Key Takeaways

- Deeper automation, cross-asset integration, and rapid synergy capture could unlock considerably higher margins and cash flow than current market forecasts suggest.

- Strategic retail rollouts, digital innovation, and market consolidation position Ultrapar to gain market share, drive revenue growth, and exceed consensus performance expectations.

- Heavy reliance on fossil fuel distribution and limited diversification expose Ultrapar to regulatory, environmental, and competitive risks that threaten long-term profitability and margin stability.

Catalysts

About Ultrapar Participações- Through its subsidiaries, operates in the energy and infrastructure business in Brazil.

- Analysts broadly agree that operational efficiency initiatives and new governance structures will enhance margins, but this view may understate the upside; accelerated automation, deeper ERP integration, and leveraging Ultrapar's shared services across new assets like Hidrovias could drive a step-change in expense reduction and unlock significantly higher net margins than expected.

- While the consensus sees capital investments and the Hidrovias acquisition as supporting long-term growth, the full earnings potential is likely underestimated; Ultrapar's decisive majority control enables rapid integration, near-term synergy capture, and cross-asset strategic focus, potentially multiplying recurring EBITDA and generating outsized free cash flow beyond analyst forecasts.

- The company is positioned to aggressively capitalize on urbanization and Brazil's growing middle class by accelerating the rollout of new, higher-value convenience retail formats and branded partnerships at Ipiranga, unlocking substantial same-store sales and top-line revenue growth as market penetration deepens.

- A robust pipeline of digital and data-driven innovations-including advanced loyalty programs, dynamic pricing, and payment solutions-will personalize experiences, reduce churn, and drive a sustained increase in customer lifetime value, directly enhancing both revenue and EBITDA margins across all retail segments.

- Industry consolidation and regulatory reforms are poised to trigger a wave of smaller competitor exits, enabling Ultrapar to rapidly gain market share in fuel and LPG distribution at better pricing, materially boosting volume growth and supporting margin expansion ahead of industry expectations.

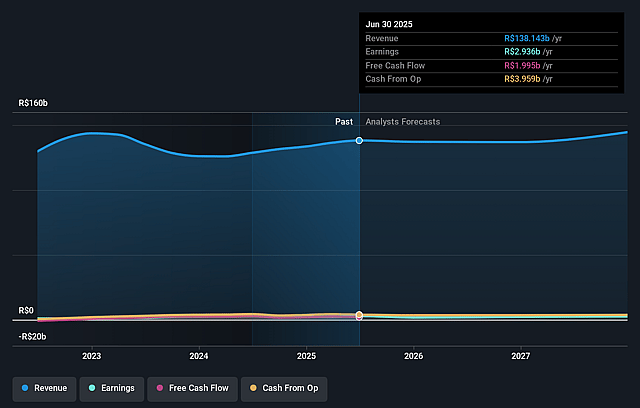

Ultrapar Participações Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ultrapar Participações compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ultrapar Participações's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.7% today to 1.9% in 3 years time.

- The bullish analysts expect earnings to reach R$3.1 billion (and earnings per share of R$2.76) by about August 2028, up from R$2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 8.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 7.0x.

- Analysts expect the number of shares outstanding to decline by 1.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.55%, as per the Simply Wall St company report.

Ultrapar Participações Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ultrapar's core dependence on fossil fuel distribution faces serious long-term pressure from the accelerating global transition to electric vehicles and alternative clean fuels, which threatens future sales volumes and revenue sustainability as the world shifts away from petroleum products.

- Increasingly strict environmental regulations and greater ESG investor scrutiny present significant risk of rising compliance costs and reduced access to capital for Ultrapar, which could result in higher capital expenditures and a structurally higher cost of capital, ultimately impacting net margins and potential future earnings.

- Persistent underinvestment in renewable energy and insufficient diversification beyond traditional fossil fuel businesses leaves Ultrapar highly exposed to oil price volatility and gradual, secular volume declines in the fuel distribution segment, raising the risk of shrinking revenue and lower long-term profitability.

- The competitive dynamics in Brazilian fuel retail-such as ongoing market share loss to smaller, often more nimble players, fluctuating inventory margins, and thin net margins intensified by informal market activities-pose a sustained risk of margin compression and possible erosion of Ultrapar's future profit base.

- Execution risks related to operational efficiency initiatives, ongoing asset divestitures, and recent major business transitions (such as the consolidation of Hidrovias) could lead to higher-than-expected operating costs and unstable EBITDA margins if synergy targets or cost reductions are not achieved as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ultrapar Participações is R$27.74, which represents two standard deviations above the consensus price target of R$22.56. This valuation is based on what can be assumed as the expectations of Ultrapar Participações's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$28.0, and the most bearish reporting a price target of just R$19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$162.7 billion, earnings will come to R$3.1 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 19.5%.

- Given the current share price of R$17.44, the bullish analyst price target of R$27.74 is 37.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.