Key Takeaways

- Sustained operational efficiencies and strategic investments could drive stronger-than-expected margin and earnings growth, with near-term improvements outpacing market forecasts.

- Expansion into clean energy and core distribution markets, combined with disciplined capital allocation, positions Ultrapar for outsized revenue and profitability gains amid favorable macro trends.

- Heavy reliance on traditional fuels, regulatory risks, and unsustainable earnings growth expose Ultrapar to margin pressures and long-term vulnerability from energy transition trends.

Catalysts

About Ultrapar Participações- Through its subsidiaries, operates in the energy and infrastructure business in Brazil.

- Analyst consensus views operational efficiencies and governance improvements as steady margin drivers, but current initiatives have already yielded record operational cash flow and exceptionally strong recurring EBITDA growth, indicating that these measures could drive a more dramatic and sustained increase in margins and net income than market participants expect as they become fully embedded.

- While analysts broadly recognize that investments in Hidrovias, Ultracargo, and infrastructure will be long-term growth levers, ongoing integration and immediate improvements in navigability, tariff adjustments, and synergy capture could deliver significant near-term EBITDA uplift and accelerate earnings growth, especially as operational results outpace the original forecasts.

- With Brazil and Latin America entering a new cycle of economic growth and urbanization, Ultrapar's dominant positions in fuel and LPG distribution, as well as convenience retail, position it to capture outsized revenue expansion as consumer mobility and logistics needs expand well beyond GDP growth rates.

- The company's disciplined capital allocation and history of opportunistic acquisitions, with leverage soon returning to historical lows, creates scope for transformative new investments or high-return buybacks, both of which could drive earnings per share and return on equity well above current market assumptions.

- Early success scaling new energy businesses, particularly in biomethane, distributed generation, and energy trading, is likely understated-rapid growth in these higher-margin, clean energy segments can deliver both meaningful revenue diversification and enhanced group-level EBITDA margins, especially as regulatory frameworks and demand for alternative fuels solidify.

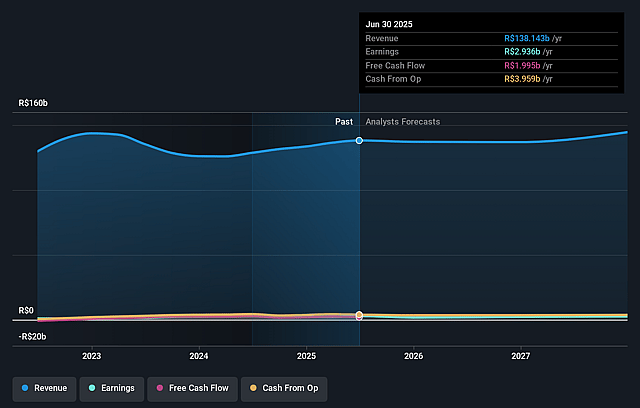

Ultrapar Participações Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Ultrapar Participações compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Ultrapar Participações's revenue will grow by 6.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 2.1% today to 1.8% in 3 years time.

- The bullish analysts expect earnings to reach R$3.0 billion (and earnings per share of R$2.61) by about September 2028, up from R$2.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 7.4x today. This future PE is greater than the current PE for the US Oil and Gas industry at 5.6x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.94%, as per the Simply Wall St company report.

Ultrapar Participações Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ultrapar remains highly dependent on legacy fuel distribution, as evidenced by Ipiranga's declining volumes of gasoline and diesel, making the company vulnerable to the global shift toward electrification and renewable energy, which will likely lead to long-term contraction in its core revenue base.

- The text highlights persistent regulatory and tax irregularities, such as illegal imports and biodiesel blend noncompliance in the fuel sector, signaling a challenging business environment and recurring margin pressures that threaten sustainable earnings growth.

- In the Ultragaz segment, proposed regulatory changes by the ANP-including ending brand respect and allowing partial LPG refilling-could increase operational costs, erode product differentiation, and create space for unlawful competition, directly impacting net margins and investment returns in this key business line.

- The company's recent EBITDA and net income gains were partially driven by extraordinary items-including one-time tax credits and the consolidation of Hidrovias-rather than organic business improvements, introducing a risk that future earnings and cash flow growth may not be repeatable.

- Ultragaz's low single-digit net income margin (for example, around two percent per bottle) amid industry overcapacity and intense competition underscores high vulnerability to margin compression, a dynamic likely to intensify as Brazil's fuel consumption growth slows due to structural shifts toward cleaner energy and new mobility trends, potentially leading to ongoing pressure on net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Ultrapar Participações is R$28.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ultrapar Participações's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$28.0, and the most bearish reporting a price target of just R$16.7.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$167.8 billion, earnings will come to R$3.0 billion, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 19.9%.

- Given the current share price of R$20.32, the bullish analyst price target of R$28.0 is 27.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.