Key Takeaways

- Strategic export expansion, product premiumization, and market diversification are driving stable revenue growth and reducing earnings volatility.

- Operational efficiency gains and improved financial flexibility are strengthening margins and enabling reinvestment for sustainable long-term growth.

- Disease risks, shifting consumer preferences, global competition, volatile input costs, and trade policy exposure collectively threaten BRF's margins, revenue stability, and long-term profitability.

Catalysts

About BRF- BRF S.A. raises, produces, and slaughters poultry and pork for processing, production, and sale of fresh meat, processed products, pasta, margarine, pet food, and other products.

- Rapid expansion of export authorizations (198 new licenses since 2022) and market diversification are enabling BRF to quickly redirect volumes despite external shocks (e.g., avian flu), positioning the company to capture future export growth as global demand for affordable protein increases-likely supporting top-line revenue and reducing cyclicality.

- Continued investment in and launch of value-added, branded, and processed foods (including new product lines in ready-to-eat, snack, and Halal segments) is driving premiumization and higher-margin sales, which should lift overall net margins and support scalable long-term earnings growth.

- Geographic and segment diversification-especially expansion in Halal, Middle Eastern, and Asian markets-reduces revenue volatility, taps into secular demographic/dietary tailwinds, and enhances top-line growth potential as emerging market demand for animal protein steadily rises.

- Improving operational efficiency through digitalization, the BRF+ program, supply chain enhancements, and asset utilization gains is structurally lowering costs (e.g., animal feed input cost reduction), which supports further EBITDA margin expansion and sustainable net income growth.

- The lowest leverage in BRF's history (0.43x LTM EBITDA) has restored financial flexibility, minimizing risk from prior high debt levels and enabling reinvestment in innovation, capacity, and global market penetration-creating a stronger foundation for sustained long-term earnings and value creation.

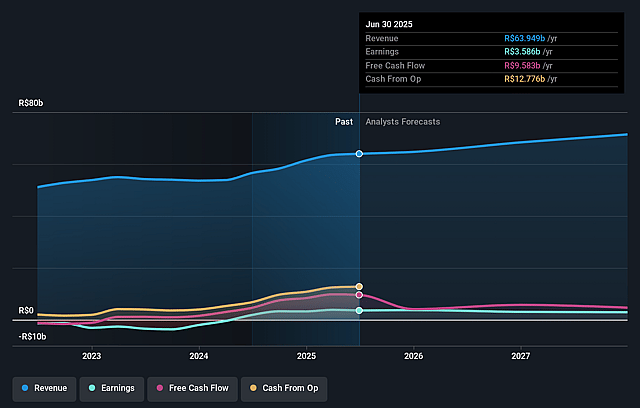

BRF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BRF's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.6% today to 3.7% in 3 years time.

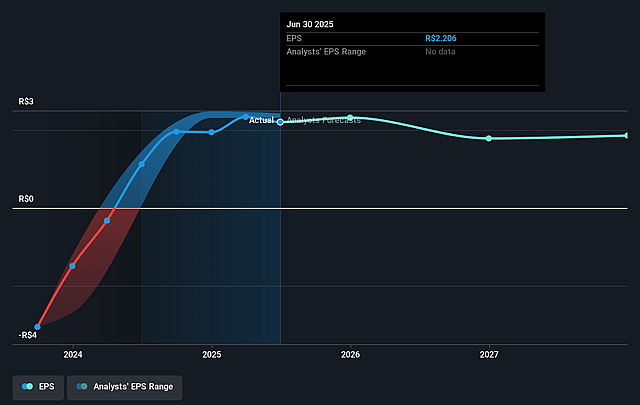

- Analysts expect earnings to reach R$2.7 billion (and earnings per share of R$1.86) by about September 2028, down from R$3.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.3x on those 2028 earnings, up from 8.9x today. This future PE is greater than the current PE for the US Food industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 2.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.8%, as per the Simply Wall St company report.

BRF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent biosecurity and disease risks (e.g., avian influenza and Newcastle disease) continue to restrict exports to key high-value markets such as China and Europe-management indicates that mitigation has improved, but these risks remain and are increasingly frequent globally, potentially disrupting revenue and pressuring margins with difficult-to-offset volume or price downgrades.

- Structural global trends toward plant-based and alternative proteins could gradually erode demand for BRF's core animal protein products; while current volume growth is strong, long-term shifts in consumer preferences and ESG-driven regulatory changes may constrain revenue and compress net margins.

- Food industry cyclicality and rising global competition, including market consolidation and increasing value-added product offerings by both domestic and international players, could intensify price pressures and squeeze BRF's margins, particularly if BRF's operational or product innovation lags behind its peers.

- Exposure to commodity cost volatility remains a risk; although recent periods saw cost benefits from lower grain prices, future climate-related supply shocks (like droughts or disease outbreaks impacting feed supply) and persistent wage inflation could result in unpredictable COGS increases, impacting net income and free cash flow.

- Continued dependence on market access and international trade policy exposes BRF to potential upswings in tariffs, quotas, or export restrictions, particularly in volatile or politically sensitive regions (e.g., Middle East, China, and Turkey), risking sudden disruptions in revenue streams and forcing price or product mix adjustments detrimental to profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$27.05 for BRF based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$34.0, and the most bearish reporting a price target of just R$18.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$73.4 billion, earnings will come to R$2.7 billion, and it would be trading on a PE ratio of 24.3x, assuming you use a discount rate of 17.8%.

- Given the current share price of R$19.9, the analyst price target of R$27.05 is 26.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.