Key Takeaways

- Slowing smartphone adoption and data privacy regulations are expected to constrain user growth, revenue potential, and increase compliance costs for Bemobi.

- Platform consolidation and the shift away from carrier billing expose Bemobi to margin pressures, intensified competition, and diminishing long-term profitability.

- International expansion, strong payments and SaaS growth, diverse enterprise relationships, and disciplined capital management position Bemobi for sustained profitability and resilient recurring revenue.

Catalysts

About Bemobi Mobile Tech- A technology company, offers solutions and mobile platforms for digital payments, customer engagement, microfinance, and digital services in Brazil and internationally.

- Bemobi's addressable user base is likely to face headwinds from an expected slowdown in smartphone adoption across emerging markets and increasing mobile penetration saturation, restricting natural user growth and creating a ceiling on the company's long-term top-line expansion.

- The rapid acceleration of global data privacy and consent regulations is anticipated to limit Bemobi's ability to scale its subscription-based and digital content services internationally, increasing compliance costs and curtailing both revenue growth and net margins over time.

- As dominant ecosystem players like Google, Apple, and Meta continue to consolidate mobile platforms and tighten control over payments and subscriptions, Bemobi faces the structural risk of being increasingly shut out from direct user access, further squeezing margins and reducing market share.

- A continued reliance on carrier billing as a core revenue driver risks rapid obsolescence, given the rise of alternative digital payment options and the waning relevance of telco-centric billing, potentially leading to sharp drops in ARPU and long-term earnings deterioration.

- The commoditization of mobile value-added services and proliferation of low-cost competitors is forecast to trigger fierce price wars, ongoing margin compression and shrinking EBITDA margins across the industry, directly impacting Bemobi's profitability and dampening future cash generation.

