Key Takeaways

- Energy transition and stricter emissions policies threaten core fossil fuel demand, weakening Ultrapar's sales, margins, and business model resilience.

- Regulatory shifts, increased competition, and market concentration amplify cost pressures and earnings volatility for both fuel distribution and LPG segments.

- Regulatory improvements, strategic diversification, operational efficiencies, and expansion in new energy and infrastructure collectively strengthen Ultrapar's margins, growth prospects, and long-term earnings stability.

Catalysts

About Ultrapar Participações- Through its subsidiaries, operates in the energy and infrastructure business in Brazil.

- Even as Ultrapar reports strong operational results, accelerating energy transition and global decarbonization policies continue to threaten core fossil fuel demand in Brazil, which is likely to drive structural revenue declines across the company's fuel distribution and LPG businesses.

- The persistent advance of electric vehicle adoption and tightening emissions standards in Latin America will reduce the addressable market for traditional gasoline and diesel sales at Ipiranga, resulting in lower volumes, weaker same-store sales and gross margin compression over the long term.

- Intensifying regulatory pressure, such as proposed changes to LPG regulation by ANP that could eliminate brand exclusivity and permit partial refilling, would increase compliance, logistics, and safety costs while eroding Ultragaz's competitive advantages and further compressing already thin net margins in the bottling segment.

- Increased capital intensity and the need for continual maintenance and modernization, combined with a high dependence on the Brazilian market, will expose Ultrapar to pronounced swings in currency, interest rates, and political risks, likely resulting in increased earnings volatility and reduced predictability of cash flow.

- The entry or return of large state-controlled players like Petrobras into the LPG market, alongside ongoing industry consolidation and competition from new energy entrants, may undermine Ultrapar's future market share and bargaining power, putting sustained pressure on revenue growth and return on invested capital.

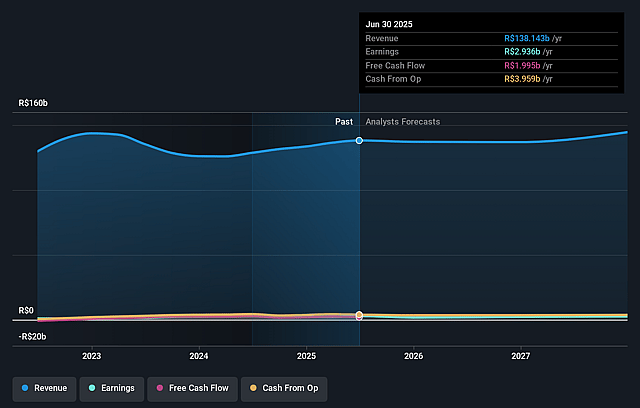

Ultrapar Participações Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ultrapar Participações compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ultrapar Participações's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 2.1% today to 1.4% in 3 years time.

- The bearish analysts expect earnings to reach R$1.9 billion (and earnings per share of R$1.7) by about September 2028, down from R$2.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 7.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 5.6x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.94%, as per the Simply Wall St company report.

Ultrapar Participações Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory enforcement-including the implementation of the solidarity tax collection principle for resellers and distributors and stronger moves against tax evasion-has begun yielding positive results and may improve formal market conditions, boosting Ultrapar's margins and supporting consistent long-term earnings growth.

- The successful consolidation of Hidrovias, coupled with strong operational cash flow generation and ongoing cost reduction and efficiency improvements, is already having a positive impact on EBITDA, while a robust capital structure allows the company to invest for growth and potentially enhance return on invested capital.

- Expansion into new energy segments such as biomethane, distributed generation, and greater emphasis on new energies within Ultragaz is providing fresh sources of revenue and diversified earnings streams, which can offset declines in traditional business segments and support long-term EBITDA expansion.

- Continuous investment in infrastructure and expansion projects, particularly in Ultracargo (e.g., new terminals in Palmeirante, Santos, and Rondonopolis), positions the company to capture rising demand tied to Brazil's economic growth and agribusiness exports, leading to improved utilization rates and revenue growth in coming years.

- Major sector-wide regulatory proposals, such as the ANP's suggested changes in LPG regulation, have faced overwhelming opposition from key stakeholders and organizations, making disruptive policy changes less likely, thereby reducing regulatory risk and helping to protect the stability of Ultrapar's margins and future cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ultrapar Participações is R$17.05, which represents two standard deviations below the consensus price target of R$22.9. This valuation is based on what can be assumed as the expectations of Ultrapar Participações's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$28.0, and the most bearish reporting a price target of just R$16.7.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$135.6 billion, earnings will come to R$1.9 billion, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 19.9%.

- Given the current share price of R$20.32, the bearish analyst price target of R$17.05 is 19.2% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.