Key Takeaways

- Regulatory and tax reforms support Ultrapar's formal fuel margins, but persistent irregular practices and tougher competition limit margin and revenue growth potential.

- Investments in logistics and core business optimization provide stability, yet volatile costs and shrinking market share threaten consistent profit and long-term scale.

- Structural market and regulatory challenges, combined with financial and energy transition risks, threaten profitability and growth prospects despite diversification efforts in convenience and logistics.

Catalysts

About Ultrapar Participações- Through its subsidiaries, operates in the energy and infrastructure business in Brazil.

- While ongoing tax and regulatory reforms, such as single-phase ethanol taxation and stricter penalties for evasion, are expected to reduce unfair competition and benefit established players like Ultrapar by restoring margins in formal fuel sales, persistent irregular market practices and creative evasion tactics continue to undermine the effectiveness of these measures, limiting potential improvements in revenue and operating margins.

- Although Ultrapar is positioned to leverage the expansion and optimization of its Ipiranga fuel and AmPm convenience store networks to drive higher volumes and retail profitability as urbanization and income levels rise in Brazil, shrinking market share in spot markets to more nimble competitors and increased competition from smaller players threaten long-term volume growth and scale, which in turn could constrain future revenue and net margin expansion.

- While the secular shift toward cleaner fuels and biofuels-including Ultrapar's stronger focus on ethanol distribution-could open new avenues for market differentiation and volumes as Brazil pushes towards its climate goals, delays in regulatory enforcement and ongoing issues with biodiesel mix compliance hinder the realization of these benefits and create a structurally uncertain environment for product mix and gross profit growth.

- Despite growing demand for logistics and infrastructure services amid ongoing industrialization, and Ultrapar's investments in Ultracargo and Hidrovias that may support stable long-term cash flow, the company remains exposed to cyclical swings in commodity flows, seasonality, and potential cost inflation in core logistics assets, all of which create variability in EBITDA and pressure on net income consistency.

- Even as operational efficiencies and the divestiture of non-core assets have provided capital for redeployment into higher-return businesses and reduction in leverage, rising personnel expenses, ongoing SG&A inflation, and volatile input costs-particularly in fuel and LPG procurement-risk eroding gains in return on equity and suppressing improvements in net margins over the medium term.

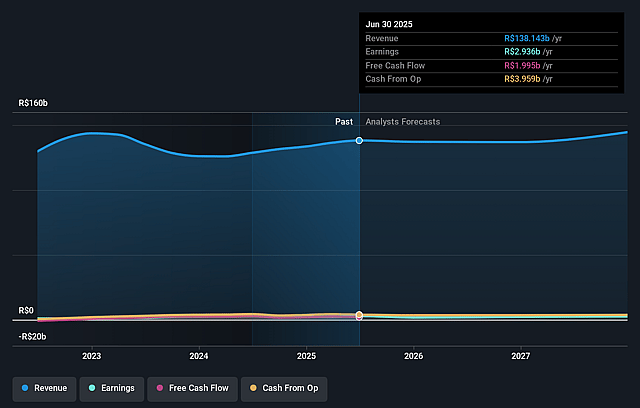

Ultrapar Participações Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ultrapar Participações compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ultrapar Participações's revenue will decrease by 1.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 1.7% today to 1.5% in 3 years time.

- The bearish analysts expect earnings to reach R$1.9 billion (and earnings per share of R$1.69) by about August 2028, down from R$2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, up from 7.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 7.8x.

- Analysts expect the number of shares outstanding to decline by 1.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.68%, as per the Simply Wall St company report.

Ultrapar Participações Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued prevalence of tax evasion and informal market practices in Brazil's fuel distribution sector, including biodiesel blend non-compliance and untaxed naphtha imports, threaten Ultrapar's market share, erode pricing power, and compress gross margins.

- Increasing competitive pressure from smaller players, especially in the spot fuel market, is resulting in long-term gradual market share loss for major players like Ipiranga, which could reduce core fuel distribution revenue and limit operating scale benefits.

- Regulatory and market dynamics, such as tight and volatile margins in the LPG segment due to Petrobras auctions and ongoing government intervention, are leading to higher operating costs and potentially lower EBITDA in Ultragaz over time.

- Ultrapar's persistent reliance on the fuel distribution segment exposes it to structural risks from the global energy transition, with potential long-term declines in fossil fuel demand impairing top-line growth and pressuring profitability even as new convenience and logistics initiatives expand.

- Rising net debt and leverage, partly due to the consolidation of Hidrovias and ongoing capital expenditures, increase financial risk and could constrain flexibility in capital allocation, negatively impacting future net income and shareholder returns if cash flows do not improve as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ultrapar Participações is R$19.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ultrapar Participações's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$28.0, and the most bearish reporting a price target of just R$19.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$129.8 billion, earnings will come to R$1.9 billion, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 19.7%.

- Given the current share price of R$16.33, the bearish analyst price target of R$19.0 is 14.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.