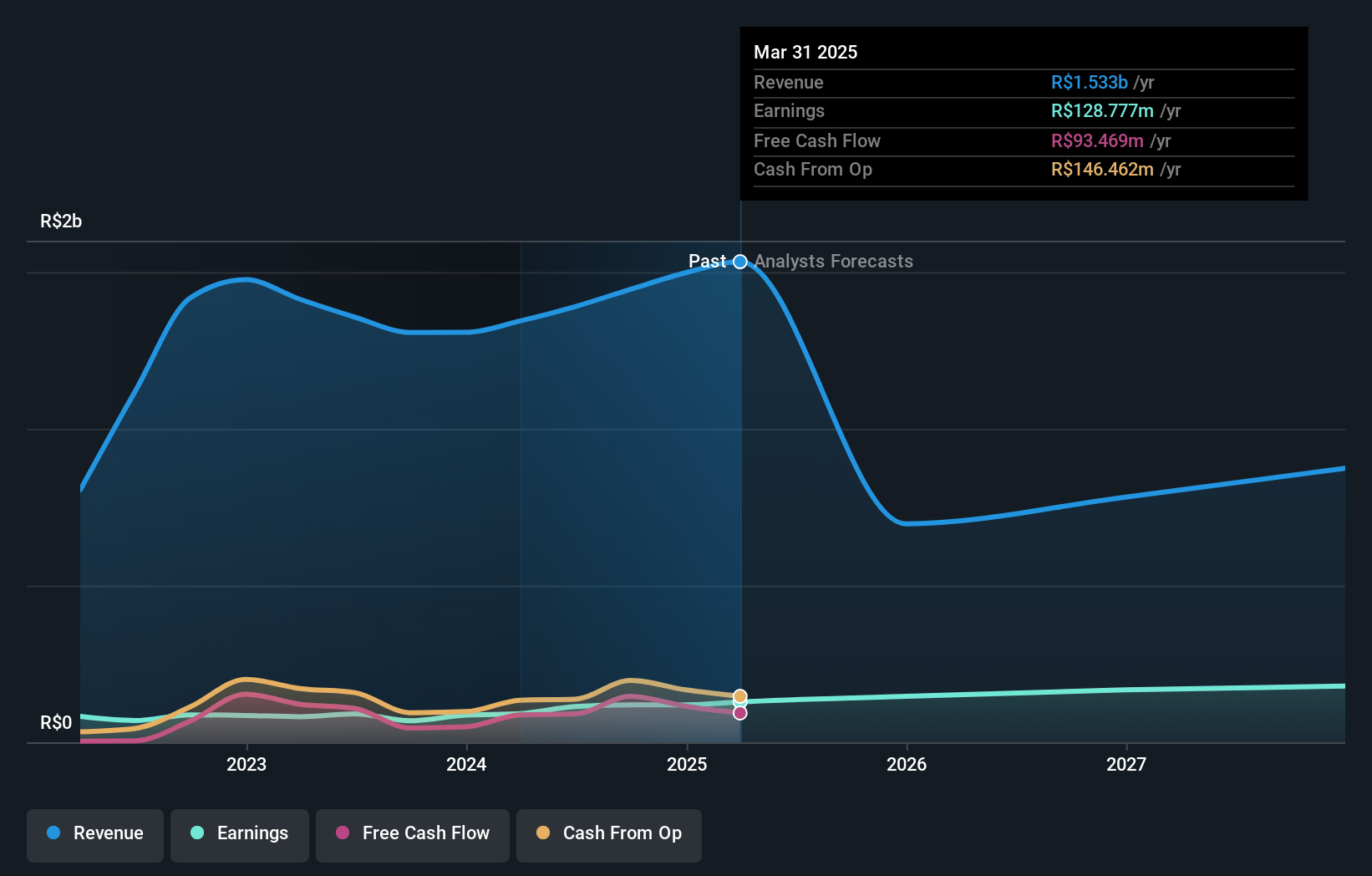

Bemobi Mobile Tech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bemobi Mobile Tech compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bemobi Mobile Tech's revenue will decrease by 18.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.4% today to 21.8% in 3 years time.

