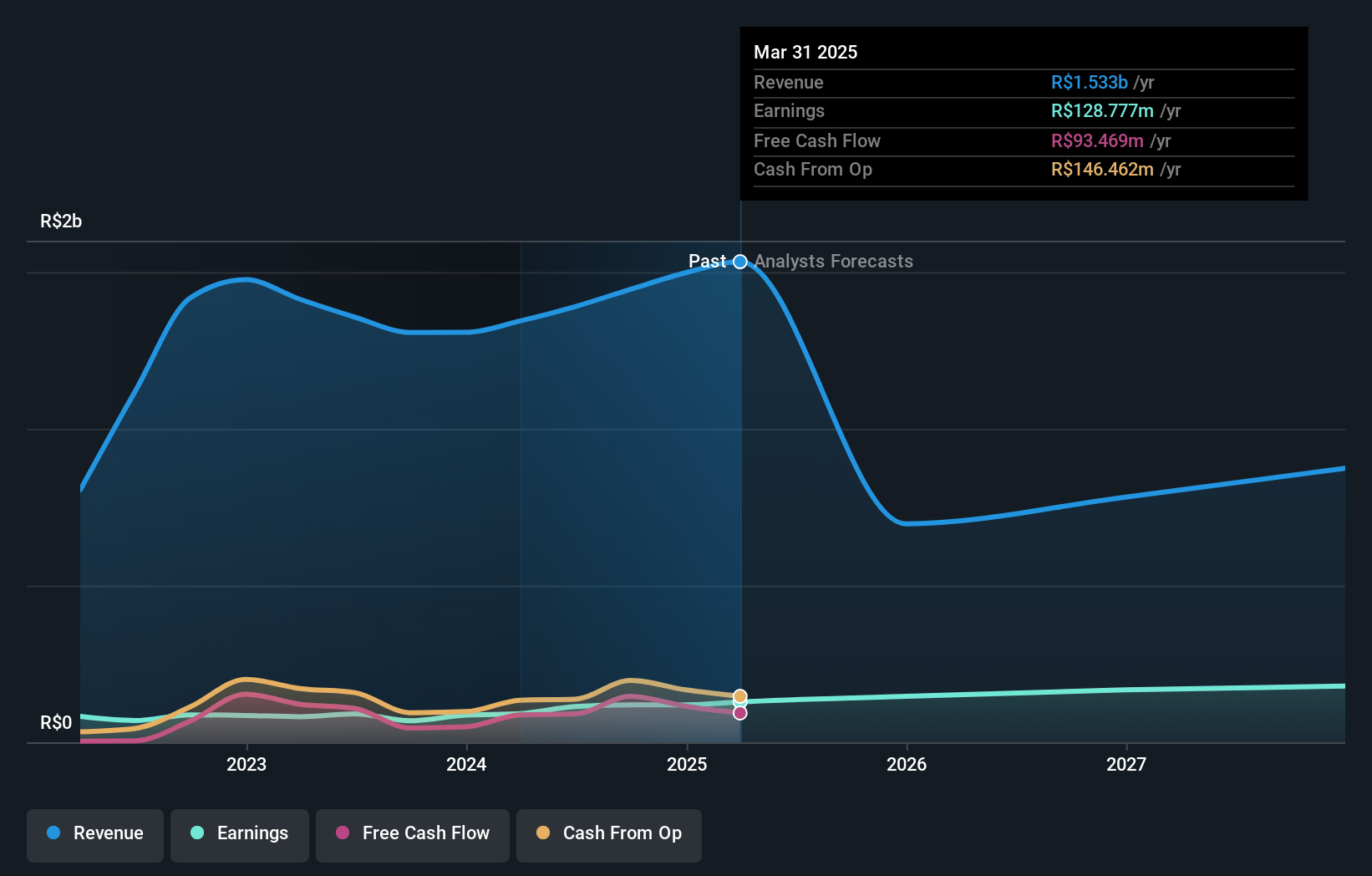

Bemobi Mobile Tech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bemobi Mobile Tech compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bemobi Mobile Tech's revenue will decrease by 18.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.4% today to 24.0% in 3 years time.

