Key Takeaways

- Strong innovation in value-added and convenience foods, plus international expansion, positions BRF for outsized growth and margin gains versus global peers.

- Operational agility and balance sheet strength enable sustainable outperformance, resiliency to shocks, and leadership in higher-demand export markets.

- BRF faces long-term risks from shifting protein preferences, sustainability pressures, trade barriers, disease outbreaks, and volatile costs undermining margins and operational stability.

Catalysts

About BRF- BRF S.A. raises, produces, and slaughters poultry and pork for processing, production, and sale of fresh meat, processed products, pasta, margarine, pet food, and other products.

- Analyst consensus expects steady revenue and margin improvement from value-added products, but current evidence of record-setting processed product volume growth in Brazil and accelerated store penetration point toward an even steeper trajectory for both top-line and operating margins as consumer trends further embrace convenience foods.

- While analysts broadly cite international expansion and the halal segment as future earnings drivers, BRF's direct investments (e.g., Addoha Poultry in Saudi Arabia and rapid new export permit awards) position it not only for growth, but for first-mover advantage and premium pricing in high-growth regions, suggesting above-peer revenue acceleration and EBITDA expansion.

- The company's learned agility in managing biosecurity crises, combined with unmatched contingency planning and a multi-year track record of fast market recovery and product reallocation, provides structural resilience that should unlock higher sustainable margins, even amidst future sanitary or geopolitical volatility.

- BRF's rapid deleveraging to a record-low 0.43 times trailing EBITDA and strong free cash flow generation set the stage for future shareholder returns, accelerated reinvestment in automation and production, and the financial firepower to outcompete or acquire in industry consolidation waves, all directly supporting long-term EPS growth.

- As the middle class expands in Asia and Africa, BRF is uniquely poised to capture outsized export demand for poultry and processed foods due to its deep brand equity and extensive export infrastructure, translating long-term demographic shifts into sustained volume and price leadership versus the global peer group, driving compounding revenue and profit growth over the next decade.

BRF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on BRF compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

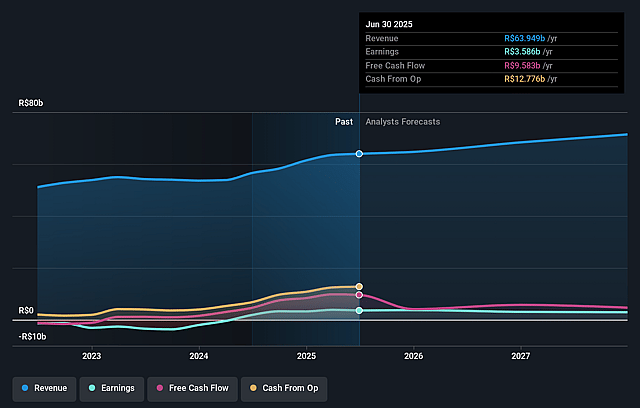

- The bullish analysts are assuming BRF's revenue will grow by 5.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 5.6% today to 3.7% in 3 years time.

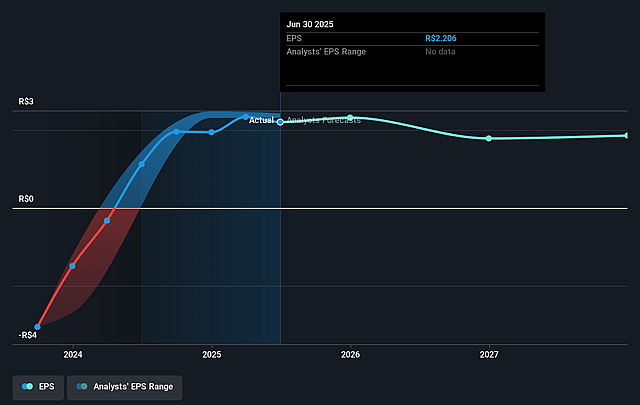

- The bullish analysts expect earnings to reach R$2.8 billion (and earnings per share of R$1.74) by about September 2028, down from R$3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.7x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the US Food industry at 12.5x.

- Analysts expect the number of shares outstanding to decline by 2.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.8%, as per the Simply Wall St company report.

BRF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Acceleration in global consumer adoption of plant-based and alternative proteins is a secular trend that threatens to structurally erode demand for BRF's core animal protein products, which could place downward pressure on the company's revenue over the long term.

- Growing regulatory and consumer focus on sustainability, particularly on reducing carbon footprints and environmental impacts, may create additional compliance obligations and reduce meat consumption preferences, leading to higher costs and shrinking net margins at BRF as new regulations roll out.

- Rising geopolitical risks and protectionist measures, such as trade barriers in key export markets like China and Europe-which remain closed to BRF's poultry after avian flu outbreaks-highlight the vulnerability of export-driven revenue, with the risk of margin compression or lost market share if such closures persist or intensify.

- Persistent industry exposure to recurring animal disease outbreaks, like avian influenza, increases the risk of operational shutdowns, inventory build-ups, and costly contingency plans, which together can disrupt operational continuity and result in lower earnings and inventory write-downs.

- Despite reductions in leverage reported this quarter, BRF's history of high indebtedness and exposure to volatile commodity (grain and feed) prices still leaves it vulnerable to interest expense spikes and margin erosion, particularly if cost reductions from favorable grain prices do not materialize or reverse, thereby threatening long-term net income stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for BRF is R$34.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BRF's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$34.0, and the most bearish reporting a price target of just R$18.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$75.9 billion, earnings will come to R$2.8 billion, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 17.8%.

- Given the current share price of R$19.69, the bullish analyst price target of R$34.0 is 42.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.