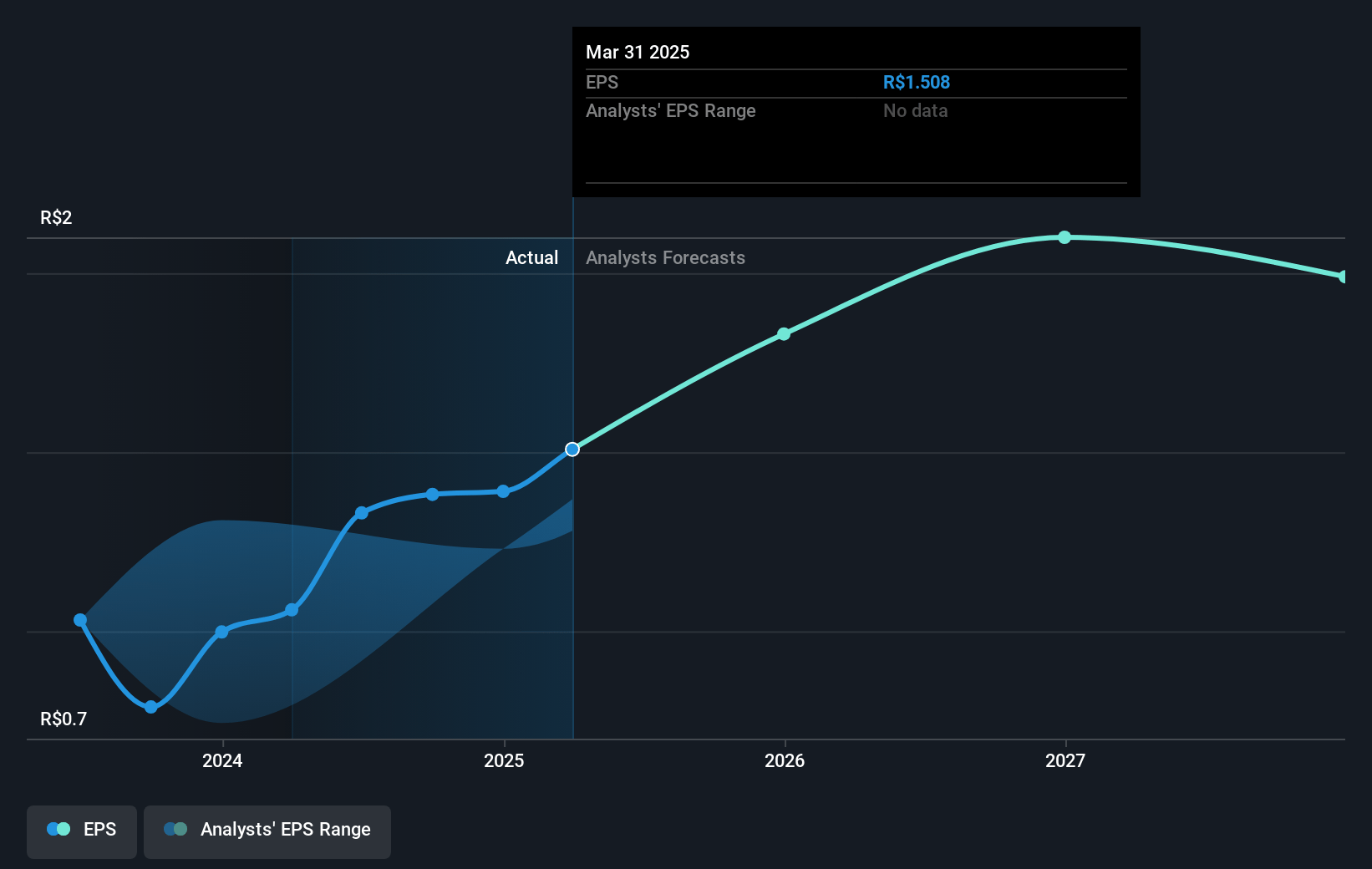

- The bearish analysts expect earnings to reach R$181.0 million (and earnings per share of R$2.09) by about July 2028, up from R$128.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.1x on those 2028 earnings, up from 14.0x today. This future PE is greater than the current PE for the BR Entertainment industry at 14.0x.

- Analysts expect the number of shares outstanding to decline by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.93%, as per the Simply Wall St company report.

Bemobi Mobile Tech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing international expansion, with successful launches in new markets like Chile, Colombia, Mexico, and the Czech Republic, significantly increases Bemobi's total addressable market and offers potential for accelerated revenue growth as these economies of scale mature.

- Rapid growth in the Payments and SaaS segments, which together now account for about 60 percent of company revenue and are projected to rise further, provide Bemobi with operating leverage and margin expansion that support improved earnings and profitability over the long term.

- Robust year-over-year increases in total payment volume, SaaS business, and revenues despite currency effects point to secular trends of rising digital payment adoption and subscription-based services, enabling sustained top-line and bottom-line improvements.

- Entrenched relationships with large enterprise customers in diverse sectors, including telecom, utilities, and especially education, coupled with entry into new verticals like higher education, strengthen Bemobi's revenue resilience and create avenues for recurring, high-quality income streams.

- Strong operating cash flow, elevated EBITDA margins, and an active, disciplined M&A strategy widen the company's growth platform, while ongoing high dividend payouts and share buybacks may signal management's confidence in maintaining or increasing net income and delivering shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bemobi Mobile Tech is R$18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bemobi Mobile Tech's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$26.0, and the most bearish reporting a price target of just R$18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$829.4 million, earnings will come to R$181.0 million, and it would be trading on a PE ratio of 14.1x, assuming you use a discount rate of 20.9%.

- Given the current share price of R$21.34, the bearish analyst price target of R$18.0 is 18.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.