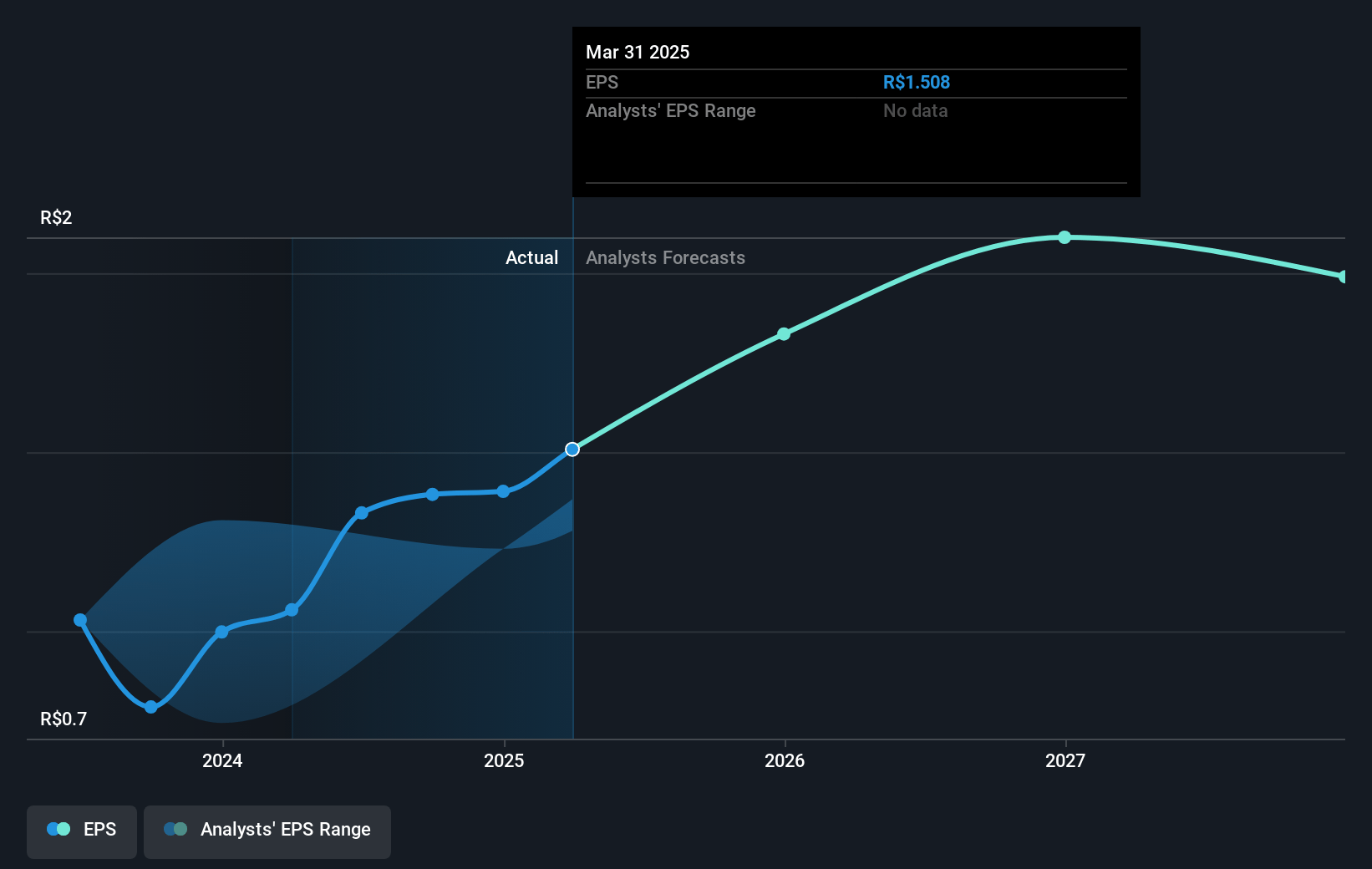

- The bullish analysts expect earnings to reach R$199.4 million (and earnings per share of R$2.09) by about July 2028, up from R$128.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 14.0x today. This future PE is greater than the current PE for the BR Entertainment industry at 14.0x.

- Analysts expect the number of shares outstanding to decline by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.93%, as per the Simply Wall St company report.

Bemobi Mobile Tech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising regulatory scrutiny around data privacy and digital services in both existing and expansion markets could restrict Bemobi's data-driven monetization models and add compliance costs, posing long-term risks to revenue growth and net margins.

- As global consumer adoption of ad-blockers and growing resistance to digital advertising accelerates, Bemobi's advertisement and subscription-driven businesses may see reduced conversion rates and declining effectiveness, ultimately squeezing revenues and profitability.

- Intensifying competition, especially as Bemobi expands into international telecom and payments markets, along with increasing customer acquisition and integration costs, could erode gross margins and dampen net earnings over the long term.

- Heavy reliance on revenue-sharing and carrier billing partnerships, particularly with telecom operators that may seek to renegotiate terms in their own favor or integrate similar in-house solutions, threatens Bemobi's top-line revenue and places ongoing pressure on gross margins.

- Changing consumer preferences away from packaged or curated mobile content and subscription models, along with increasing dominance of large ecosystem players embedding value-added services directly in operating systems, could undermine demand for Bemobi's offerings and reduce both revenue and recurring earnings streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bemobi Mobile Tech is R$26.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bemobi Mobile Tech's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$26.0, and the most bearish reporting a price target of just R$18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$829.4 million, earnings will come to R$199.4 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 20.9%.

- Given the current share price of R$21.34, the bullish analyst price target of R$26.0 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.