Key Takeaways

- BRF faces supply and revenue risks from climate volatility, disease outbreaks, changing dietary trends, and regulatory shifts impacting traditional protein demand.

- Expansion into new markets and value-added products supports profitability, but heightened geopolitical, compliance, and ESG risks may pressure future margins and growth.

- Export disruptions, competitive pressures, currency volatility, and rising domestic costs threaten revenue growth, profitability, and margin stability amid ongoing industry and geopolitical uncertainties.

Catalysts

About BRF- BRF S.A. raises, produces, and slaughters poultry and pork for processing, production, and sale of fresh meat, processed products, pasta, margarine, pet food, and other products.

- While BRF continues to benefit from growing global protein demand in emerging markets and the rising middle class shifting toward animal-based and convenience foods, persistent risks from intensified climate volatility and potential new outbreaks of animal disease (such as avian flu) still threaten supply stability, which could create unpredictable input costs and intermittent disruptions that pressure future operating margins and earnings growth.

- Although the company's expansion of value-added and branded product lines is supporting margin gains and improved profitability, the accelerating adoption of plant-based alternatives and international shifts in dietary preferences could erode long-term demand for traditional animal proteins and pressure revenue, especially if BRF is slow to adapt its portfolio.

- While BRF's operational efficiency initiatives, debt reduction, and improved logistics have brought leverage to historic lows and strengthened its balance sheet, ongoing high leverage and interest expense risk remain if the company cannot sustain cost reductions amid cyclical commodity price increases or faces unforeseen shocks, potentially curbing future net earnings and investment capacity.

- Although BRF is making strong inroads into new export markets (including halal and Asia) and achieving greater market share, this increases exposure to geopolitical risk, currency volatility, and heightened international regulatory scrutiny, which could negatively impact revenue consistency and long-term earnings visibility.

- Despite management's success in capitalizing on scale and market consolidation advantages, emerging environmental regulations and a shifting consumer focus on ESG compliance could drive up operational and compliance costs, and any failure to maintain or enhance BRF's ESG leadership may limit access to premium markets and capital, ultimately constraining long-term valuation and profitability.

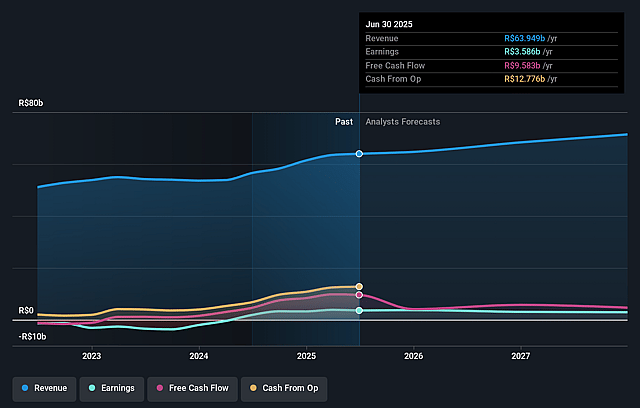

BRF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on BRF compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming BRF's revenue will grow by 4.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.6% today to 3.6% in 3 years time.

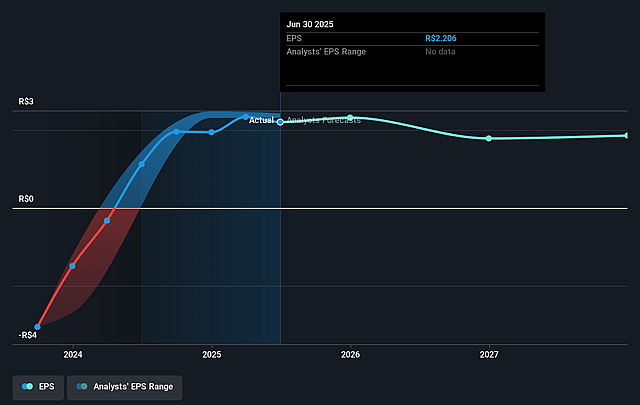

- The bearish analysts expect earnings to reach R$2.6 billion (and earnings per share of R$0.89) by about August 2028, down from R$3.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, up from 8.9x today. This future PE is greater than the current PE for the US Food industry at 10.2x.

- Analysts expect the number of shares outstanding to decline by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.8%, as per the Simply Wall St company report.

BRF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Recurring risks from avian influenza and other animal health outbreaks continue to disrupt exports, as seen with ongoing market closures in China and Europe, which introduces long-term uncertainty for revenue growth and margin stability in export markets.

- Heavy reliance on export market diversification exposes BRF to foreign exchange volatility and geopolitical risks, especially as key destinations like China and Turkey remain vulnerable to both sanitary restrictions and economic instability, potentially depressing net earnings.

- Intense competition in protein supply, including local supply surges in regions such as Turkey and lower disposable incomes, places continued downward pressure on selling prices and profitability, as evidenced by the negative EBITDA margin in Banvit for the quarter, which could impact group net margins over time.

- Long-term inflationary pressures on labor costs in Brazil, compounded by full domestic employment, may drive operating costs higher and outpace the anticipated benefits of operational efficiency programs, negatively affecting operating margins.

- Elevated industry inventory levels resulting from export restrictions require careful management to avoid value destruction, and prolonged closure of major export markets could force product liquidation or price discounts, directly reducing revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for BRF is R$22.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BRF's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$34.0, and the most bearish reporting a price target of just R$22.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$72.3 billion, earnings will come to R$2.6 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 17.8%.

- Given the current share price of R$19.93, the bearish analyst price target of R$22.0 is 9.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on BRF?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.